FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

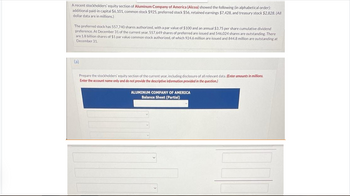

Transcribed Image Text:A recent stockholders' equity section of Aluminum Company of America (Alcoa) showed the following (in alphabetical order):

additional paid-in capital $6,101, common stock $925, preferred stock $56, retained earnings $7,428, and treasury stock $2,828. (All

dollar data are in millions.)

The preferred stock has 557,740 shares authorized, with a par value of $100 and an annual $3.75 per share cumulative dividend

preference. At December 31 of the current year, 557,649 shares of preferred are issued and 546,024 shares are outstanding. There

are 1.8 billion shares of $1 par value common stock authorized, of which 924.6 million are issued and 844.8 million are outstanding at

December 31.

(a)

Prepare the stockholders' equity section of the current year, including disclosure of all relevant data. (Enter amounts in millions.

Enter the account name only and do not provide the descriptive information provided in the question.)

ALUMINUM COMPANY OF AMERICA

Balance Sheet (Partial)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- The following information is available for Metloc Rock Corporation: Common Stock ($5 par) $1,620,000 Retained Earnings 1,205,000 An 17% stock dividend is declared and paid when the market value was $12 per share. Compute total stockholders' equity after the stock dividend. Total Stockholders' Equityarrow_forwardWhispering Inc. had net income for the current year ending December 31, 2023 of $1,063,260. During the entire year, there were 501,000 common shares outstanding. The company had two classes of preferred shares outstanding: the Class A preferred shares were $2.60 cumulative shares of which 12,000 were outstanding, and were convertible to common shares at a rate of 1:1. There were 107,000 $5.60 Class B non-cumulative preferred shares outstanding that were also convertible at a rate of 1:1. Whispering had outstanding a $1,000,000, 7% bond issued at par in 2012 that was convertible to 22,000 common shares. The company also had outstanding a $1,000,000, 6% bond issued at par in 2013 that was convertible to 26,000 common shares. No dividends were declared or paid this year. Whispering's tax rate is 37%. (a) Calculate the income effect of the dividends for the Class A preferred shares. (b) Your answer is correct. Dividends on Class A preferred shares $ (c) eTextbook and Media Your answer is…arrow_forwardRichman Company had 100,000 shares of common stock outstanding as of January 1, 2020. The following common stock transactions occurred during 2020. March 1—Issued 20,000 shares for cash. June 1—Issued a 10% stock dividend. September 1—Reacquired 10,000 shares as treasury shares. November 1—Sold the 10,000 treasury shares for cash. Instructions: Compute the weighted-average common shares for 2020.arrow_forward

- Texas Inc. has 4,724 shares of 8%, $100 par value cumulative preferred stock and 83,877 shares of $1 par value common stock outstanding at December 31. What is the annual dividend on the preferred stock? a. $80.00 per share b. $4,724 in total )c. $37,792 in total Od. $6,710 in totalarrow_forwardAt the beginning of 2023, Valero Energy had 300,000 shares of $5 par value Common Stock outstanding. On August 1, Valero issued another 150,000 shares. Valero's 2023 Net Income was $637,500. In addition, you are given the following portion of the Company's 12/31/2023 Stockholders' Equity section of its Balance Sheet: Preferred Stock (5%, $10 par, 90,000 shares issued and outstanding) $900,000 Calculate Valero Energy's Earnings per Share for 2023 (round to the nearest cent). Select one: O O O a. $1.72 b. $1.63 c. $1.32 d. $1.42 e. $1.76arrow_forwardThe Stockholders' Equity accounts of ExxonMobil on December 31, 2022 were as follows: Preferred Stock ( 6%, $100 par, cumulative, 800 authorized) $720,000 Common Stock ($3 par, 1,500,000 authorized) 1,080,000 APIC - Preferred Stock APIC-Common Stock Retained Earnings Treasury Stock - Common ($9 cost) During 2023, ExxonMobil had the following transactions and events pertaining to its stockholders' equity: March 21: Issued 24,000 shares of Common Stock in exchange for Land. On the date of purchase, the Land had a Fair Market Value of $210,000 and the stock was selling for $11 per share. April 17: Sold 1,800 shares of Treasury Stock - Common for $12 per share. November 22: Purchased 800 shares of Common Stock for the Treasury at a cost of $7,560. December 31: Determine that net income for the year was $556,000. Dividends were declared and paid during December. These dividends included a $0.20 per share dividend to common stockholders of record as of December 12. Preferred dividends are…arrow_forward

- The balance sheet for Lauren Inc. shows the following: total paid-in capital and retained earnings $877,000, total stockholders’ equity $817,000, common stock issued 44,000 shares, and common stock outstanding 38,000 shares. Compute the book value per share. (No preferred stock is outstanding.)arrow_forwardThe net income of Charles Company for the year ended December 31, 2002 was $100,000. The following additional information is available about the Company:- The weighted average number of shares outstanding during the year was 19,000. - During the year 1,000 shares of $100 par, 5% convertible preferred stock were outstanding. Each preferred stock is convertible into one share of common stock.- During the year, 100 bonds each of $1,000 face value were outstanding. The bonds were issued at par, pay 12% interest per year, and are convertible into 20 shares of common stock.- There were 5,000 options outstanding, with an option price of $20 each. The average market price for the period was $25. Calculate the basic and diluted earnings per share, assuming that the tax rate for the company is 30%.arrow_forwardThe following selected accounts appear in the ledger of Upscale Construction Inc. at the beginning of the current year: Preferred 2% Stock, $150 par (40,000 shares authorized, 20,000 shares issued) $3,000,000 Paid-In Capital in Excess of Par—Preferred Stock 360,000 Common Stock, $15 par (500,000 shares authorized, 230,000 shares issued) 3,450,000 Paid-In Capital in Excess of Par—Common Stock 450,000 Retained Earnings 15,391,000 During the year, the corporation completed a number of transactions affecting the stockholders' equity. They are summarized as follows: Issued 50,000 shares of common stock at $19, receiving cash. Issued 10,000 shares of preferred 2% stock at $167. Purchased 30,000 shares of treasury common for $16 per share. Sold 15,000 shares of treasury common for $19 per share. Sold 10,000 shares of treasury common for $14 per share. Declared cash dividends of $3.00 per share on preferred stock and $0.08 per share on common stock. Paid the cash dividends.…arrow_forward

- [The following information applies to the questions displayed below.] The stockholders’ equity section of Velcro World is presented here. VELCRO WORLD Balance Sheet (partial) ($ and shares in thousands) Stockholders' equity: Preferred stock, $1 par value $ 6,000 Common stock, $1 par value 30,000 Additional paid-in capital 1,164,000 Total paid-in capital 1,200,000 Retained earnings 288,000 Treasury stock, 11,000 common shares (352,000 ) Total stockholders' equity $ 1,136,000 Based on the stockholders’ equity section of Velcro World, answer the following questions. Remember that all amounts are presented in thousands. Required: 1. How many shares of preferred stock have been issued?arrow_forwardHow many shares of preferred stock have been issued? How many shares of common stock have been issued? Total paid-in capital is $81.60 million. At what average price per share were the common shares issued?arrow_forwardBlossom Inc. had net income for the current year ending December 31, 2023 of $1.230,480. During the entire year, there were 506,000 common shares outstanding. The company had two classes of preferred shares outstanding the Class A preferred shares were $2.62 cumulative shares of which 10,000 were outstanding, and were convertible to common shares at a rate of 1:1. There were 102,000 $5.62 Class B non-cumulative preferred shares outstanding that were also convertible at a rate of 1:1. Blossom had outstanding a $1,000,000, 8% bond issued in 2012 that was convertible to 21,000 common shares. The company also had outstanding a $1,000,000, 7% bond issued in 2013 that was convertible to 26,000 common shares. No dividends were declared or paid this year. Blossom's tax rate is 38%.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education