FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

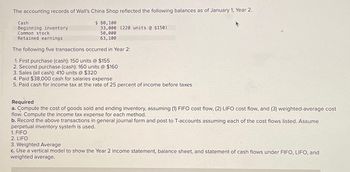

Transcribed Image Text:The accounting records of Wall's China Shop reflected the following balances as of January 1, Year 2.

$ 80,100

33,000 (220 units @ $150)

50,000

63,100

Cash

Beginning inventory

Common stock

Retained earnings

The following five transactions occurred in Year 2:

1. First purchase (cash): 150 units @ $155

2. Second purchase (cash): 160 units @ $160

3. Sales (all cash): 410 units @ $320

4. Paid $38,000 cash for salaries expense

5. Paid cash for income tax at the rate of 25 percent of income before taxes

Required

a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost

flow. Compute the income tax expense for each method.

b. Record the above transactions in general journal form and post to T-accounts assuming each of the cost flows listed. Assume

perpetual inventory system is used.

1. FIFO

2. LIFO

3. Weighted Average

c. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and

weighted average.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The accounting records of Wall's China Shop reflected the following balances as of January 1, Year 2: Cash Beginning inventory Common stock Retained earnings The following five transactions occurred in Year 2: 1. First purchase (cash) 120 units @ $90 2. Second purchase (cash) 205 units @ $98 3. Sales (all cash) 350 units @ $197 4. Paid $13,950 cash for salaries expense 5. Paid cash for income tax at the rate of 25 percent of income before taxes $16, 800 17,600 (200 units @ $88) 15, 700 18,700 Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req A Req B1 Cost of goods sold Ending inventory Req…arrow_forwardSheffield Corp. markets CDs of numerous performing artists. At the beginning of March, Sheffield had in beginning inventory 2,500 CDs with a unit cost of $8. During March, Sheffield made the following purchases of CDs. March 5. March 13 1,900 @ 3,500 @ $9 $10 March 21 March 26 5,200 @ $11 $12 1,900 @ During March 11,500 units were sold. Sheffield uses a periodic inventory system.arrow_forwardFIFO, Average cost, and LIFO are often used for inventory valuation purposes. Compare these methods and discuss the effects of each method in the determination of income and asset managementarrow_forward

- d The records of Cordova Corp. showed the following transactions, in the order given, relating to the major inventory item: Required: Complete the following schedule for each independent assumption. (Round unit costs to the nearest cent.) a. 1. Inventory 2. Purchase 3. Sale (at $15.20) 4. Purchase 5. Sale (at $15.20) 6. Purchase 7. Sale (at $18.20) 8. Purchase Independent Assumptions FIFO Weighted average, periodic inventory system Moving average, perpetual inventory system b. Unit Units Cost 5,600 $7.00 11,200 7.30 7,900 10,200 7.60 16,800 18,800 7.76 16,800 11,200 7.90 C. $ Ending Inventory 121,848 121,675 X 121,676 Units and Amounts Cost of Goods Sold $ 311,000 311,064 311,328 $ Gross Margin 370,200 370,136 X 369,872arrow_forwardOn the basis of the following data, determine the value of the inventory at the lower of cost or market. Assemble the data in the form illustrated in Exhibit 10. Product InventoryQuantity Cost PerUnit Market Value per Unit(Net Realizable Value) Class 1: Model A 16 $162 $169 Model B 32 190 198 Model C 34 152 148 Class 2: Model D 31 298 309 Model E 42 72 78 Question Content Area a. Determine the value of the inventory at the lower of cost or market applied to each item in the inventory. Inventory at the Lower of Cost or Market Product InventoryQuantity Costper Unit Market Valueper Unit(Net Realizable Value) Cost Market Lower of Cost or Market Model A fill in the blank 1b67cb01c017023_1 $fill in the blank 1b67cb01c017023_2 $fill in the blank 1b67cb01c017023_3 $fill in the blank 1b67cb01c017023_4 $fill in the blank 1b67cb01c017023_5 $fill in…arrow_forwardPlease help mearrow_forward

- Identify each item as describing the FIFO method, LIFO method, or average cost method of inventory valuation. A. Involves calculating the total number of units in the warehouse FIFO LIFO Average cost B. To determine cost of goods sold, begin with the earliest goods acquired FIFO LIFO Average cost C. To determine merchandise inventory balance, begin with the earliest goods acquired FIFO LIFO Average costarrow_forwardGlasgow Corporation has the following inventory transactions during the year. Unit Number of Units 53 133 Cost $ 45 47 Total Cost $ 2,385 6,251 10,150 5,763 Date Transaction Jan. 1 Beginning inventory Purchase Purchase Purchase Apr. 7 Jul.16 203 50 Oct. 6 113 51 502 $24,549 For the entire year, the company sells 433 units of inventory for $63 each.arrow_forward10. Choose the options to correctly complete the following statement. Some balance sheet and income statement accounts that vary directly with sales include: 1. Cost of goods sold II. Depreciation III. Accounts payable IV. Accounts receivable O I, II, III only O I, II, IV only O I, III, IV only O I, II, III, and IVarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education