FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

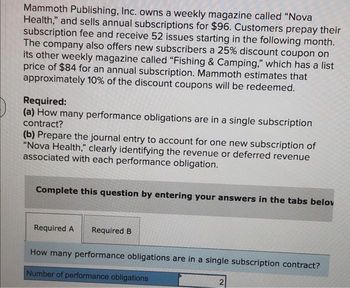

Transcribed Image Text:Mammoth Publishing, Inc. owns a weekly magazine called "Nova

Health," and sells annual subscriptions for $96. Customers prepay their

subscription fee and receive 52 issues starting in the following month.

The company also offers new subscribers a 25% discount coupon on

its other weekly magazine called "Fishing & Camping," which has a list

price of $84 for an annual subscription. Mammoth estimates that

approximately 10% of the discount coupons will be redeemed.

Required:

(a) How many performance obligations are in a single subscription

contract?

(b) Prepare the journal entry to account for one new subscription of

"Nova Health," clearly identifying the revenue or deferred revenue

associated with each performance obligation.

Complete this question by entering your answers in the tabs belov

Required A

Required B

How many performance obligations are in a single subscription contract?

Number of performance obligations

2

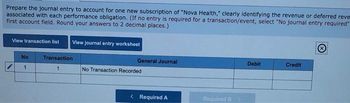

Transcribed Image Text:Prepare the journal entry to account for one new subscription of "Nova Health," clearly identifying the revenue or deferred reve

associated with each performance obligation. (If no entry is required for a transaction/event, select "No journal entry required"

first account field. Round your answers to 2 decimal places.)

View transaction list View journal entry worksheet

No

1

Transaction

1

General Journal

No Transaction Recorded

< Required A

Required B >

Debit

Credit

Ⓒ

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hi! Can someone please help me understand this question? Thank you.arrow_forwardAccess the FASB’s Codification Research System® at the FASB website (www.fasb.org) and select Basic View. Determine the specific seven-digit (XXX-XX-XX) or eight-digit Codification citation (XXX-XX-XX-X) for accounting for each of the following items: Definition of initial direct costs. When a modification to a contract is reported as a separate contract (that is, separate from the original contract). The disclosures required in the notes to the financial statements for a lessor. The classification criteria for when a lessee classifies a lease as a finance lease and a lessor classifies a lease as a sales-type lease.arrow_forwardValaarrow_forward

- Regling Company provides its employees vacation benefits and a defined benefit pension plan. Employees earned vacation pay of $20,000 for the period. The pension formula determined a pension cost of $232,000. Only $13,920 was contributed to the pension plan administrator. Question Content Area a. Journalize the entry to record the vacation pay. If an amount box does not require an entry, leave it blank. blank Account Debit Credit blank Feedback Area Feedback Question Content Area b. Journalize the entry to record the pension benefit. If an amount box does not require an entry, leave it blank. blank Account Debit Credit blankarrow_forwardSubject:arrow_forwardCurrent Attempt in Progress Expenses are recognized when they are billed by the supplier. O they are paid. the invoice is received. they contribute to the production of revenue.arrow_forward

- Pumpkin Ltd. received the following information from its pension plan trustee concerning their defined benefit pension plan for the year ended December 31, 2020: December 31, 2020 $3,500,000 Defined benefit obligation Fair value of plan assets 1,750,000 For 2020, the service cost is $210,000 and past service cost (effective Jan 1, 2020) is $100,000. During 2020, Pumpkin contributed $595,000 to the plan, and paid 89,000 to the retirees throughout the year. The actual return of the plan assets is $90,000. The company was also informed by the consulting firm that an actuarial gain of $750 should be reported. Pumpkin uses discount rates of 6%. Pumpkin uses the immediate recognition approach under IFRS. Instructions Please calculate Pumpkin's DBO and Plan Assets ending balance and net defined pension asset/liability by completing the following worksheet. No separate journal entry necessary.arrow_forwardProcess activity analysis: For a service company Statewide insurance company has a process for making payments on insurance claims as follows. An activity analysis revealed the cause of these activities was as follows. Receiving claim $78,000 Adjusting claim 338,000 Paying claim 104,000 Total. $520,000 This process includes only the cost of the process the claims payments, not the actual amount of the claim payments. The adjustment activity involves verify the estimated amount of the claim and is variable to the number of claims adjusted. The process received, adjusted, and paid 6,500 claims During the period. All claims were treated identically in this process. To improve the cost of the process, management has determined that claims should be segregated into two categories. Claims under $1,000 at claims greater than $1,000 claims under 1,000 would not be adjusted but would be acceptable to insured evidence of the claim. Claims above $1,000 would be adjusted it is estimated…arrow_forwardUnder the completed-contract method, Question 16 options: a revenue, cost, and gross profit are recognized at the time the contract is completed. b revenue and cost are recognized during the production cycle, but gross profit recognition is deferred until the contract is completed. c revenue, cost, and gross profit are recognized during the production cycle. d None of these answers are correct.arrow_forward

- A seller uses a perpetual inventory system, and on April 17, a customer returns $1,000 of merchandise previously purchased on credit on April 13. The seller's cost of the merchandise returned was $480. The merchandise is not defective and is restored to inventory. The seller has not yet received any cash from the customer.arrow_forwardTransactions (a) through (e) took place in Stoney Heights Private Hospital during the year ending December 31, 2019.a. Gross revenues of $5,000,000 were earned for service toMedicare patients.b. Expected contractual adjustments with Medicare, a third-party payor, are $2,500,000; and an allowance for contractual adjustments account is used by Stoney Heights.c. Medicare cleared charges of $5,000,000 with payments of $2,160,000 and total contractual allowances of $2,840,000 ($2,500,000 + $340,000).d. Interim payments received fromMedicare amounted to $250,000.e. The hospital made a lump-sum payment back toMedicare of $100,000.1. Record the transactions in the general journal.2. Calculate the amount of net patient service revenues.3. What is the net cash flow from transactions withMedicare?4. What adjustments must be made at year-end to settle up with Medicare and properly report the net patient service revenues after this settlement?arrow_forwardThe five steps in the revenue recognition process are: Identify the contract(s) with customers. 2. 1. lidentify the separate performance obligations in the contract. 3. Determine the Delivery Date 4. Allocate the transaction price to the separate performance obligations. 5 Recognize revenue when each performance obligation is satisfied. O True Falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education