FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

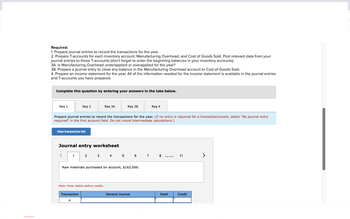

Transcribed Image Text:Required:

1. Prepare journal entries to record the transactions for the year.

2. Prepare T-accounts for each inventory account, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from your

journal entries to these T-accounts (don't forget to enter the beginning balances in your inventory accounts).

3A. Is Manufacturing Overhead underapplied or overapplied for the year?

3B. Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold.

4. Prepare an income statement for the year. All of the information needed for the income statement is available in the journal entries

and T-accounts you have prepared.

Complete this question by entering your answers in the tabs below.

Req 1

View transaction list

<

Req 2

Prepare journal entries to record the transactions for the year. (If no entry is required for a transaction/event, select "No journal entry

required" in the first account field. Do not round intermediate calculations.)

Journal entry worksheet

1

Transaction

a.

Req 3A

2

Note: Enter debits before credits.

Req 3B

Raw materials purchased on account, $162,000.

3 4 5 6 7 8

Req 4

General Journal

…………..

Debit

11

Credit

>

Transcribed Image Text:Gold Nest Company of Guandong, China, is a family-owned enterprise that makes birdcages for the South China market. The company

sells its birdcages through an extensive network of street vendors who receive commissions on their sales.

The company uses a job-order costing system in which overhead is applied to jobs on the basis of direct labor cost. Its predetermined

overhead rate is based on a cost formula that estimated $84,000 of manufacturing overhead for an estimated activity level of $40,000

direct labor dollars. At the beginning of the year, the inventory balances were as follows:

Raw materials

Work in process.

Finished goods

During the year, the following transactions were completed:

$ 10,400

$ 4,700

$ 8,500

a. Raw materials purchased on account, $162,000.

b. Raw materials used in production, $148,000 (materials costing $126,000 were charged directly to jobs; the remaining materials

were indirect).

c. Costs for employee services were incurred as follows:

Direct labor

Indirect labor.

Sales commissions

Administrative salaries

$ 179,000

$ 292,200

$ 28,000

$ 43,000

d. Rent for the year was $18,200 ($13,600 of this amount related to factory operations, and the remainder related to selling and

administrative activities).

e. Utility costs incurred in the factory, $19,000.

f. Advertising costs incurred, $11,000.

g. Depreciation recorded on equipment, $25,000. ($16,000 of this amount related to equipment used in factory operations; the

remaining $9,000 related to equipment used in selling and administrative activities.)

h. Manufacturing overhead cost was applied to jobs, $ ?

i. Goods that had cost $228,000 to manufacture according to their job cost sheets were completed.

j. Sales for the year (all paid in cash) totaled $511,000. The total cost to manufacture these goods according to their job cost sheets

was $219,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

I need help with Req 2 and Req 3B

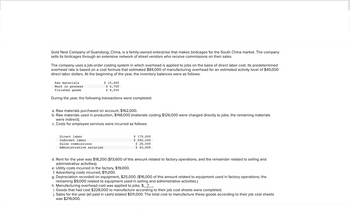

Transcribed Image Text:Required:

1. Prepare journal entries to record the transactions for the year.

2. Prepare T-accounts for each inventory account, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from your

journal entries to these T-accounts (don't forget to enter the beginning balances in your inventory accounts).

3A. Is Manufacturing Overhead underapplied or overapplied for the year?

3B. Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold.

4. Prepare an income statement for the year. All of the information needed for the income statement is available in the journal entries

and T-accounts you have prepared.

Complete this question by entering your answers in the tabs below.

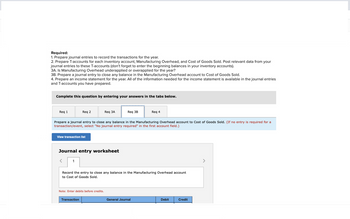

Req 1

Req 2

View transaction list

1

Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold. (If no entry is required for a

transaction/event, select "No journal entry required" in the first account field.)

Journal entry worksheet

Req 3A

Note: Enter debits before credits.

Transaction

Req 3B

Record the entry to close any balance in the Manufacturing Overhead account

to Cost of Goods Sold.

Req 4

General Journal

Debit

Credit

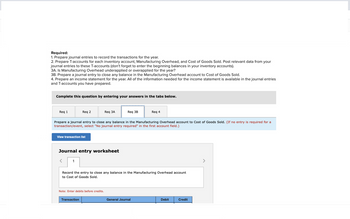

Transcribed Image Text:Required:

1. Prepare journal entries to record the transactions for the year.

2. Prepare T-accounts for each inventory account, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from your

journal entries to these T-accounts (don't forget to enter the beginning balances in your inventory accounts).

3A. Is Manufacturing Overhead underapplied or overapplied for the year?

3B. Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold.

4. Prepare an income statement for the year. All of the information needed for the income statement is available in the journal entries

and T-accounts you have prepared.

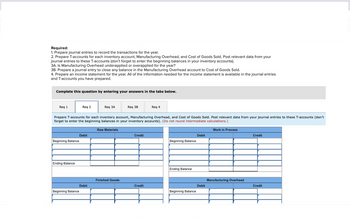

Complete this question by entering your answers in the tabs below.

Req 1

Beginning Balance

Ending Balance

Req 2

Beginning Balance

Prepare T-accounts for each inventory account, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from your journal entries to these T-accounts (don't

forget to enter the beginning balances in your inventory accounts). (Do not round intermediate calculations.)

Work in Process

Debit

Req 3A

Debit

Raw Materials

Req 3B

Finished Goods

Credit

Req 4

Credit

Beginning Balance

Ending Balance

Beginning Balance

Debit

Debit

Manufacturing Overhead

Credit

Credit

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

I need help with Req 2 and Req 3B

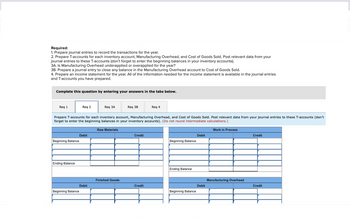

Transcribed Image Text:Required:

1. Prepare journal entries to record the transactions for the year.

2. Prepare T-accounts for each inventory account, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from your

journal entries to these T-accounts (don't forget to enter the beginning balances in your inventory accounts).

3A. Is Manufacturing Overhead underapplied or overapplied for the year?

3B. Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold.

4. Prepare an income statement for the year. All of the information needed for the income statement is available in the journal entries

and T-accounts you have prepared.

Complete this question by entering your answers in the tabs below.

Req 1

Req 2

View transaction list

1

Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold. (If no entry is required for a

transaction/event, select "No journal entry required" in the first account field.)

Journal entry worksheet

Req 3A

Note: Enter debits before credits.

Transaction

Req 3B

Record the entry to close any balance in the Manufacturing Overhead account

to Cost of Goods Sold.

Req 4

General Journal

Debit

Credit

Transcribed Image Text:Required:

1. Prepare journal entries to record the transactions for the year.

2. Prepare T-accounts for each inventory account, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from your

journal entries to these T-accounts (don't forget to enter the beginning balances in your inventory accounts).

3A. Is Manufacturing Overhead underapplied or overapplied for the year?

3B. Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold.

4. Prepare an income statement for the year. All of the information needed for the income statement is available in the journal entries

and T-accounts you have prepared.

Complete this question by entering your answers in the tabs below.

Req 1

Beginning Balance

Ending Balance

Req 2

Beginning Balance

Prepare T-accounts for each inventory account, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from your journal entries to these T-accounts (don't

forget to enter the beginning balances in your inventory accounts). (Do not round intermediate calculations.)

Work in Process

Debit

Req 3A

Debit

Raw Materials

Req 3B

Finished Goods

Credit

Req 4

Credit

Beginning Balance

Ending Balance

Beginning Balance

Debit

Debit

Manufacturing Overhead

Credit

Credit

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format thankuarrow_forwardplease provide all journal entry without image thnxarrow_forwardOn January 1, 2020, Corgan Company acquired 70 percent of the outstanding voting stock of Smashing, Inc., for a total of $980,000 in cash and other consideration. At the acquisition date, Smashing had common stock of $790,000, retained earnings of $340,000, and a noncontrolling interest fair value of $420,000. Corgan attributed the excess of fair value over Smashing's book value to various covenants with a 20-year remaining life. Corgan uses the equity method to account for its investment in Smashing. During the next two years, Smashing reported the following: Inventory Dividends Purchases from Net Income Declared Corgan $190,000 210, 000 $240, 000 $44,000 54,000 2020 2021 220,000 Corgan sells inventory to Smashing using a 60 percent markup on cost. At the end of 2020 and 2021, 50 percent of the current year purchases remain in Smashing's inventory. a. Compute the equity method balance in Corgan's Investment in Smashing, Inc., account as of December 31, 2021. b. Prepare the worksheet…arrow_forward

- Kimberly Ashley, the bookkeeper for Interiors Designs, has just finished posting the closing entries for the year to the ledger. She is concerned about the following balances: Capital account balance in the general ledger: Ending capital balance on the statement of owner's equity: Ashley knows that these amounts should agree and asks for your assistance in reviewing her work. Your review of the general ledger of Interiors Designs reveals a beginning capital balance of $100,000. You also review the general journal for the accounting period and find the closing entries shown below. Date 20X1 Dec. 31 31 GENERAL JOURNAL Description Closing Entries Fees income Accumulated depreciation Account payable Income summary Income summary Salaries expense Supplies expense Depreciation expense Wade Wilson, Drawing Debit 196,000 17,000 66,000 184,800 Page 15 Credit 279,000 $194,200 111, 200 156,000 10,000 4,800 14,000 Required: 2. Prepare a general journal entry to correct the errors made. 3.…arrow_forwarddon't give answer in image formatarrow_forwardHow do I record the current transaction?arrow_forward

- Do not give image formatarrow_forwardes Required information [The following information applies to the questions displayed below.] Bunnell Corporation is a manufacturer that uses job-order costing. On January 1, the company's inventory balances were as follows: Raw materials Work in process Finished goods $ 50,000 $ 30,800 $ 43,200 The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the company's predetermined overhead rate of $12.00 per direct labor-hour was based on a cost formula that estimated $480,000 of total manufacturing overhead for an estimated activity level of 40,000 direct labor-hours. The following transactions were recorded for the year: a. Raw materials were purchased on account, $696,000. b. Raw materials used in production, $655,400. All of of the raw materials were used as direct materials. c. The following costs were accrued for employee services: direct labor, $430,000, indirect labor, $150,000; selling and administrative salaries, $251,000. d. Incurred…arrow_forwardQuestion: Journalize the required returns! Include excel formula in your answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education