Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

Please help me.

Thankyou.

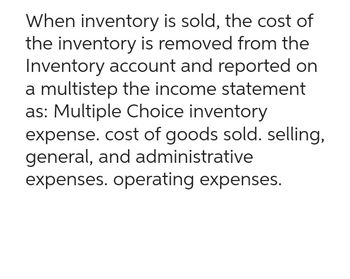

Transcribed Image Text:When inventory is sold, the cost of

the inventory is removed from the

Inventory account and reported on

a multistep the income statement

as: Multiple Choice inventory

expense. cost of goods sold. selling,

general, and administrative

expenses. operating expenses.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Identify items missing in determining cost of goods sold For (a) through (e), identify the items designated by X and Y. A. Purchases (X + Y) = Net purchases B. Net purchases + X = Cost of inventory purchased C. Inventory (beginning) + Cost of inventory purchased = X D. Inventory available for sale X = Cost of inventory before estimated returns E. Cost of goods sold before estimated returns X = Cost of goods soldarrow_forwardInventory Costing: LIFO Refer to the information for Filimonov Inc. and assume that the company uses a perpetual inventory system. Required: Calculate the cost of goods sold and the cost of ending inventory using the LIFO inventory costing method.arrow_forwardCalculate a) cost of goods sold, b) ending inventory, and c) gross margin for A76 Company, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for first-in, first-out (FIFO).arrow_forward

- Calculate a) cost of goods sold, b) ending inventory, and c) gross margin for A76 Company, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for weighted average (AVG).arrow_forwardCalculate a) cost of goods sold, b) ending inventory, and c) gross margin for A76 Company, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for last-in, first-out (LIFO).arrow_forwardUse the last-in, first-out method (LIFO) cost allocation method, with perpetual inventory updating, to calculate (a) sales revenue, (b) cost of goods sold, and c) gross margin for B75 Company, considering the following transactions.arrow_forward

- Based on the data in Exercise 6-15 part (a) and assuming that cost was determined by the FIFO method, show how the inventory would appear on the balance sheet.arrow_forwardUnder the periodic inventory system, the ending inventory is entered by debiting Merchandise Inventory and crediting Income Summary.arrow_forwardDETERMINING THE BEGINNING AND ENDING INVENTORY FROM A PARTIAL SPREADSHEET: PERIODIC INVENTORY SYSTEM From the following partial spreadsheet, indicate the dollar amount of beginning and ending merchandise inventory to be used to compute cost of goods sold.arrow_forward

- Perpetual and Periodic Inventory Systems Below is a list of inventory systems options. a. Perpetual inventory system b. Periodic inventory system c. Both perpetual and periodic inventory systems Required: Match each option with one of the following: 1. Only revenue is recorded as sales are made during the period; the cost of goods sold is recorded at the end of the period. 2. Cost of goods sold is determined as each sale is made. 3. Inventory purchases are recorded in an inventory account. 4. Inventory purchases are recorded in a purchases account. 5. Cost of goods sold is determined only at the end of the period by subtracting the cost of ending inventory from the cost of goods available for sale. 6. Both revenue and cost of goods sold are recorded during the period as sales are made. 7. The inventory is verified by a physical count.arrow_forwardWhich of the following accounts are used when recording a purchase using a periodic inventory system? A. cash, purchases B. accounts payable, sales C. accounts payable, accounts receivable D. cash, merchandise inventoryarrow_forwardAssume that the business in Exercise 6-9 maintains a perpetual inventory system. Determine the cost of goods sold for each sale and the inventory balance after each sale, assuming the first-in, first-out method. Present the data in the form illustrated in Exhibit 3.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,