ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Required information

Graph A shows the market demand and supply i...

Graph A shows the market demand and supply in a perfectly competitive market Graph B shows the cost curves of a

representative profit maximizing firm in that industry

TB 08-94 Refer to the above figure to answer this que...

Refer to the above figure to answer this question Suppose that the industry demand was to increase by 3,000 units. At the new equilibrium, what quantity will the firm produce?

Multiple Choice

ed

50

< Prev

10 11

ill

Next >

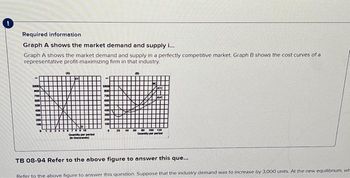

Transcribed Image Text:Required information.

Graph A shows the market demand and supply i...

Graph A shows the market demand and supply in a perfectly competitive market. Graph B shows the cost curves of a

representative profit-maximizing firm in that industry.

Qayerd

Onthousand)

ATC

AVC

100 129

Otype per

TB 08-94 Refer to the above figure to answer this que...

Refer to the above figure to answer this question. Suppose that the industry demand was to increase by 3,000 units. At the new equilibrium, wh

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- #3 defarrow_forwardGiven your understanding of the various market structures, use the information contained in the diagram below to answer the following questions. Price and cost (dollars per unit) $750 600 475 460 450 400 a) $500, 600 The firm would maximize profit by charging b) $400, 675 Oc) $750: 500 500 d) $400, 500 MR 650 700 725 per unit and producing? ATC MC Quantity per yeararrow_forwardIn a perfect market the TR and TC create a ___________________breakeven quantity whenever the MC is constant and the potential profit is ___________________________________?arrow_forward

- 13 / 14 63.6% Question 4 from the book. If the market demand crve is Q=100 –p, what is the price elasticty of demand? If the supply curve of indrvidual firms is q-p and there are 50 identical firms. (perfect competition) Draw the residual demand facing any one firm. What is the residual demand elasticity facing one firm at the competitive equilibrium? 图arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardQuestion 14 “Healthy Morning” is a firm that produces breakfast cereal and suppose breakfast cereal is a competitive market. The firm earned $10,000 in total revenue and had a marginal revenue of $10 for the last unit produced and sold. What is the average revenue per unit, and how many units were sold? $10 and 500 units $5 and 1000 units $10 and 1000 units $5 and 500 unitsarrow_forward

- 1. Suppose that inverse demand is given by P = 100 − 1/2 Q and each firm’s marginal cost is 10. Assume fixed costs are 0.(a) Solve for equilibrium price and quantity assuming this is a monopoly market. (i.e. Sup-posing there is only one firm, with no threat of entry, find the choice of quantity thatmaximizes profit, and then compute the corresponding market price.)(b) At this price and quantity, what is the monopolist’s profit?(c) What is consumer surplus?(d) What would be the perfectly competitive price, quantity, and consumer surplus?(e) How much is deadweight loss due to monopoly?arrow_forwardThe information in the table shows the total demand for water service in Takoma. Assume that there are two companies operating in Takoma. Each company that provides these services incurs an annual fixed cost of $400 and that the marginal cost of providing the service to each customer is exactly $2.00. Figures listed are for an annual service contract. Quantity 0 100 200 300 400 500 600 700 800 900 1000 1100 1200 Price 60 55 50 45 40 35 30 25 b. Refer to Table 17-36. Suppose these 2 firms are price competing with each other (as what happens in a perfectly competitive market). What would total output be? a. 0 21250 1200arrow_forwardThe graph below depicts the cost curves faced by all firms in a particular industry. While the second graph show the total market demand (in thousands). Initially there are 500 firms. 10 B N 5 20 40 60 80 100 120 140 160 180 200 9 50 100 150 200 250 300 350 400 450 500 Demand in thousands What is the SR profit per firm? -80 240 0300 400arrow_forward

- AVC, ATC,MC 110 80 76 " 50 40 30 29 18 MC ATC 1234567H0 11 12 13 14 Output per period O a Loss of $90 O b. Profit of $180 O c. 50 Od. Profit of $6300 The Competitive Industry and Firm Refer to the figure above to answer this question for a representative firm in a perfectly competitive market. Suppose that the market price is $70. What is the firm's maximum profit (or minimum loss)?arrow_forward8. Short-run and long run effects of a shift in demand Suppose that the tuna industry is in long-run equilibrium at a price of $5 per can of tuna and a quantity of 350 million cans per year. Suppose that WebMD daims that a protein found in tuna will increase your expected lifespan by 2 years. WebMD's claim will cause consumers to demand more PRICE (Dollars per cani producing more tuna and earning positive profit Shift the demand curve, the supply curve, or both on the following graph to illustrate these short-run effects of WebMD's claim. ? 0 tuna at every price. In the short run, firms will respond by Supply Demand 70 140 210 200 350 420 400 560 630 700 QUANTITY (Millions of cans) Demand -0 Supplyarrow_forwardPlease answer in tipping formatarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education