FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

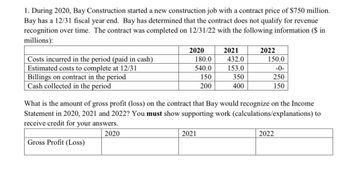

Transcribed Image Text:1. During 2020, Bay Construction started a new construction job with a contract price of $750 million.

Bay has a 12/31 fiscal year end. Bay has determined that the contract does not qualify for revenue

recognition over time. The contract was completed on 12/31/22 with the following information ($ in

millions):

Costs incurred in the period (paid in cash)

Estimated costs to complete at 12/31

Billings on contract in the period

Cash collected in the period

2020

180.0

2021

2022

432.0

150.0

540.0

153.0

-0-

150

350

250

200

400

150

What is the amount of gross profit (loss) on the contract that Bay would recognize on the Income

Statement in 2020, 2021 and 2022? You must show supporting work (calculations/explanations) to

receive credit for your answers.

Gross Profit (Loss)

2020

2021

2022

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Kingbird Construction Company began work on a $418,500 construction contract in 2020. During 2020, Kingbird incurred costs of $285,500, billed its customer for $233,000, and collected $172,000. At December 31, 2020, the estimated additional costs to complete the project total $155,765.Prepare Kingbird’s journal entry to record profit or loss, if any, using (a) the percentage-of-completion method and (b) the completed-contract method. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 5,275.) No. Account Titles and Explanation Debit Credit (a) enter an account title to record the transaction using the percentage-of-completion method enter a debit amount enter a credit amount enter an account title to record the transaction using the percentage-of-completion method enter a debit…arrow_forwardDuring 2023, Sunland Company started a construction job with a contract price of $1,792,000. The job was completed in 2025. The following information is available. The contract is non-cancellable. Costs incurred to date Estimated costs to complete Billings to date (non-refundable) Collections to date (a) 2023 2024 $448,000 $924,000 672,000 336,000 1,008,000 907,200 302.400 308,000 0000 2025 $1,198,400 0 1,792,000 1,596,000 Calculate the amount of gross profit to be recognized each year, assuming the percentage-of-completion method is used. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) nont ROOFarrow_forwardAnswer is $1,800,000. Please explain the reasoning and calculationsarrow_forward

- In 2021, Montana Corp. entered into a contract to begin work on a two-year project. Montana recognizes revenue over time according to percentage of completion for this contract, and provides the following information (dollars in millions): Accounts receivable, 12/31/2021 (from construction progress billings) $37.5 $140 Actual construction costs incurred in 2021 Cash collected on project during 2021 $105 Construction in progress, 12/31/2021 $210 Estimated percentage of completion during 2021 Selected Amounts O $70,000,000 What is the amount of gross profit on the project recognized by Montana during 2021? O $60,000,000 $35,000,000 O $105,000,000 50 %arrow_forwardM5-13. Computing Revenues under Long-Term Contracts Camden Corporation agreed to build a warehouse for a client at an agreed contract price of $900,000. Ex- pected (and actual) costs for the warehouse follow: 2016, $202,500; 2017, $337,500; and 2018, $135,000. The company completed the warehouse in 2018. Compute revenues, expenses, and income for each year 2016 through 2018, and for all three years combined, using the cost-to-cost method.arrow_forward1. During 2020, Bay Construction started a new construction job with a contract price of $750 million. Bay has a 12/31 fiscal year end. Bay has determined that the contract does not qualify for revenue recognition over time. The contract was completed on 12/31/22 with the following information ($ in millions): Costs incurred in the period (paid in cash) Estimated costs to complete at 12/31 Billings on contract in the period Cash collected in the period 2020 180.0 2021 2022 432.0 150.0 540.0 153.0 -0- 150 350 250 200 400 150 What is the amount of gross profit (loss) on the contract that Bay would recognize on the Income Statement in 2020, 2021 and 2022? You must show supporting work (calculations/explanations) to receive credit for your answers. Gross Profit (Loss) 2020 2021 2022arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education