FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Required: Compute the following for Year 2:

- Earnings per share of common stock

- Price-earnings ratio

- Dividend payout ratio

- Dividend yield ratio

- Return on total assets

- Return on common

stockholders' equity - Book value per share

Working capital Current ratio - Acid-test (quick) ratio

Accounts receivable turnover- Average collection period (age of receivables)

- Inventory turnover

- Average sale period (turnover in days)

- Times interest earned

- Debt-to-equity ratio

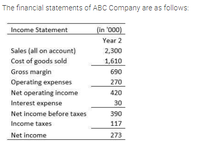

Transcribed Image Text:The financial statements of ABC Company are as follows:

Income Statement

(in '000)

Year 2

Sales (all on account)

2,300

Cost of goods sold

1,610

Gross margin

690

Operating expenses

270

Net operating income

420

Interest expense

30

Net income before taxes

390

Income taxes

117

Net income

273

Transcribed Image Text:Dividends during Year 2 totaled P153,000, of wnich P10,000 was preferred dividends. The market price of a snare of common stock on December 31, Year 2 was P210.

Balance Sheets (in '000)

ASSETS

Year 2

Year 1

Current Assets

Cash

130

120

Receivables

180

180

Inventories

170

180

Other current assts

20

500

20

Total current assets

500

Noncurrent assets

Property and equipment, net

2,000

1,930

Total noncurrent assets

2,000

1,930

Total assets

2,500

2,430

LIABILITIES and EQUITY

Current liabilities

Accounts payable

130

160

Accrued liabilities

30

60

Notes payable, short term

130

130

Total current liabilities

290

350

Noncurrent liabilities

Bonds payable

Total noncurrent liabilities

310

300

310

300

Total liabilities

600

650

Stockholders' equity

Preferred stock, P10 par, 10%

100

100

Common stock

180

180

Additional paid-in capital -

common

160

160

Retained earnings

1460

1340

Total equity

1900

1780

Total Liabilities and Equity

2,500

2,430

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the information provided from Sapphire Ltd calculate and comment on the following ratios:1. Profit margin2. Return on equityarrow_forwardCurrent Position Analysis The following data were taken from the balance sheet of Albertini Company at the end of two recent fiscal years: Previous Year Current assets: Cash Marketable securities Accounts and notes receivable (net) Inventories Prepaid expenses. Total current assets. Current liabilities: Accounts and notes payable (short-term) Accrued liabilities Total current liabilities 1. Working capital 2. Current ratio: Current Year 3. Quick ratio b. The liquidity of Albertini has $356,400 412,700 168,900 1,547,700 797,300 $3,283,000 $388,600 281,400 $670,000 $278,400 313,200 104,400 1,167,500 746,500 $2,610,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year $406,000 174,000 $580,000 from the preceding year to the current year. The working capital, current ratio, and quick ratio have all in current assets relative to current liabilities. Most of these changes are the…arrow_forwardPlease correct answer and don't use hand ratingarrow_forward

- use the following information to make a Common size income statementarrow_forwardConsider this simplified balance sheet for Geomorph Trading: Current assets Long-term assets $ 245 Current liabilities Long-term debt 630 Other liabilities Equity $ 875 Required: a. What is the company's debt-equity ratio? (Hint: debt = Current liabilities, Long-term debt, and Other liabilities) Note: Round your answer to 2 decimal places. b. What is the ratio of total long-term debt to total long-term capital? Note: Round your answer to 2 decimal places. c. What is its net working capital? d. What is its current ratio? Note: Round your answer to 2 decimal places. $ 170 215 140 350 $ 875 a Debt-equity ratio b. Long-term debt-to-capital ratio c. Net working capital d. Current ratioarrow_forwardCurrent Position Analysis The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash Marketable securities Accounts and notes receivable (net) Inventories Prepaid expenses Total current assets Current liabilities: Accounts and notes payable (short-term) Accrued liabilities Total current liabilities a. Determine for each year (1) the working Current Year 1. Working capital 2. Current ratio 3. Quick ratio b. The liquidity of Nilo has current assets relative to current liabilities. $690,500 799,500 327,000 1,042,800 537,200. $3,397,000 $458,200 $579,600 652,100 217,300 673,400 430,600 $2,553,000 $483,000 331,800 207,000 $790,000 $690,000 capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Previous Year from the preceding year to the current year. The working capital, current ratio, and quick ratio have all . Most of these changes are the result of an inarrow_forward

- Current Position Analysis The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash Marketable securities Accounts and notes receivable (net) Inventories Prepaid expenses Total current assets Current liabilities: Accounts and notes payable (short-term) Accrued liabilities Total current liabilities $387,600 448,800 183,600 1,032,200 531,800 $2,584,000 1. Working capital 2. Current ratio 3. Quick ratio b. The liquidity of Nilo has improved increased $394,400 285,600 $680,000 $306,800 345,200 115,000 719,800 460,200 $1,947,000 $413,000 177,000 $590,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year ✔ from the preceding year to the current year. The working capital, current ratio, and quick ratio have all ✔Most of these channes are the result of an increase ✔in nurrent accets…arrow_forwardMatch the following ratio functions with the ratio (place the number of your chosen answer into the box with the border beside the term you think it goes with : Dividend Yield Debt ratio Current Ratio Price/Earnings Ratio Acid-test ratio Earnings per share 1. The amount of net income earned for each share of the company's common stock 2. The percentage of a stock's market value returned to stockholders as dividends each period 3. The ability to pay current liabilities with current assets. 4. The percentage of assets financed with debt. 5. The ability to pay all current liabilities if they come due immediately. 6. The market price of $1 of earnings.arrow_forwardPlease solve for PART A (liquidity’s current ratio, account receivables turnover, and inventory turnover/profitability’s profit margin, asset turnover, return on assets, and earnings per share) and PART B (return on common stockholder’s equity, debt to assets ratio, and price earnings ratio)arrow_forward

- 2. Calculate the projected inventory turnover, days sales outstanding (DSO), fixed assets turnover, and total assets turnover. How does Abiproffy's utilization of assets stack up against other firms in its industry? Calculate the projected current and quick ratios based on the projected balance sheet and income statement data. What can you say about the company's liquidity position and its trend? Calculate the projected debt ratio, the debt-to-equity ratio, liabilities-to-assets ratio, earnings multiplier, times-interest-earned, and EBITDA coverage ratios. How does Abiproffy compare with the industry with respect to financial leverage? What can you conclude from these ratios? Calculate the projected price/earnings ratio and market/book ratio. Do these ratios indicate that investors are expected to have a high or low opinion of the company? It is commonly recommended that the managers of a firm compare the performance of their firm to that of its peers. Increasingly, this is becoming a…arrow_forwardRequired: Compute the following ratios for 2020: 1. Current Ratio 2. Quick Ratio 3. Receivable Turnover 4. Average Collection Period 5. Inventory Turnover 6. Average Sales Period 7. Working Capital 8. Debt Ratio 9. Equity Ratio 10. Debt to Equity Ratio 11. Time Interest Earned 12. Gross Profit Ratio 13. Operating Profit Margin 14. Net Profit Margin 15. Return on Assetsarrow_forwardMatch each ratio that follows to its use. Items may be used more than once.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education