FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

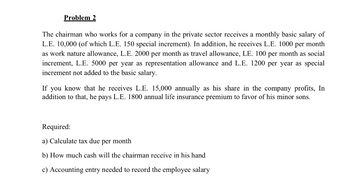

Transcribed Image Text:Problem 2

The chairman who works for a company in the private sector receives a monthly basic salary of

L.E. 10,000 (of which L.E. 150 special increment). In addition, he receives L.E. 1000 per month

as work nature allowance, L.E. 2000 per month as travel allowance, LE. 100 per month as social

increment, L.E. 5000 per year as representation allowance and L.E. 1200 per year as special

increment not added to the basic salary.

If you know that he receives L.E. 15,000 annually as his share in the company profits, In

addition to that, he pays L.E. 1800 annual life insurance premium to favor of his minor sons.

Required:

a) Calculate tax due per month

b) How much cash will the chairman receive in his hand

c) Accounting entry needed to record the employee salary

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Completing the Payroll Register The Employee Payroll Register presents all the computations previously performed as it applies to this payroll period. Complete the following steps (if a field should be blank, leave it blank): Record the amount to be withheld for group insurance. Record the amount to be withheld for health insurance. Each worker is to be paid by check. Assign check numbers provided to the correct employee. Compute the net pay for each employee. Total the input columns. KIPLEY COMPANY, INC.Payroll RegisterFor Period Ending January 8, 20-- EARNINGS DEDUCTIONS NET PAY Name Gross OASDI HI FIT SIT SUTA CIT SIMPLE Grp. Ins. Health Ins. Ck. No. Amount Carson, F. $700.00 $43.40 $10.15 $48.00 $21.49 $0.42 $21.00 $20.00 Wilson, W. 897.04 55.62 13.01 68.00 27.54 0.54 26.91 50.00 Utley, H. 678.75 42.08 9.84 14.00 20.84 0.41 20.36 40.00 Fife, L. 877.10 54.38 12.72 33.00 26.93 0.53 26.31 50.00 Smith, L. 790.00 48.98 11.46 59.00…arrow_forwardTrue or False 4. The entry to record the employer's payroll taxes would include a debit to an expense account and a credit to one or more liability accounts.arrow_forwardWhich of the following accounts represents the "take-home pay" or "net pay" related to employees? EMPLOYEE BENEFITS PAYABLE OPAYROLL TAX EXPENSE SALARY EXPENSE SALARY PAYABLE TO EMPLOYEESarrow_forward

- 2. Prepare a general journal entry to record the payroll. The firm's general ledger contains a Wages Expense account and a Wages Payable account. Then assuming that the firm has transferred funds from its regular bank account to its special payroll bank account and that this entry has been made, prepare a general journal entry to record the payment of wages. If required, round your intermediate calculations and the final answers to the nearest cent and use the rounded answers in subsequent computations. If an amount box does not require an entry, leave it blank. GENERAL JOURNAL PAGE DATE DESCRIPTION POST. REF. DEBIT CREDIT 20-- Oct. 14 fill in the blank 177445fc1f8a014_2 fill in the blank 177445fc1f8a014_3 fill in the blank 177445fc1f8a014_5 fill in the blank 177445fc1f8a014_6 fill in the blank 177445fc1f8a014_8 fill in the blank 177445fc1f8a014_9 fill in the blank 177445fc1f8a014_11 fill in the blank…arrow_forwardIn this section, you are asked to review and comment on the one of the business cycles provided. Complete steps 1 and 2 prior to preparing your response: 1. Choose from one of the following cycles: Payroll or Purchasing. 2. Review the list of main activities in the cycle you chose (a summary of main activities is listed for each cycle) from the table below. Payroll Activities 1. Hiring Employees 2. Authorizing Payroll Changes Purchasing Activities 1. Requisitioning goods and services 2. Preparing purchase ordersarrow_forwardQuestion 9: In a journal entry for employee payroll, what type of account is credited to record each of the amounts withheld from employee earnings? Answer: A. O Asset В. O Liability C. O Revenue D. O Expensearrow_forward

- Subject - account Please help me. Thankyou.arrow_forwardTo determine how much to deduct from the gross pay of Jason Parker, an employee of Jensen Ltd., one would look at the earnings record. O Form TD1. O payroll register. O Form T4.arrow_forwardTypes of Debts Amounts Administrative expenses Government claims to unpaid taxes Salary during last month owed to Mr. Key and Ms. Rankinarrow_forward

- This problem continues the computing and recording employee payroll for the Olney Company for the pay period ending January 8th, 20--. Tasks previously performed include determining gross earnings, FICA withholding, federal, state and city taxes. These computations are shown in the Employee Payroll Register. Requirements: Compute and record the employee's SUTA contributions. Compute and record the Olney Company's SUTA and FUTA contributions. Payroll Register The State Unemployment Tax Act, better known as SUTA, is a form of payroll tax that all states require employers to pay for their employees. SUTA is a counterpart to FUTA, the federal unemployment insurance program. Your tasks now are to compute FUTA and SUTA. Complete the following step: Compute and record the employee's SUTA contributions (employees pay 0.06% on total gross pay). Note: Round your final answers to nearest cent. ONLEY COMPANY, INC.Employee Payroll Register For Period Ending January 8, 20-- EARNINGS…arrow_forwardFor the Corporation I have created I need to prepare the Corporation needs a Payroll Register and Payroll Tax Register for the three employees for the week ended August 31, 2024. August 2024 has 22 working days. As well as the total coronation payroll expense for the month ended August 31, 2024. -I also attached an image of the outline of the payroll register and payroll tax register for my corporation. The Corporation employs three employees, and pays time-and-a-half for overtime and monthly paychecks are distributed on the Friday following the last day of the month. The Corporation withholds federal income tax at 18%, state income tax at 7%, FICA-OASDI at 6.2% for wages up to $118,500, and FICA-Medicare at 1.45%. The Corporation also pays payroll taxes for FICA-OASDI at 6.2% for wages up to $118,500, FICA--Medicare at 1.45%, and state and federal unemployment at 5.4% and 0.6% respectively for wages up to $7,000. August 2024 has 22 working days. The payroll data employees…arrow_forward20arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education