FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

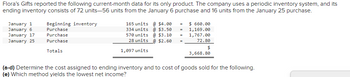

Transcribed Image Text:Flora's Gifts reported the following current-month data for its only product. The company uses a periodic inventory system, and its

ending inventory consists of 72 units-56 units from the January 6 purchase and 16 units from the January 25 purchase.

January 1 Beginning inventory

January 6

Purchase

January 17

Purchase

January 25

Purchase

Totals

165 units@ $4.00

334 units @ $3.50

570 units @ $3.10

28 units @ $2.60

1,097 units

=

$ 660.00

1,169.00

1,767.00

72.80

$

3,668.80

(a-d) Determine the cost assigned to ending inventory and to cost of goods sold for the following.

(e) Which method yields the lowest net income?

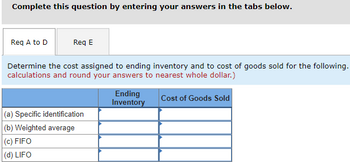

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Req A to D

Req E

Determine the cost assigned to ending inventory and to cost of goods sold for the following.

calculations and round your answers to nearest whole dollar.)

Cost of Goods Sold

(a) Specific identification

(b) Weighted average

(c) FIFO

(d) LIFO

Ending

Inventory

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Laker Company reported the following January purchases and sales data for its only product. The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 180 units from the January 30 purchase, 5 units from the January 20 purchase, and 15 units from beginning inventory. Date Activities 1-Jan Beginning inventory 10-Jan Sales 20-Jan Purchase 25-Jan Sales 30-Jan Purchase Totals 140 units 60 units 180 units 380 units Units Acquired at Cost @ $6.00 = $5.00 = $4.50 $840 300 810 $1,950 Required: 1. Compute gross profit for the month of January for Laker Company for the four inventory methods. (Use cells A2 to L12 from the given information to complete this question. Round cost per unit to 2 decimal places and final answers to the nearest whole dollars.) Specific Identification 180 5 Units sold at Retail 100 units 80 units 180 units 1-Jan 10-Jan 20-Jan 25-Jan 30-Jan 15 $15 $15 Weighted average cost per unit on: $6.00 $6.00 $5.40 $5.40 $4.59arrow_forwardBeech Soda, Inc. uses a perpetual inventory system. The company's beginning inventory of a particular product and its purchases during the month of January were as follows: Quantity Unit Cost Total Cost Beginning inventory (Jan. 1) 20 $ 11 $ 220 Purchase (Jan. 11) 12 $ 17 204 Purchase (Jan. 20) 23 $ 19 437 Total 55 $ 861 On January 14, Beech Soda, Inc. sold 25 units of this product. The other 30 units remained in inventory at January 31. Assuming that Beech Soda uses the FIFO cost flow assumption, the 30 units of this product in inventory at January 31 have a total cost of:arrow_forwardFlora’s Gifts reported the following current-month data for its only product. The company uses a periodic inventory system, and its ending inventory consists of 60 units—50 units from the January 6 purchase and 10 units from the January 25 purchase. Determine the cost assigned to ending inventory and to cost of goods sold using (a) specific identification, (b) weighted average, (c) FIFO, and (d) LIFO. (Round per unit costs and inventory amounts to cents.) (e) Which method yields the lowest net income?arrow_forward

- A company reports the following beginning inventory and two purchases for the month of January. On January 26, the company sells 310 units. Ending inventory at January 31 totals 130 units. Units Unit Cost Beginning inventory on January 1 280 $ 2.60 Purchase on January 9 60 2.80 Purchase on January 25 100 2.94 Required:Assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on LIFO.arrow_forward[The following information applies to the questions displayed below.] Laker Company reported the following January purchases and sales data for its only product. The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 355 units from the January 30 purchase, 5 units from the January 20 purchase, and 15 units from beginning inventory. Date January 1 January 10 January 20 January 25 January 30 Activities Beginning inventory Sales Purchase Sales Purchase Totals Units Acquired at Cost @ $ 14.00 = @ $ 13.00 = 215 units 160 units 355 units 730 units $ 11.00 = $ 3,010 2,080 3,905 $ 8,995 Units sold at Retail 165 units 190 units 355 units @ @ $23.00 $23.00 The Company uses a periodic inventory system. For specific identification, ending inventory consists of 355 units from the January 30 purchase, 5 units from the January 20 purchase, and 15 units from beginning inventory. Determine the cost assigned to ending inventory and to cost of goods sold…arrow_forwardA company reports the following beginning inventory and two purchases for the month of January. On January 26, the company sells 390 units. Ending inventory at January 31 totals 150 units. Units Unit Cost Beginning inventory on January 1 350 $ 3.40 Purchase on January 9 80 3.60 Purchase on January 25 110 3.70arrow_forward

- [The following information applies to the questions displayed below.] Laker Company reported the following January purchases and sales data for its only product. The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 355 units from the January 30 purchase, 5 units from the January 20 purchase, and 15 units from beginning inventory. Date January 1 January 10 January 20 January 25 January 30 Activities Beginning inventory Sales Purchase Sales Purchase Totals Units Acquired at Cost @ $ 14.00 = 215 units 160 units 355 units 730 units @ @ $ 13.00 = $ 11.00 = $ 3,010 2,080 3,905 $ 8,995 Units sold at Retail 165 units 190 units 355 units @ @ $23.00 $ 23.00 Required: 1. Complete the table to determine the cost assigned to ending inventory and cost of goods sold using specific identification. 2. Determine the cost assigned to ending inventory and to cost of goods sold using weighted average. 3. Determine the cost assigned to ending inventory and…arrow_forwardLaker Company reported the following January purchases and sales data for its only product. The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 270 units from the January 30 purchase, 5 units from the January 20 purchase, and 15 units from beginning inventory. 28 Date January 1 January 10 January 20 January 25 January 30 Required: S ual Activities Beginning inventory Sales Purchase Sales Purchase Totals Units Acquired at Cost 180 units @ $ 10.50 = 110 units @ Units sold at Retail $ 1,890 140 units @ $ 19.50 $9.50- 1,045 130 units @ $ 19.50 270 units @ 560 units $ 9.00 = 2,430 $ 5,365 270 units 1. Compute gross profit for the month of January for Laker Company for the four inventory methods. 2. Which method yields the highest gross profit? 3. Does gross profit using weighted average fall between that using FIFO and LIFO? 4. If costs were rising instead of falling, which method would yield the highest gross profit? งarrow_forwardABC Company employs a periodic inventory system and sells its inventory to customers for $20 per unit. ABC Company had the following inventory information available for May: May 1 May 3 May 8 May 13 May 18 May 20 May 24 May 30 Beginning inventory 1,900 units @ $10.20 cost per unit Purchased 2,100 units @ $11.60 cost per unit Sold 1,400 units Purchased 3,700 units $8.10 cost per unit Sold 2,600 units Purchase 4,100 units @ $14.70 cost per unit Sold 2,900 units Purchased 2,200 units @ $12.60 cost per unit During May, ABC Company reported operating expenses of $14,000 and had an income tax rate of 36%. Calculate the dollar amount of ending inventory shown on ABC Company's May 31 balance sheet using the FIFO method.arrow_forward

- The company uses a periodic inventory system. Determine the cost assigned to ending inventory using the specific identification method. Ending inventory consists of 270 units from the April 16 purchase, 80 units from the April 7 purchase, and 100 units from beginning inventory. I provided all that was givento answer my question A company's inventory records indicate the following data for the month of April: Units Acquired at Cost 770 units @ $36= $27,720 650 units @ $40 = $26,000 570 units @ $44 = $25,080 Date April 1 April 7 April 11 April 16 April 22 The comp Activities Beginning inventory Purchase Sale Purchase Sale Units Sold at Retail 1,140 units @ $110 400 units @ $110arrow_forwardABC Company employs a periodic inventory system and sells its inventory to customers for $20 per unit. ABC Company had the following inventory information available for May: May 1 May 3 May 8 May 13 May 18 May 20 May 24 May 30 Beginning inventory 1,900 units @ $10.20 cost per unit Purchased 2,100 units @ $11.60 cost per unit Sold 1,400 units Purchased 3,700 units @ $8.10 cost per unit Sold 2,600 units Purchase 4,100 units @ $14.70 cost per unit Sold 2,900 units Purchased 2,200 units @ $12.60 cost per unit During May, ABC Company reported operating expenses of $14,000 and had an income tax rate of 36%. Calculate the amount of net income shown on ABC Company's income statement for May using the LIFO method.arrow_forwardWaterway Company had a beginning inventory on January 1 of 180 units of Product 4-18-15 at a cost of $20 per unit. During the year, purchases were as follows. Mar. 15 July 20 450 units 320 units (a) at $23 at $25 Sept. 4 Dec. 2 Determine the cost of goods available for sale. The cost of goods available for sale Waterway Company uses a periodic inventory system. Sales totaled 1,180 units. $ 350 units $27 100 units at $29 atarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education