ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

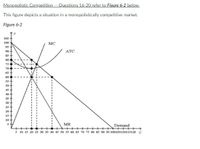

Transcribed Image Text:Monopolistic Competition -- Questions 16-20 refer to Figure 6-2 below.

This figure depicts a situation in a monopolistically competitive market.

Figure 6-2

105

100 -

MC

95+

90+

ATC

75

70

65

60

55

30

45

40

35

15

10

MR

Demand

5 10 15 20 25 3o 35 40 45 50 ss 60 6s 70 75 80 85 90 95 100105110115120 2

Transcribed Image Text:Question 17

Refer to Figure 6-2.

What price will the monopolistically competitive fırm charge in this market? (Write just the number, not $)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Answer the question based on the demand and cost schedules for a monopolistically competitive firm given in the table below. Price $18 16 14 12 10 8 Multiple Choice $8 $12 $14 Quantity Demanded 1 2 $16 3 4 5 6 What price will this monopolistically competitive firm charge to maximize profits? Total Cost $ 10 20 29 36 40 42 Output 1 2 3 4 5 6 >arrow_forwardThe accompanying graph depicts average total cost (ATC) marginal cost (MC), marginal revenue (M), and demand (D) 50 facing a monopolistically competitive firm MC 45 Place point A at the firm's profit maximizing price and quantity 40 35 What is the firm's total cost? ATC 30 25 total cost: 20 15 What is the firm's total revenue? 10 5 total revenue: $ MR 0 5 10 15 20 25 30 35 40 45 50 55 60 65 70 75 80 85 90 95100 Quantity What is the firm's total profit? profit: $ Price and Cost ($)arrow_forwardPart II | The graph below shows a monopolistically competitive firm in the short run. $ 10 6 4 MC ATC 10 25 30 9. What is the firm's profit-maximizing price and quantity? 10. How much profit does that firm make at that price and quantity? 60arrow_forward

- Q. 2arrow_forwardMelCo’s Xamoff The global pharmaceuticals giant, MelCo, has had great success with Xamoff, and over-thecounter medicine that reduces exam-related anxiety. A patent currently protects Xamoff from competition, although rumors persist that similar products are in development. Two years ago, MelCo sold 25 million units for a price of $10 for a package of ten. Last year it raised the price to $11, and sales fell to 22 million units. Finally, a financial analyst estimates the cost of production at $2 per package. (a) Estimate the elasticity of demand for this product at $10. Is this price too high or too low? (b) Estimate the elasticity of demand for this product at $11. Is this price too high or too low? (c) Based on your answers to (a) and (b), what can we say about MelCo’s profit-maximizing price?arrow_forwardThe graph below shows cost and revenue curves for a monopolistic competitor producing different amounts of chairs. On the graph, suppose that: A = $55, B = $21, C = $15, E = $7, F = 13, and G = 31 Price BL BCE CP MC ATC EH MR F G Quantity Calculate the maximum profit the firm can earnarrow_forward

- F24arrow_forwardThe figure below depicts a monopolistically competitive firm operating in the short run. Label the diagram with the items listed to the right of the figure. You will have to decide whether the firm is making a profit or a loss. Profit Price 8 25 OF 50 QUESTIONS COMPLETED -> At ед MR MC Quantity D ATC C Loss Average total cost Profit- maximizing price Profit- maximizing output SUBMIT ANSWEarrow_forwardK Suppose the figure to the right represents the market for a particular brand of shampoo, such as L'Oreal, Lancome, or Maybelline. Assume the market is monopolistically competitive. What is the firm's profit-maximizing price and quantity? thousand per bottle. (Enter your The monopolistically competitive firm's profit-maximizing quantity is bottles of shampoo, and its profit-maximizing price is $ responses as integers.) Price and cost (per bottle) ♫ 3.00- MC 2.80- ATC 2.60- 2.40- 2.20- 2.00- 1.80- 1.60- 1.40- 1.20- 1.00- 0.80- 0.60- 0.40- 0.20- 0.00+ 0 MR 2 4 6 8 10 12 14 16 18 20 22 24 Quantity (shampoo bottles in thousands)arrow_forward

- 1. Briefly discuss the various ways monopolistically competitive firms can differentiate their products? 2. In the long-run, a perfectly competitive firm will earn what kind of economic profit?arrow_forwardThe information below provides conditions faced by a monopolistically competitive firm. Price and costs $70 $65 $60 $55 $50 $45 $40 $40 $35 $30 $25 $250 $20455 $15 $10 $5 0 $32.50 MIR Quantity MC ATC Demand Use the information above to answer the following question. This monopolistically competitive firm's economic profit/loss is $.arrow_forwardexplain the relationship between the market price and a monopolistically competitive firm’s marginal revenue, be able to find the profit-maximizing output and pricearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education