FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Question:

Journalize the required returns! Include excel formula in your answer

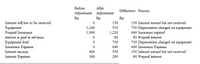

Transcribed Image Text:Before

After

Difference Reason

Adjustment Adjustment

Rp

Rp

Rp

150

Interest still has to be received

150 Interest earned but not received

Equipment

Prepaid Insurance

interest is paid in advance

Equipment load

Insurance Expense

1,240

510

730 Depreciation charged on equipment

640 Insurance expired

80 Prepaid interest

730 Depreciation charged on equipment

640 Insurance Expense

1,860

1,220

80

730

640

Interest income

400

550

150 Interest earned but not received

Interest Expense

360

280

80 Prepaid interest

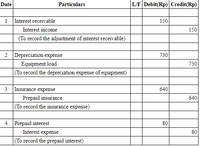

Transcribed Image Text:Date

Particulars

L/F Debit(Rp) Credit(Rp)

1

Interest receivable

150

Interest income

150

(To record the adjustment of interest receivable)

2 Depreciation expense

730

Equipment load

730

|(To record the depreciation expense of equipment)

3 Insurance expense

640

Prepaid insurance

640

(To record the insurance expense)

4 Prepaid interest

80

Interest expense

|(To record the prepaid interest)

80

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forwardWill you please provide the formulas (explanation) to understand the results or numbers that were added in the solution?arrow_forwardCan i have the steps in formula form pleasearrow_forward

- Further info is in the attached images For the Excel part of the question give the solutions in the form of the Excel equations. Please and thank you! :) Download the Applying Excel form and enter formulas in all cells that contain question marks. For example, in cell B34 enter the formula "= B9". After entering formulas in all of the cells that contained question marks, verify that the dollar amounts match the example in the text. Check your worksheet by changing the beginning work in process inventory to 100 units, the units started into production during the period to 2,500 units, and the units in ending work in process inventory to 200 units, keeping all of the other data the same as in the original example. If your worksheet is operating properly, the cost per equivalent unit for materials should now be $152.50 and the cost per equivalent unit for conversion should be $145.50. Thank you!arrow_forwardIn SAP Business ByDesign Built-In Analytics, which of the following tasks can business users perform using interactive analysis options in charts? Show/hide key figure values using the interactive legend. Change the color of chart values (bars, pie pieces, . ..) Zoom into values. Modify key figures please choose 2 correct answers aboarrow_forwardshow journal entry (for part b) assuming estimate is considered to be accurate. and show a journal entry (from part b) assuming the amount is large enough to intentionally impact decision of users.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education