FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

![es

Required information

[The following information applies to the questions displayed below.]

Bunnell Corporation is a manufacturer that uses job-order costing. On January 1, the company's inventory balances were

as follows:

Raw materials

Work in process

Finished goods

$ 50,000

$ 30,800

$ 43,200

The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the company's

predetermined overhead rate of $12.00 per direct labor-hour was based on a cost formula that estimated $480,000 of

total manufacturing overhead for an estimated activity level of 40,000 direct labor-hours. The following transactions were

recorded for the year:

a. Raw materials were purchased on account, $696,000.

b. Raw materials used in production, $655,400. All of of the raw materials were used as direct materials.

c. The following costs were accrued for employee services: direct labor, $430,000, indirect labor, $150,000; selling and

administrative salaries, $251,000.

d. Incurred various selling and administrative expenses (e.g., advertising, sales travel costs, and finished goods

warehousing). $411,000.

e. Incurred various manufacturing overhead costs (e.g., depreciation, insurance, and utilities), $330,000.

1. Manufacturing overhead cost was applied to production. The company actually worked 41,000 direct labor-hours on all

jobs during the year.

g. Jobs costing $1,521,800 to manufacture according to their job cost sheets were completed during the year.

h. Jobs were sold on account to customers during the year for a total of $3,255,000. The jobs cost $1,531,800 to

manufacture according to their job cost sheets.](https://content.bartleby.com/qna-images/question/346aae26-d0e0-42d3-8145-e419f49eefed/f1d2f12a-52ad-4b07-bcc5-71c37eb5c9fc/mk0iqam_thumbnail.jpeg)

Transcribed Image Text:es

Required information

[The following information applies to the questions displayed below.]

Bunnell Corporation is a manufacturer that uses job-order costing. On January 1, the company's inventory balances were

as follows:

Raw materials

Work in process

Finished goods

$ 50,000

$ 30,800

$ 43,200

The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the company's

predetermined overhead rate of $12.00 per direct labor-hour was based on a cost formula that estimated $480,000 of

total manufacturing overhead for an estimated activity level of 40,000 direct labor-hours. The following transactions were

recorded for the year:

a. Raw materials were purchased on account, $696,000.

b. Raw materials used in production, $655,400. All of of the raw materials were used as direct materials.

c. The following costs were accrued for employee services: direct labor, $430,000, indirect labor, $150,000; selling and

administrative salaries, $251,000.

d. Incurred various selling and administrative expenses (e.g., advertising, sales travel costs, and finished goods

warehousing). $411,000.

e. Incurred various manufacturing overhead costs (e.g., depreciation, insurance, and utilities), $330,000.

1. Manufacturing overhead cost was applied to production. The company actually worked 41,000 direct labor-hours on all

jobs during the year.

g. Jobs costing $1,521,800 to manufacture according to their job cost sheets were completed during the year.

h. Jobs were sold on account to customers during the year for a total of $3,255,000. The jobs cost $1,531,800 to

manufacture according to their job cost sheets.

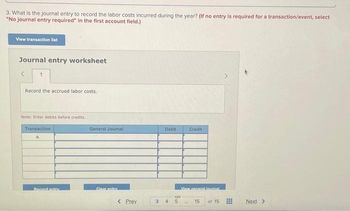

Transcribed Image Text:3. What is the journal entry to record the labor costs incurred during the year? (If no entry is required for a transaction/event, select

"No journal entry required" in the first account field.)

View transaction list

Journal entry worksheet

1

Record the accrued labor costs.

Note: Enter debits before credits.

Transaction

a

Record entry

General Journal

Clear entry

< Prev

3

Debit

4

GO

Credit

View general lournal

He

15

of 15

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Harriott manufacturing company uses job order costing system. The company uses machinehours to apply overhead cost to jobs. At the beginning of 2020, the company estimated that 31,400machine hours would be worked and $5,024,000 overhead cost would be incurred during 2020.The following activities took place in the work in process inventory during February: WIP Inventory A/CNovember 1 Bal. b/f$51,250Direct Materials Used 256,400 Other transactions incurred:▪ Indirect material issued to production was $40,360▪ Total manufacturing labour incurred in November was $368,000, 75% of this amountrepresented direct labour.▪ Other manufacturing overhead costs incurred for November amounted to $340,490.▪ Two jobs were completed with total costs of $384,000 & $270,000 respectively. They weresold on account at a margin of 33⅓% on sales. Cont' For other manufacturing overhead incurredf) For manufacturing overhead applied to production for November, given that…arrow_forwardBunnell Corporation is a manufacturer that uses job-order costing. On January 1, the company’s inventory balances were as follows: The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the company’s predetermined overhead rate of $16.25 per direct labor-hour was based on a cost formula that estimated $650,000 of total manufacturing overhead for an estimated activity level of 40,000 direct labor-hours. The following transactions were recorded for the year: a. Raw materials were purchased on account, $510,000. b. Raw materials used in production, $480,000. All of of the raw materials were used as direct materials. c. The following costs were accrued for employee services: direct labor, $600,000; indirect labor, $150,000; selling and administrative salaries, $240,000. d. Incurred various selling and administrative expenses (e.g., advertising, sales travel costs, and finished goods warehousing), $367,000. e. Incurred various manufacturing…arrow_forwardThe Lofton manufacturing company uses job order costing system. The company uses machine hours to apply overhead cost to jobs. At the beginning of 2020, the company estimated that 31,400 machine hours would be worked and $5,024,000 overhead cost would be incurred during 2020. The following activities took place in the work in process inventory during February: *see attached image* Other transactions incurred: Indirect material issued to production was $40,360 Total manufacturing labour incurred in November was $368,000, 75% of this amount represented direct labour. Other manufacturing overhead costs incurred for November amounted to $340,490. Two jobs were completed with total costs of $384,000 & $270,000 respectively. They were sold on account at a margin of 33 1 ⁄ 3% on sales. Required: Compute Lofton’s predetermined manufacturing overhead rate for 2020. State the journal entries necessary to record the above transactions in the general journal: For direct materials…arrow_forward

- Bunnell Corporation is a manufacturer that uses job-order costing. On January 1, the company’s inventory balances were as follows: Raw materials $ 40,000 Work in process $ 18,000 Finished goods $ 35,000 The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the company’s predetermined overhead rate of $16.25 per direct labor-hour was based on a cost formula that estimated $650,000 of total manufacturing overhead for an estimated activity level of 40,000 direct labor-hours. The following transactions were recorded for the year: Raw materials were purchased on account, $510,000. Raw materials used in production, $480,000. All of of the raw materials were used as direct materials. The following costs were accrued for employee services: direct labor, $600,000; indirect labor, $150,000; selling and administrative salaries, $240,000. Incurred various selling and administrative expenses (e.g., advertising, sales travel costs, and…arrow_forwardPlease do not give image formatarrow_forwardBunnell Corporation is a manufacturer that uses job-order costing. On January 1, the company’s inventory balances were as follows: Raw materials $ 40,000 Work in process $ 18,000 Finished goods $ 35,000 The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the company’s predetermined overhead rate of $16.25 per direct labor-hour was based on a cost formula that estimated $650,000 of total manufacturing overhead for an estimated activity level of 40,000 direct labor-hours. The following transactions were recorded for the year: Raw materials were purchased on account, $510,000. Raw materials use in production, $480,000. All of of the raw materials were used as direct materials. The following costs were accrued for employee services: direct labor, $600,000; indirect labor, $150,000; selling and administrative salaries, $240,000. Incurred various selling and administrative expenses (e.g., advertising, sales travel…arrow_forward

- Bunnell Corporation is a manufacturer that uses job-order costing. On January 1, the company’s inventory balances were as follows: Raw materials $ 84,500 Work in process $ 35,000 Finished goods $ 44,100 The company applies overhead cost to jobs using direct labor-hours. For this year, the company’s predetermined overhead rate of $12.50 per direct labor-hour was based on a cost formula that estimated $500,000 of total manufacturing overhead for an estimated activity level of 40,000 direct labor-hours. The following transactions were recorded this year: Raw materials were purchased on account, $614,000. Raw materials used in production, $567,600. All of of the raw materials were used as direct materials. The following costs were accrued for employee services: direct labor, $450,000; indirect labor, $150,000; selling and administrative salaries, $290,000. Incurred various selling and administrative expenses (e.g., advertising, sales travel costs, and finished goods…arrow_forwardBunnell Corporation is a manufacturer that uses job-order costing. On January 1, the company's inventory balances were as follows: Raw materials Work in process Finished goods $ 40,000 $ 18,000 $ 35,000 The company applies overhead cost to jobs using direct labor-hours. For this year, the company's predetermined overhead rate of $16.25 per direct labor-hour was based on a cost formula that estimated $650,000 of total manufacturing overhead for an estimated activity level of 40,000 direct labor-hours. The following transactions were recorded this year: a. Raw materials were purchased on account, $510,000. b. Raw materials used in production, $480,000. All of of the raw materials were used as direct materials. c. The following costs were accrued for employee services: direct labor, $600,000; indirect labor, $150,000; selling and administrative salaries, $240,000. d. Incurred various selling and administrative expenses (e.g., advertising, sales travel costs, and finished goods…arrow_forwardBunnell Corporation is a manufacturer that uses job-order costing. On January 1, the company’s inventory balances were as follows: Raw materials $ 40,000 Work in process $ 18,000 Finished goods $ 35,000 The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the company’s predetermined overhead rate of $16.25 per direct labor-hour was based on a cost formula that estimated $650,000 of total manufacturing overhead for an estimated activity level of 40,000 direct labor-hours. The following transactions were recorded for the year: Raw materials were purchased on account, $510,000. Raw materials use in production, $480,000. All of of the raw materials were used as direct materials. The following costs were accrued for employee services: direct labor, $600,000; indirect labor, $150,000; selling and administrative salaries, $240,000. Incurred various selling and administrative expenses (e.g., advertising, sales travel…arrow_forward

- Saved Blueberry Corp. uses a job order costing system with manufacturing overhead applied to products on the basis of machine hours. For the upcoming year, Blueberry Corp. estimated total manufacturing overhead cost at $333,500 and total machine hours of 46,000. During the year actual manufacturing overhead incurred was $323,680 and 47,600 machine hours were used. (a) Calculate the predetermined overhead rate. (Round your answer to 2 decimal places.) Pdetemined Overhed Rate per hourarrow_forwardBunnell Corporation is a manufacturer that uses job-order costing. On January 1, the company’s inventory balances were as follows: Raw materials $ 59,500 Work in process $ 37,600 Finished goods $ 61,800 The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the company’s predetermined overhead rate of $14.25 per direct labor-hour was based on a cost formula that estimated $570,000 of total manufacturing overhead for an estimated activity level of 40,000 direct labor-hours. The following transactions were recorded for the year: Raw materials were purchased on account, $634,000. Raw materials use in production, $598,400. All of of the raw materials were used as direct materials. The following costs were accrued for employee services: direct labor, $520,000; indirect labor, $150,000; selling and administrative salaries, $337,000. Incurred various selling and administrative expenses (e.g., advertising, sales travel…arrow_forwardChristopher's Custom Cabinet Company uses a job order cost system with overhead applied as a percentage of direct labor costs. Inventory balances at the beginning of the current year follow: Raw Materials Inventory Work in Process Inventory Finished Goods Inventory $ 16,700 5,800 20,500 The following transactions occurred during January: a. Purchased materials on account for $26,100. b. Issued materials to production totaling $21,000, 90 percent of which was traced to specific jobs and the remainder of which was treated as indirect materials. c. Payroll costs totaling $18,300 were recorded as follows: $10,900 for assembly workers $1,900 for factory supervision $2,200 for administrative personnel $3,300 for sales commissions d. Recorded depreciation: $4,700 for factory machines, $1,300 for the copier used in the administrative office. e. Recorded $1,500 of expired insurance. Forty percent was insurance on the manufacturing facility, with the remainder classified as an administrative…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education