FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

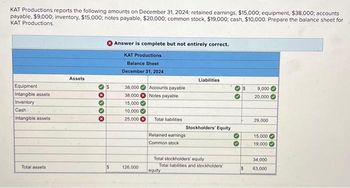

Transcribed Image Text:KAT Productions reports the following amounts on December 31, 2024: retained earnings, $15,000; equipment, $38,000; accounts

payable, $9,000; inventory, $15,000; notes payable, $20,000; common stock, $19,000; cash, $10,000. Prepare the balance sheet for

KAT Productions.

Equipment

Intangible assets

Inventory

Cash

Intangible assets

Total assets

Assets

*****

S

$

Answer is complete but not entirely correct.

KAT Productions

Balance Sheet

December 31, 2024

38,000

38,000

15,000

10,000✔✔

25,000

126,000

Accounts payable

Notes payable

Total liabilities

Retained earnings

Common stock

Liabilities

Stockholders' Equity

equity

Total stockholders' equity

Total liabilities and stockholders

9

$

9,000

20,000

29,000

15,000

19,000

34,000

63,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- the balance sheets for Plasma Screens Corporation and additional information are provided below. PLASMA SCREENS CORPORATIONBalance SheetsDecember 31, 2021 and 2020 2021 2020 Assets Current assets: Cash $ 242,000 $ 130,000 Accounts receivable 98,000 102,000 Inventory 105,000 90,000 Investments 5,000 3,000 Long-term assets: Land 580,000 580,000 Equipment 890,000 770,000 Less: Accumulated depreciation (528,000 ) (368,000 ) Total assets $ 1,392,000 $ 1,307,000 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $ 109,000 $ 95,000 Interest payable 7,000 13,000 Income tax payable 9,000 6,000 Long-term liabilities: Notes payable 110,000 220,000 Stockholders' equity: Common stock…arrow_forwardPresented below are data taken from the records of Wildhorse Company. December 31,2020 December 31,2019 Cash $15,200 $8,100 Current assets other than cash 84,700 60,600 Long-term investments 10,000 52,900 Plant assets 332,400 215,200 $442,300 $336,800 Accumulated depreciation $20,100 $40,100 Current liabilities 39,600 22,100 Bonds payable 74,800 –0– Common stock 254,500 254,500 Retained earnings 53,300 20,100 $442,300 $336,800 Additional information: 1. Held-to-maturity debt securities carried at a cost of $42,900 on December 31, 2019, were sold in 2020 for $33,600. The loss (not unusual) was incorrectly charged directly to Retained Earnings. 2. Plant assets that cost $50,500 and were 80% depreciated were sold during 2020 for $8,000. The loss was incorrectly charged directly to Retained Earnings. 3. Net income as reported on the…arrow_forwardSelected financial info for Strand Corp is below: Cash Accounts receivable (net) Inventory Land Equipment Accumulated depreciation TOTAL Accounts payable Notes payable- current Notes payable- non-current Common stock Retained earnings TOTAL 2022 2021 $63,000 $42,000 $151,200 $84,000 $201,600 $168,000 $21,000 $58,800 $789,600 $504,000 ($115,600) ($84,000) $1,110,800 $772,800 $86,000 $50,400 $29,400 $67,200 $302,400 $168,000 $487,200 $420,000 $205,800 $67,200 $1,110,800 $772,800 Additional info for 2022: 1) Net Income was $235,200 2) Depreciation expense was recorded 3) Land was sold at its original cost. No other assets were sold 4) Cash dividends were paid 5) Equipment was purchased for cash REQUIRED: A) Prepare a formal Statement of Cash Flows for 2022 B) Prepare a calculation for Free Cash Flowarrow_forward

- The balance sheet shows the following accounts and amounts: Inventory, $84.000; Long-term Debt 125,000; Common Stock $60,000, Accounts Payable $44,000; Cash $132,000, Buildings and Equipment $390,000: Short-term Debt $48,000, Accounts Receivable $109,000; Retained Earnings $204,000; Notes Payable $54,000; Accumulated Depreciation $180,000. Total current assets on the balance sheet are Multiple Choice $216,000 $325,000 $535.000 $715,000 1 www Literarrow_forwardThe comparative balance sheet of Gus Company at December 31, 2021 and 2020 appears below: Assets: 12/31/2021 12/31/2020 Cash $ 53,000 $ 120,000 Accounts receivable (net) 37,000 48,000 Inventories 108,500 100,000 Equipment 573,200 450,000 Accumulated depreciation-equipment (142,000) (176,000) $629,700 $542,000 Liabilities & Stockholders Equity: Accounts payable $ 62,500 $ 43,800 Bonds payable, due June 2021 0 100,000 Common stock, $10 par 335,000 285,000 Paid-in capital in excess of par - Common stock 74,000 55,000 Retained earnings 158,200 58,200 $629,700 $542,000 The income statement for the year ended December 31, 2021 appears below: Sales $625,700 Cost of merchandise sold 340,000 Gross profit 285,700 Operating expenses (includes $26,000 depreciation expense) 94,000…arrow_forwardThe balance sheet data of Blossom Company at the end of 2025 and 2024 are shown below. 2025 2024 Cash $7,500 $9,900 Accounts receivable (net) 80,500 87,700 Merchandise inventory 85,800 79,600 Prepaid expenses 9,000 12,000 Equipment 171,500 145,500 Accumulated depreciation-equipment (45,100) (36,500) Land 30,200 50,100 Total assets $339,400 $348,300 Accounts payable $45,200 $57,600 Accrued expenses 11,100 9,000 Notes payable-bank, short-term -0- 49,100 Bonds payable 19,900 -0- Common stock, $1 par 181,000 161,000 Retained earnings 82,200 71,600 Total liabilities and shareholders' equity $339,400 $348,300 Equipment was purchased for $20,000 in exchange for common stock, par $20,000, during the year; all other equipment purchased was for cash. Land was sold for $31,700. Cash dividends of $7,100 were declared and paid during the year. Compute net cash provided (used) by: (Show amounts that decrease cash flow with either a - sign e.g. -12,000 or in parenthesis e.g. (12,000).) (a) Net cash…arrow_forward

- The balance sheets for a company and additional information are provided below. A COMPANY Balance Sheets December 31, 2024 and 2023 2024 2023 Assets Current assets: Cash $160,000 $116,000 Accounts receivable 70,000 88,000 Inventory 91,000 76,000 Investments 3,600 1,600 Long-term assets: Land 440,000 440,000 Equipment 750,000 630,000 Less: Accumulated depreciation (388,000) (228,000) Total assets $1,126,600 $1,123,600 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $95,200 $81,000 Interest payable 5,500 11,600 Income tax payable 7,500 4,600 Long-term liabilities: Notes payable 120,000 240,000 Stockholders' equity: Common stock 660,000 660,000 Retained earnings 238,400 126,400 Total liabilities and stockholders' equity $1,126,600 $1,123,600 Additional information for 2024: Net income is $112,000. Sales on account are $1,382,500. (All sales are credit sales.) Cost of goods…arrow_forwardCQ Photography reported net income of $103,000 for 2022. Included in the income statement were depreciation expense of $6,500, patent amortization expense of $3,800, and a gain on disposal of plant assets of $4,000. CQ's comparative balance sheets show the following balances. Accounts receivable Accounts payable 12/31/22 $19,200 Net Income 8,400 12/31/21 Cash Flows from Operating Activities Calculate net cash provided by operating activities for CQ Photography using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) $27,000 CQ Photography Statement of Cash Flows For the Year Ended December 31, 2022 Adjustments to reconcile net income to 6,500 Net Cash Provided by Operating Activities $ 103000arrow_forwardThe comparative balance sheet for the ZYX Company on December 31, 2019 and 2018 is as follows: 12/31/19 12/31/18 Assets: Cash $146,600 $179,800 Accounts Receivable 224,600 242,000 Merchandise Inventory…arrow_forward

- Following information relate to Hawke Ltd for the financial year ended 2020 Hawke Ltd Statement of Financial position As at 30 June 2020 2020 2019 Assets Cash at bank 84200 100000 Accounts receivable 208000 172000 Inventory 200000 208000 Prepaid insurance 12000 20000 Interest receivable 400 600 Investments 80000 40000 Plant and equipment 800000 720000 Less: Accumulated depreciation -200000 -180000 Total assets 1184600 1080600 Liabilities Accounts payable 152000 128000 Provision for employee benefits 24000 16000 Other expenses payable 8000 12000 Equity Share capital 800000 800000 Retained earnings 200600 124600 Total liabilities and equity 1184600 1080600 Hawke Ltd Statement of Financial performance For the period ended 30 June 2020…arrow_forward19. A listing of the estimated balances in the company's ledger accounts as of December 31, 2023 is given below (as well as in your Excel template): Cash Accounts receivable Inventory-raw materials Inventory-finished goods Capital assets (net) Assets $ 83,365 1,122,900 10,000 9,125 724,000 $1,949,390 Total assets Liabilities and Shareholders' Equity Accounts payable $ 231,563 Capital stock 1,000,000 Retained Earnings Total liabilities and shareholders' equity 717,828 $1,949,390 Required: 1. Prepare a monthly master budget for ToyWorks for the year ended December 31, 2024, including the following schedules (Use the Excel template provided!): Sales Budget & Schedule of Cash Receipts Production Budget & Manufacturing Overhead Budget Direct Materials Budget & Schedule of Cash Disbursements Direct Labour Budget Selling and Administrative Expense Budget Ending Finished Goods Inventory Budget Cash Budget 2. Prepare budgeted financial statements at December 31, 2024, using absorption costing.arrow_forwardSuppose the following items were taken from the December 31, 2025, assets section of the Boeing Company balance sheet. (All dollars are in millions.) Inventory Notes receivable-due after December 31, 2026 Notes receivable-due before December 31, 2026 Accumulated depreciation-buildings eTextbook and Media List of Accounts Save for Later TS V $16,140 > 5,530 345 12,530 Patents Buildings Cash Prepare the assets section of a classified balance sheet. (List the Current Assets in order of liquidity. Enter amounts in millions) Accounts receivable Debt investments (short-term) BOEING COMPANY Partial Balance Sheet (in millions) Assets $13,040 20,700 $ 7.900 5,590 1,590 Assistance Used Attempts: 0 of 3 used Submit Answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education