FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 55 on December 31, 20Y2.

| Marshall Inc. | |||||

| Comparative |

|||||

| For the Years Ended December 31, 20Y2 and 20Y1 | |||||

| 20Y2 | 20Y1 | ||||

| Retained earnings, January 1 | $3,112,575 | $2,638,225 | |||

| Net income | 700,800 | 540,300 | |||

| Dividends: | |||||

| On |

(11,200) | (11,200) | |||

| On common stock | (54,750) | (54,750) | |||

| Retained earnings, December 31 | $3,747,425 | $3,112,575 |

| Marshall Inc. | ||||

| Comparative Income Statement | ||||

| For the Years Ended December 31, 20Y2 and 20Y1 | ||||

| 20Y2 | 20Y1 | |||

| Sales | $3,863,160 | $3,559,340 | ||

| Cost of merchandise sold | 1,516,210 | 1,394,910 | ||

| Gross profit | $2,346,950 | $2,164,430 | ||

| Selling expenses | $731,580 | $918,970 | ||

| Administrative expenses | 623,190 | 539,710 | ||

| Total operating expenses | $1,354,770 | $1,458,680 | ||

| Income from operations | $992,180 | $705,750 | ||

| Other revenue and expense: | ||||

| Other revenue | 52,220 | 45,050 | ||

| Other expense (interest) | (248,000) | (136,800) | ||

| Income before income tax expense | $796,400 | $614,000 | ||

| Income tax expense | 95,600 | 73,700 | ||

| Net income | $700,800 | $540,300 |

| Marshall Inc. | ||||||

| Comparative |

||||||

| December 31, 20Y2 and 20Y1 | ||||||

| 20Y2 | 20Y1 | |||||

| Assets | ||||||

| Current assets: | ||||||

| Cash | $698,750 | $697,040 | ||||

| Marketable securities | 1,057,560 | 1,155,090 | ||||

| 737,300 | 693,500 | |||||

| Inventories | 554,800 | 423,400 | ||||

| Prepaid expenses | 132,198 | 139,410 | ||||

| Total current assets | $3,180,608 | $3,108,440 | ||||

| Long-term investments | 2,310,757 | 1,125,115 | ||||

| Property, plant, and equipment (net) | 3,720,000 | 3,348,000 | ||||

| Total assets | $9,211,365 | $7,581,555 | ||||

| Liabilities | ||||||

| Current liabilities | $993,940 | $1,388,980 | ||||

| Long-term liabilities: | ||||||

| Mortgage note payable, 8% | $1,390,000 | $0 | ||||

| Bonds payable, 8% | 1,710,000 | 1,710,000 | ||||

| Total long-term liabilities | $3,100,000 | $1,710,000 | ||||

| Total liabilities | $4,093,940 | $3,098,980 | ||||

| Preferred $0.70 stock, $40 par | $640,000 | $640,000 | ||||

| Common stock, $10 par | 730,000 | 730,000 | ||||

| Retained earnings | 3,747,425 | 3,112,575 | ||||

| Total stockholders' equity | $5,117,425 | $4,482,575 | ||||

| Total liabilities and stockholders' equity | $9,211,365 | $7,581,555 |

Required:

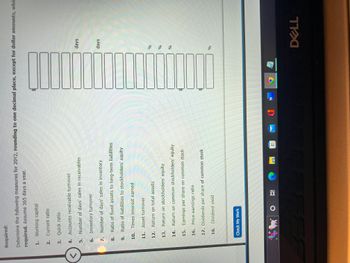

Determine the following measures for 20Y2, rounding to one decimal place, except for dollar amounts, which should be rounded to the nearest cent. Use the rounded answer of the requirement for subsequent requirement, if required. Assume 365 days a year.

***SEE ATTACHED PHOTO FOR QUESTIONS ASKED ABOUT THE INFORMATION ABOVE. I AM NEEDING NUMBERS 7,8,9 PLEASE***

Transcribed Image Text:<

Required:

Determine the following measures for 20Y2, rounding to one decimal place, except for dollar amounts, whic

required. Assume 365 days a year.

1. Working capital

2. Current ratio

Quick ratio

Accounts receivable turnover

Number of days' sales in receivables

Inventory turnover

Number of days' sales in inventory

8.

Ratio of fixed assets to long-term liabilities

9.

Ratio of liabilities to stockholders' equity

10. Times interest earned

3.

4.

5.

6.

7.

11. Asset turnover

12. Return on total assets

13. Return on stockholders' equity

14. Return on common stockholders' equity

15. Earnings per share on common stock

16. Price-earnings ratio

17. Dividends per share of common stock

18. Dividend yield

Check My Work

DOG

20

O

@

_____

M

0

W

$

100000

days

days

%

%

%

%

DELL

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 62 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $1,808,800 $1,544,500 Net income 414,400 316,300 Total $2,223,200 $1,860,800 Dividends: On preferred stock $13,300 $13,300 On common stock 38,700 38,700 Total dividends $52,000 $52,000 Retained earnings, December 31 $2,171,200 $1,808,800 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $2,413,380 $2,223,550 Cost of goods sold 825,630 759,580 Gross profit $1,587,750 $1,463,970 Selling expenses $541,940 $662,800 Administrative expenses 461,660 389,260 Total operating expenses $1,003,600 $1,052,060 Income from…arrow_forward[The following information applies to the questions displayed below.] The financial statements for Highland Corporation included the following selected information: Common stock Retained earnings Net income Shares issued Shares outstanding Dividends declared and paid $ 465,000 $ 730,000 $ 1,110,000 93,000 68,000 $ 770,000 The common stock was sold at a price of $23 per share.arrow_forwardBelow is select information from DC United Company's income statement. At the end of the current year, the weighted average number of common shares outstanding was 133,000. Select Data from Income Statement, End of Current Year Sales $ 952,000 Cost of goods sold 802, 000 Operating expenses 82,000 Tax expense 16,000 Required: Calculate EPS for DC United.arrow_forward

- The following information is available for Metloc Rock Corporation: Common Stock ($5 par) $1,620,000 Retained Earnings 1,205,000 An 17% stock dividend is declared and paid when the market value was $12 per share. Compute total stockholders' equity after the stock dividend. Total Stockholders' Equityarrow_forwardShown below is information relating to the stockholders' equity of Perry Corporation as of December 31, Year 1: 5.5% cumulative preferred stock, $100 par value; authorized, ?? shares; issued and outstanding, ?? shares Common stock, $10 par value; authorized, 360,000 shares; issued and outstanding, 140,000 shares Additional paid-in capital: Common stock Retained earnings (Deficit) Dividends in arrears What was the original issue price per share of common stock?arrow_forwardSelected data for Adams Company for Year 3 follows: Earnings (net income) $ 184,000 Preferred stock (13,000 shares at $50 par, 6%) $ 650,000 Common stock (44,000 shares no par, market value $47) 517,000 Retained earnings 570,500 1,737,500 Less: Treasury stock Preferred (1,600 shares) $ 52,000 Common (1,600 shares) 27,000 79,000 Total stockholders' equity $ 1,658,500 Required a. Calculate the following ratios for Adams Company. Note: Round intermediate calculations and final answers to 2 decimal places. Earning per share price earning ratio return on equityarrow_forward

- Texas Inc. has 4,724 shares of 8%, $100 par value cumulative preferred stock and 83,877 shares of $1 par value common stock outstanding at December 31. What is the annual dividend on the preferred stock? a. $80.00 per share b. $4,724 in total )c. $37,792 in total Od. $6,710 in totalarrow_forwardComparative statements of shareholders’ equity for Anaconda International Corporation were reported as follows for the fiscal years ending December 31, 2021, 2022, and 2023. ANACONDA INTERNATIONAL CORPORATIONStatements of Shareholders' EquityFor the Years Ended Dec. 31, 2021, 2022, and 2023($ in millions) Preferred Stock$10 par Common Stock$1 par AdditionalPaid-In Capital Retained Earnings TotalShareholders' Equity Balance at January 1, 2021 65 520 1,860 2,445 Sale of preferred shares 30 900 930 Sale of common shares 7 56 63 Cash dividend, preferred (3 ) (3 ) Cash dividend, common (17 ) (17 ) Net income 340 340 Balance at December 31, 2021 30 72 1,476 2,180 3,758 Retirement of shares (2 ) (16 ) (24 ) (42 ) Cash dividend, preferred…arrow_forwardThe Stockholders' Equity accounts of ExxonMobil on December 31, 2022 were as follows: Preferred Stock ( 6%, $100 par, cumulative, 800 authorized) $720,000 Common Stock ($3 par, 1,500,000 authorized) 1,080,000 APIC - Preferred Stock APIC-Common Stock Retained Earnings Treasury Stock - Common ($9 cost) During 2023, ExxonMobil had the following transactions and events pertaining to its stockholders' equity: March 21: Issued 24,000 shares of Common Stock in exchange for Land. On the date of purchase, the Land had a Fair Market Value of $210,000 and the stock was selling for $11 per share. April 17: Sold 1,800 shares of Treasury Stock - Common for $12 per share. November 22: Purchased 800 shares of Common Stock for the Treasury at a cost of $7,560. December 31: Determine that net income for the year was $556,000. Dividends were declared and paid during December. These dividends included a $0.20 per share dividend to common stockholders of record as of December 12. Preferred dividends are…arrow_forward

- [The following information applies to the questions displayed below.] Markus Company’s common stock sold for $5.25 per share at the end of this year. The company paid a common stock dividend of $0.63 per share this year. It also provided the following data excerpts from this year’s financial statements: EndingBalance BeginningBalance Cash $ 49,000 $ 44,200 Accounts receivable $ 92,000 $ 68,700 Inventory $ 76,300 $ 92,000 Current assets $ 217,300 $ 204,900 Total assets $ 801,000 $ 875,400 Current liabilities $ 85,500 $ 90,000 Total liabilities $ 206,000 $ 185,400 Common stock, $1 par value $ 165,000 $ 165,000 Total stockholders’ equity $ 595,000 $ 690,000 Total liabilities and stockholders’ equity $ 801,000 $ 875,400 This Year Sales (all on account) $ 1,095,000 Cost of goods sold $ 635,100 Gross margin $ 459,900 Net operating income $ 313,875 Interest expense $ 15,500 Net income $ 208,862 10. What is the…arrow_forwardThe following balances were taken from the records of Cullumber Company: Common stock (1/1/20 and 12/31/20) $724, 200 Retained earnings 1/1/20 $ 161,000 Net income for 2023 181,000 Dividends declared in 2023 (41,000) Retained earnings, 12/31/20 301,000 Total stockholders' equity on 12/31/20 $ 1,025, 200 Marigold Company purchased 75% of Cullumber Company's common stock on January 1, 2021 for $901,500. The difference between implied value and book value is attributable to assets with a remaining useful life on January 1, 2023 of ten years. (a) Compute the difference between cost/(implied) and book value applying: Difference 1. Parent company theory $ 2. Economic unit theory $arrow_forwardThe comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 55 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $3,112,575 $2,638,225 Net income 700,800 540,300 Dividends: On preferred stock (11,200) (11,200) On common stock (54,750) (54,750) Retained earnings, December 31 $3,747,425 $3,112,575 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $3,863,160 $3,559,340 Cost of merchandise sold 1,516,210 1,394,910 Gross profit $2,346,950 $2,164,430 Selling expenses $731,580 $918,970 Administrative expenses 623,190 539,710 Total operating expenses $1,354,770 $1,458,680 Income from operations $992,180 $705,750 Other revenue and expense:…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education