FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

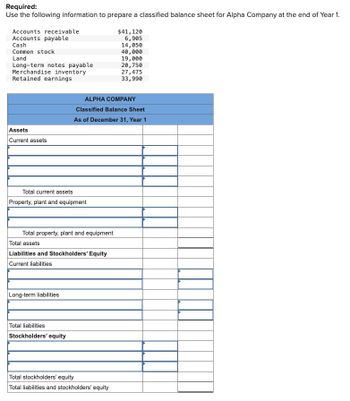

Transcribed Image Text:Required:

Use the following information to prepare a classified balance sheet for Alpha Company at the end of Year 1.

Accounts receivable

$41,120

Accounts payable

6,905

Cash

14,050

Common stock

40,000

Land

19,000

Long-term notes payable

20,750

Merchandise inventory

27,475

Retained earnings

33,990

Assets

Current assets

ALPHA COMPANY

Classified Balance Sheet

As of December 31, Year 1

Total current assets

Property, plant and equipment

Total property, plant and equipment

Total assets

Liabilities and Stockholders' Equity

Current liabilities

Long-term liabilities

Total liabilities

Stockholders' equity

Total stockholders' equity

Total liabilities and stockholders' equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Balance sheet ($ in millions) ASSETS Cash & Marketable Securities 449.90 Accounts Receivable 954.80 Inventories 3,645.20 Other Current Assets 116.60 Total Current Assets 5,166.50 Machinery & Equipment 1,688.90 Land 1,129.70 Buildings 2,348.40 Depreciation (575.60) Property, Plant & Equip. - Net 4,591.40 Other Long Term Assets 120.90 Total Long-Term Assets 4,712.30 Total Assets 9,878.80 part of Balance Sheet LIABILITIES Accounts Payable 1,611.20 Salaries Payable 225.20 Other Current Liabilities 1,118.80 Total Current Liabilities 2,955.20 Other Liabilities 693.40 Total Liabilities 3,648.60 SHAREHOLDER'S EQUITY Common Stock 828.50 Retained Earnings 5,401.70 Total Shareholder's Equity 6,230.20 Total Liabilities…arrow_forwardREQUIRED: Prepare and present the following financial statement: Statement of financial positionarrow_forwardPlease Do not Give image formatarrow_forward

- The Cambridge Company collected the following information for the preparation of its December 31 classified balance sheet: Accounts receivable $11.250 Property, plant, and equipment $150,000 15,000 Inventory Cash 48.750 Other current assets 22,500 Other long term assets 30.000 Accounts payable 15.750 Common stock 7,500 Long-term liabilities 41,250 Retained earnings Other current liabilities 13,500 Prepare a classified balance sheet for Cambridge Company Cambridge Company Balance Sheet December 31 Assets Liabilities & Stockholders' Equity Current Labilities Current Assets Other current liabilities Total Current Liabilities Other current assets Noncurrent Liabilities Total Curren Assets Total Liabilities Noncurrent Assets Stockholders Couity Common stock Other long term assets Total Stockholders Equity Total Nonturent Assets Total Assets Total Liabilities & Stockholders' Equity 3 Checkarrow_forwardQuestion Content Area Use the information provided for Harding Company to answer the question that follow. Harding Company Accounts payable $31,654 Accounts receivable 69,987 Accrued liabilities 6,524 Cash 16,364 Intangible assets 38,210 Inventory 80,832 Long-term investments 90,451 Long-term liabilities 73,398 Notes payable (short-term) 26,425 Property, plant, and equipment 659,739 Prepaid expenses 1,697 Temporary investments 38,252 Based on the data for Harding Company, what is the amount of quick assets?arrow_forwardQuestion Content Area Use the information provided for Privett Company to answer the question that follow. Privett Company Accounts payable $30,000 Accounts receivable 35,000 Accrued liabilities 7,000 Cash 25,000 Intangible assets 40,000 Inventory 72,000 Long-term investments 100,000 Long-term liabilities 75,000 Notes payable (short-term) 20,000 Property, plant, and equipment 400,000 Prepaid expenses 2,000 Temporary investments 36,000 Based on the data for Privett Company, what is the amount of working capital? a.$213,000 b.$153,000 c.$39,000 d.$113,000arrow_forward

- The following three accounts appear in the general ledger of Herrick Corp. during 2020. Equipment Date Debit Credit Balance Jan. 1 Balance 161,200 July 31 Purchase of equipment 68,100 229,300 Sept. 2 Cost of equipment constructed 54,600 283,900 Nov. 10 Cost of equipment sold 49,100 234,800 Accumulated Depreciation—Equipment Date Debit Credit Balance Jan. 1 Balance 70,700 Nov. 10 Accumulated depreciation on equipment sold 31,200 39,500 Dec. 31 Depreciation for year 24,200 63,700 Retained Earnings Date Debit Credit Balance Jan. 1 Balance 104,200 Aug. 23 Dividends (cash) 15,800 88,400 Dec. 31 Net income 66,700 155,100 From the postings in the accounts, indicate how the information is reported on a statement of cash flows using the indirect method. The…arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward1arrow_forward

- Green Moose Industries has the following end-of-year balance sheet: Green Moose Industries Balance Sheet For the Year Ended on December 31 Assets Liabilities Current Assets: Current Liabilities: Accounts payable Accrued liabilities. Notes payable Total Current Liabilities Cash and equivalents Accounts receivable Inventories Total Current Assets Net Fixed Assets: Net plant and equipment (cost minus depreciation) Total Assets O $64,000 $150,000 400,000 350,000 $900,000 O $57,600 Long-Term Bonds O $54,400 $2,100,000 Total Debt O $51,200 Common Equity Common stock Retained earnings Total Common Equity $3,000,000 Total Liabilities and Equity The firm is currently in the process of forecasting sales, asset requirements, and required funding for the coming year. In the year that just ended, Green Moose Industries generated $400,000 net income on sales of $13,500,000. The firm expects sales to increase by 16% this coming year and also expects to maintain its long-run dividend payout ratio of…arrow_forwardPlease answer all requirementsarrow_forwardThe following are the ending balances of accounts at December 31, 2021, for the Valley Pump Corporation. Credits Account Title Cash Accounts receivable Inventory Interest payable Investment in equity securities Land Buildings Accumulated depreciation-buildings Equipment Accumulated depreciation-equipment Copyright (net) Prepaid expenses (next 12 months) Accounts payable Deferred revenue (next 12 months) Notes payable Allowance for uncollectible accounts Common stock Retained earnings Totals $ Debits 44,000 94,000 119,000 82,000 158,000 395,000 113,000 31,000 51,000 $ 29,000 119,000 44,000 84,000 39,000 345,000 6,000 390,000 31,000 $1,087,000 $1,087,000 Additional Information: 1. The $158,000 balance in the land account consists of $119,000 for the cost of land where the plant and office buildings are located. The remaining $39,000 represents the cost of land being held for speculation. 2. The $82,000 balance in the investment in equity securities account represents an investment in the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education