FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

PART 1:

Raw Materials Inventory Turnover

A. How is this ratio calculated?

What does the ratio show?

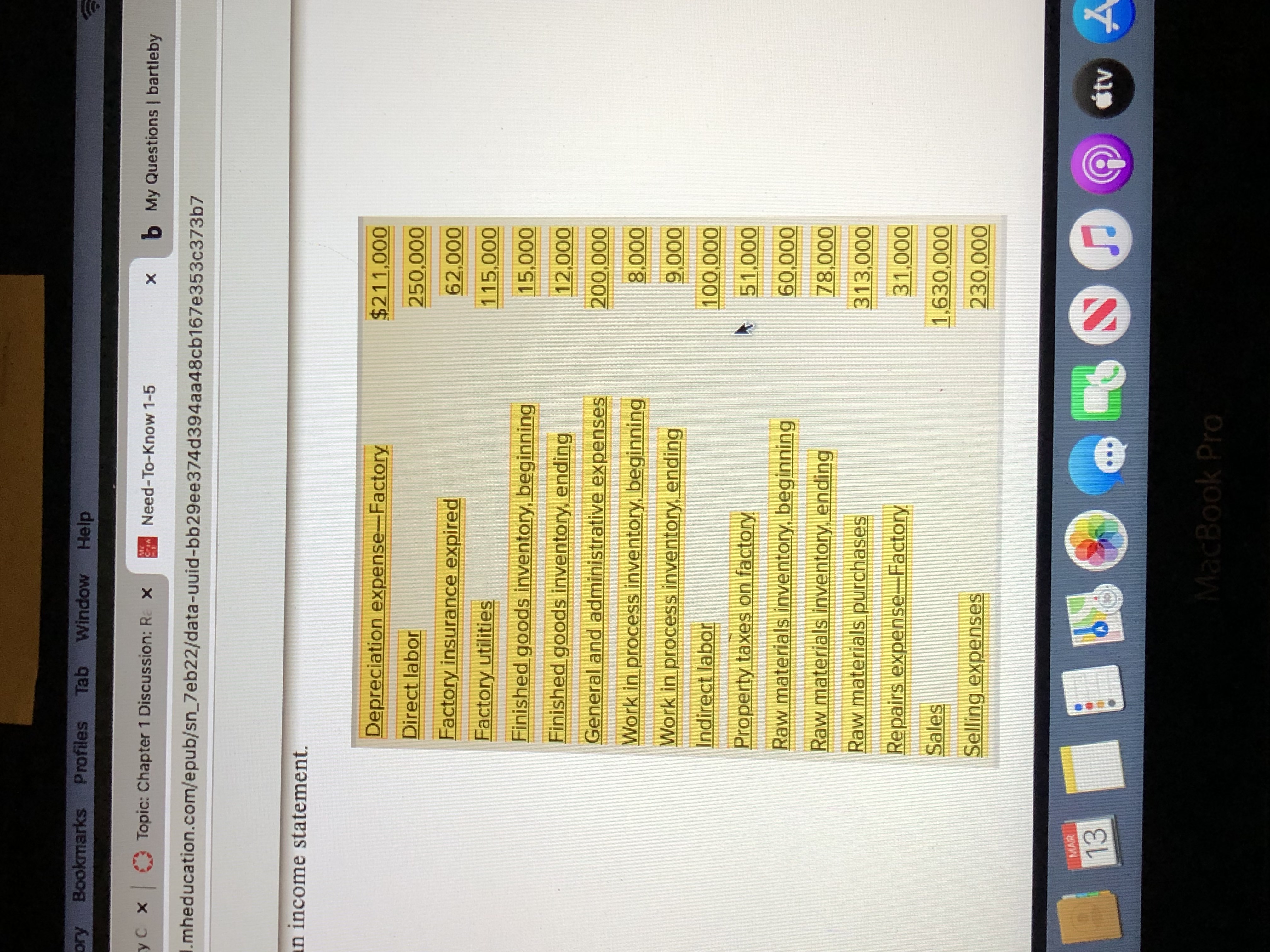

Using the data below (Sunn Corporation) , calculate and discuss the implications of Sunn's RM Inventory Turnover.

Days' Sales in Raw Materials Inventory

B. How is this ratio calculated?

What does the ratio show?

Using the data below (Sunn Corporation) calculate and discuss the implications of Sunn's Days' Sales in RM Inventory

Transcribed Image Text:Bookmarks Profiles Tab

Window Help

yC x Topic: Chapter 1 Discussion: Re x

Need-To-Know 1-5

b My Questions | bartleby

Cran

I.mheducation.com/epub/sn_7eb22/data-uuid-bb29ee374d394aa48cb167e353c373b7

an income statement.

Depreciation expense-Factory

$211,000

Direct labor

250,000

Factory insurance expired

62,000

Factory utilities

115,000

Finished goods inventory, beginning

15,000

Finished goods inventory, ending

12,000

General and administrative expenses

000'007

Work in process inventory, beginning

000

Work in process inventory, ending

Indirect labor

Property taxes on factory

000'

Raw materials inventory, beginning

000'09

Raw materials inventory, ending

000'8

Raw materials purchases

313,000

Repairs expense-Factory

000

Sales

1,630,000

Selling expenses

230,000

MAR

13

étv A

MacBook Pro

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Requirement 3. Calculate the cost of goods sold for each company Begin by calculating the cost of goods sold for Company A.arrow_forwardScrappers Supplies tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31. Units Unit Cost $30 Transactions Beginning inventory, January 1 Transactions during the year: a. Purchase on account, March 2 b. Cash sale, April 1 ($46 each) c. Purchase on account, June 30 d. Cash sale, August 1 ($46 each) 200 300 32 (350) 250 36 (50) TIP: Although the purchases and sales are listed in chronological order, Scrappers determines the cost of goods sold after all of the purchases have occurred. Required: 1. Compute the cost of goods available for sale, cost of ending inventory, and cost of goods sold at December 31 under each of the following inventory costing methods: (Round "Cost per Unit" to 2 decimal places.) a. Last-in, first-out. LIFO…arrow_forwardWhen creating financial statements, why is it essential to create the income statement before the balance sheet? O Because sales is an essential component of the balance sheet O Because net income is required to determine the balance in retained earnings Because cost of goods sold is a component of inventory O Because S&A costs are required to determine the balance in Plant & Equipment (net). O Actually, the balance sheet must always be created first and used to create the income statement.arrow_forward

- A measures how successfully a company buys and sells merchandise at a profit. Gross Profit Margin B Return on Assets C) Return on Sales D Asset Turnover Ratioarrow_forwardWhat are expenses like sales salaries expense, advertising expense, etc. called that are incurred directly in the selling of merchandise inventory? Group of answer choices administrative expenses other expenses selling expenses cost of goods soldarrow_forwardCruz Company uses LIFO for inventory costing and reports the following financial data. It also recomputed inventory and cost of sold using FIFO for comparison purposes. LIFO inventory LIFO cost of goods sold FIFO inventory FIFO cost of goods sold Current assets (using LIFO) Current assets (using FIFO) Current liabilities 1. Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using (a) LIFO numbers and (b) FIFO number Current ratio Inventory turnover Days' sales in inventory Answer is not complete. (a) Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using LIFO numbers. Current ratio Inventory turnover Days' sales in inventory Current ratio Inventory turnover Days' sales in inventory $ $ $ $ Year 2 $ 290 870 360 825 350 420 170 Numerator 1 Denominator 350.0 / $ $ 870.0 111.0 X $ $ $ Numerator 1 350.0 / (a) Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using LIFO numbers.…arrow_forward

- The management of Milque Corp. is considering the effects of inventory-costing methods on its financial statements and its income tax expense. Assuming that the cost the company pays for inventory is increasing, which method will: (a) (b) (c) Provide the highest net income? Provide the highest ending inventory? Result in the lowest income tax expense? 10arrow_forwardWhich of the following types of companies may be the least likely to carry inventory on its balance sheet? A. Retail B. Wholesale C. Manufacturing D. servicearrow_forwardAccounting for Merchandising Businesses and Inventory and Assets Define the following: Cost of goods sold Credit memo Credit terms Debit memo FIFO FOB Gross profit Invoice LIFO Net sales Periodic inventory Perpetual inventory Sales Selling expense Subsidiary ledger Trade discount Weighted averagearrow_forward

- A bank that is examining the ratio of annual costs of goods sold to average inventory, is examining which category of ratios? a.Profit measures b.Operating efficiency measures c.Liquidity measures d.Expense control measuresarrow_forwardWhich of the following items should not be included in the cost of inventory? Select one: O a. The initial purchase price of inventory O b. Freight out cost to deliver inventory to a customer c. Insurance cost paid to purchase the inventory d. Delivery cost paid to purchase the inventoryarrow_forwardSelect all that apply Determine which of the following statements are correct regarding the difference between physical flow and the cost flow of inventory Check all that apply) A business may adopt any cost flow assumption when accounting for perishable sems Perishable-items Usually have an actual physical flow of FIFO Penshable items neve an actual physical flow of LIFO Cost flow in an assumption about which goods/items are sold Physical flow refers to the actual movement of goodsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education