FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

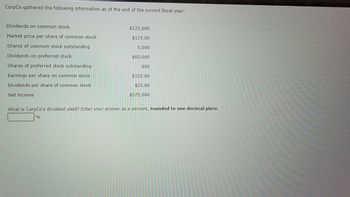

Transcribed Image Text:CorpCo gathered the following information as of the end of the current fiscal year:

Dividends on common stock

Market price per share of common stock

Shares of common stock outstanding

Dividends on preferred stock

Shares of preferred stock outstanding

Earnings per share on common stock

Dividends per share of common stock

Net income

$125,000

$115.00

5,000

$65,000

600

$102.00

$25.00

$575,000

What is CorpCo's dividend yield? Enter your answer as a percent, rounded to one decimal place.

96

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- On June 30, Setzer Corporation had a market price of $100 per share of common stock. For the previous year, Setzer paid an annual dividend of $4.00. Compute the dividend yield for Setzer Corporation.arrow_forwardA company reports basic earnings per share of $5.40, cash dividends per share of $2.20, and a market price per share of $65.70. The company's dividend yield equals: 8.07%. 3.35%. 12.39%. 3.21%. 3.11%.arrow_forwardSong Corp's stock price at the end of last year was $28.75 and its earnings per share for the year were $1.30. What was its P/E ratio? a. 27.64 b. 22.12 c. 17.69 d. 23.00 e. 18.80arrow_forward

- At the market close on May 12 of a recent year, McDonald’s Corporation had a closing stock price of $129.51. In addition, McDonald’s Corporation had a dividend per share of $3.56 during the previous year.Determine McDonald’s Corporation’s dividend yield. Round to one decimal place.arrow_forwardCalculating key stock performance metrics The Castle Company recently reported net profits after taxes of $11.4 million. It has 3.5 million shares of common stock outstanding and pays preferred dividends of $1 million a year. The company's stock currently trades at $60 per share. Compute the stock's earnings per share (EPS). Round the answer to two decimal places.$ per share What's the stock's P/E ratio? Round the answer to two decimal places.$ times Determine what the stock's dividend yield would be if it paid $2.82 per share to common stockholders. Round the answer to two decimal places. %arrow_forwardFive Measures of Solvency or Profitability The balance sheet for Bearing Industries Inc. at the end of the current fiscal year indicated the following: Bonds payable, 7% $1,400,000 320,000 Preferred $5 stock, $100 par Common stock, $12 par 600,000 Income before income tax was $254,800, and income taxes were $38,800, for the current year. Cash dividends paid on common stock during the current year totaled $30,000. The common stock was selling for $40 per share at the end of the year. Determine each of the following. Round answers to one decimal place, except for dollar amounts which should be rounded to the nearest whole cent. Use the rounded answers for subsequent requirements, if required. a. Times interest earned ratio b. Earnings per share on common stock c. Price-earnings ratio d. Dividends per share of common stock e. Dividend yield $ $ times %arrow_forward

- A company reports the following: Net income $171,720 Preferred dividends $12,720 Shares of common stock outstanding 25,000 Market price per share of common stock $18.44 Calculate the company's earnings per share on common stock. Round your answer to the nearest cent.arrow_forwardUsing the information for Blue Northern Clothing Company presented in the table below, determine the following: Price-earnings ratio. The number of shares bought and sold on this trading day. Amount of income per share paid to a stockholder in the last 12 months. Additional Resources Year-to-Date % Change 1.92% EPS $1.79 52-Week Hi $58.59 PE Ratio 17.92 52-Week Lo $21.21 Volume 2,430,000 Dividend $0.83 Close Price $32.07 Yield Percentage 2.59% Net Change 1.74 1. Price-earnings ratio: 2. Number of shares: 3. Amount of income:arrow_forwardHow do I solve this?arrow_forward

- Dividend Yield On June 30, Rae Corporation had a market price of $16 per share of common stock. For the previous year, Rae paid an annual dividend of $0.96. Compute the dividend yield for Rae Corporation. If necessary, round your answer to two decimal places.arrow_forwardEarnings per Share, Price-Earnings Ratio, Dividend Yield The following information was taken from the financial statements of Tolbert Inc. for December 31 of the current fiscal year: Common stock, $25 par value (no change during the year) $6,750,000 Preferred $4 stock, $200 par (no change during the year) 8,000,000 The net income was $862,000 and the declared dividends on the common stock were $67,500 for the current year. The market price of the common stock is $22.10 per share. For the common stock, determine (a) the earnings per share, (b) the price-earnings ratio, (c) the dividends per share, and (d) the dividend yield. If required, round your answers to two decimal places. a. Earnings per Share b. Price-Earnings Ratio c. Dividends per Share d. Dividend Yield %arrow_forwardA company reports the following: Net income Preferred dividends Average stockholders' equity $190,000 7,600 1,532,258 848,372 Average common stockholders' equity Determine (a) the return on stockholders' equity and (b) the return on common stockholders' equity. If required, round your answers to one decimal place. a. Return on Stockholders' Equity b. Return on Common Stockholders' Equity % %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education