Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

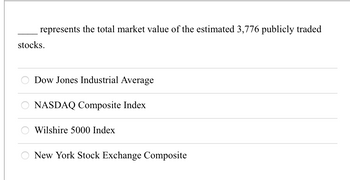

Transcribed Image Text:represents the total market value of the estimated 3,776 publicly traded

stocks.

Dow Jones Industrial Average

€ 388

NASDAQ Composite Index

Wilshire 5000 Index

New York Stock Exchange Composite

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 61 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $3,350,500 $2,822,200 Net income 748,800 578,100 Dividends: On preferred stock (9,800) (9,800) On common stock (40,000) (40,000) Retained earnings, December 31 $4,049,500 $3,350,500 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $4,270,500 $3,934,620 Cost of merchandise sold 1,608,920 1,480,210 Gross profit $2,661,580 $2,454,410 Selling expenses $844,790 $1,058,190 Administrative expenses 719,640 621,470 Total operating expenses $1,564,430 $1,679,660 Income from operations $1,097,150 $774,750 Other revenue and…arrow_forward[The following information applies to the questions displayed below.] The stockholders' equity section of Velcro World is presented here. VELCRO WORLD Balance Sheet (partial) (S and shares in thousands) Stockholders' equity: Preferred stock, $1 par value Common stock, $1 par value Additional paid-in capital Total paid-in capital Retained earnings 5,800 28,000 1,028,600 1,062,400 286,000 (360,000) $ 988,400 Treasury stock, 12,000 common shares Total stockholders equity Based on the stockholders' equity section of Velcro World, answer the following questions. Remember that all amounts are presented in thousands Problem 10-4A Part 4 4. If retained earnings at the beginning of the period was $248 million and $28 million was paid in dividends during the year, what was the net income for the year? (Enter your answer in million (i.., 5,000,000 should be entered as 5).) Net income millionarrow_forwardA recent stockholders' equity section of Aluminum Company of America (Alcoa) showed the following (in alphabetical order): additional paid-in capital $6,101, common stock $925, preferred stock $56, retained earnings $7,428, and treasury stock $2,828. (All dollar data are in millions.) The preferred stock has 557,740 shares authorized, with a par value of $100 and an annual $3.75 per share cumulative dividend preference. At December 31 of the current year, 557,649 shares of preferred are issued and 546,024 shares are outstanding. There are 1.8 billion shares of $1 par value common stock authorized, of which 924.6 million are issued and 844.8 million are outstanding at December 31. (a) Prepare the stockholders' equity section of the current year, including disclosure of all relevant data. (Enter amounts in millions. Enter the account name only and do not provide the descriptive information provided in the question.) ALUMINUM COMPANY OF AMERICA Balance Sheet (Partial)arrow_forward

- 1. Concord Corporation had net income of $203000 and paid dividends to common stockholders of $35000 in 2020. The weighted average number of shares outstanding in 2020 was 50000 shares. Concord Corporation's common stock is selling for $121.80 per share on the New York Stock Exchange. Concord Corporation's price-earnings ratio is A. 3.4 times. B. 30.0 times. C. 21.0 times. D. 36.3 times.arrow_forwardGiven the following data for the King Company: How would common stock appear on a common size balance sheet? Curment labites $ 400 Long term debt 480 Common stack 700 Retained eanings Total iabities & sochdders equty $2,500 920 Enlarged View 20% 70% 28% 30%arrow_forwardConsider the following table for a period of six years: Year 123456 Large- Company Stocks - 16.09% -26.89 37.51 24.21 7.72 6.85 Returns U.S. Treasury Bills 7.57% 8.13 6.15 6.47 5.59 8.06arrow_forward

- CorpCo gathered the following information as of the end of the current fiscal year: Dividends on common stock Market price per share of common stock Shares of common stock outstanding Dividends on preferred stock Shares of preferred stock outstanding Earnings per share on common stock Dividends per share of common stock Net income $125,000 $115.00 5,000 $65,000 600 $102.00 $25.00 $575,000 What is CorpCo's dividend yield? Enter your answer as a percent, rounded to one decimal place. 96arrow_forwardThe stockholders' equity section of the January 1, 2031 balance sheet for XYZ Company is given below: Common stock, $14 par value ................. $525,000 Paid-in capital – common stock .............. $150,000 Treasury stock (14,000 shares @ $16 cost) ... $224,000 Paid-in capital – treasury stock ............ $ 13,000 Retained earnings ........................... $107,000 XYZ Company entered into the following transactions during 2031: a. Re-issued 2,000 of the treasury shares for $11 per share. b. Re-issued 3,000 of the treasury shares for $13 per share. c. Issued 5,000 shares of previously un-issued common stock for $21 per share. d. Re-issued 6,000 of the treasury shares for $19 per share. Calculate the balance in the retained earnings account after all four transactions above are recorded.arrow_forwardThe stockholders’ equity section of Aluminum Company of America (Alcoa) showed the following (in alphabetical order): additional paid-in capital $6,101, common stock $925, preferred stock $56, retained earnings $7,428, and treasury stock 2,828. All dollar data are in millions.The preferred stock has 557,740 shares authorized, with a par value of $100. At December 31 of the current year, 557,649 shares of preferred are issued and 546,024 shares are outstanding. There are 1.8 billion shares of $1 par value common stock authorized, of which 924.6 million are issued and 844.8 million are outstanding at December 31.Prepare the stockholders’ equity section of the current year. (Enter amounts in millions. Enter the account name only and do not provide the descriptive information provided in the question.) ALUMINUM COMPANY OF AMERICABalance Sheet (Partial)choose the accounting period select an opening section name…arrow_forward

- (Market value analysis) Lei Materials' balance sheet lists total assets of $1.35 billion, $196 million in current liabilities, $421 million in long-term debt, $733 million in common equity, and 52 million shares of common stock. If Lei's current stock price is $50.89, what is the firm's market-to-book ratio? The market-to-book ratio is (Round to two decimal places.)arrow_forwardCalculate WACC given the following information. Total Value of Common Stocks (CS) $800,000 Total Value of Preferred Stocks (PS) $100,000 Cost of Preferred stock Total Value of Debt (D) $400,000 Pre-tax Cost of Debt Tax rate (t) Cost of Equity (common stocks) 0.17 0.11 0.09 0.4arrow_forward(Market value analysis) Lei Materials' balance sheet lists total assets of $1.17 billion, $197 million in current liabilities, $435 million in long-term debt, $538 million in common equity, and 50 million shares of common stock. If Lei's current stock price is $54.48, what is the firm's market-to-book ratio? The market-to-book ratio is (Round to two decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education