ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

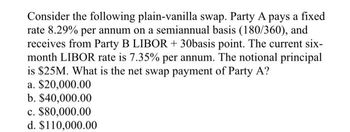

Transcribed Image Text:Consider the following plain-vanilla swap. Party A pays a fixed

rate 8.29% per annum on a semiannual basis (180/360), and

receives from Party B LIBOR + 30basis point. The current six-

month LIBOR rate is 7.35% per annum. The notional principal

is $25M. What is the net swap payment of Party A?

a. $20,000.00

b. $40,000.00

c. $80,000.00

d. $110,000.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Lucy Lampkin wants to purchase a bond with a face value of $7,000 and a bond rate of 7.5 percent per year, payable at 3.75 percent semiannually. The bond has a remaining life of 5 years. If Lucy wants to earn at least 9.5 percent per year compounded semiannually, what is the maximum price she would be willing to pay to purchase the bond? $ Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is +5.arrow_forwardA payment stream consists of three payments: $1,900 due today, $2,400 due 80 days from today, and $2,900 due 180 days from today. What single payment, 70 days from today, is economically equivalent to the payment stream if money can be invested at a rate of 4.4%? (Use 365 days a year. Do not round intermediate calculations and round your final answer to 2 decimal places.) Single payment $arrow_forwardA bank agrees a repurchase agreement (Repo) with its prime broker using £30 million of Mortgage Backed Securities as collateral for a period of 50 days. The prime broker levies a haircut of 10 per cent and charges an annual Repo rate of 4.5 per cent. What is the price at which the bank will repurchase the £30 million MBS at the end of 50 days when the Repo rate interest applies only on the sum of money being lent by the prime broker ? Use a 360 day-count.arrow_forward

- If $4,000 is borrowed today and $8,955 is paid back in 10 years, what interest rate compounded annually has been earned? % Round entry to one decimal place. Tolerance is ±0.2.arrow_forwardYou expect to receive the following: $3,527 $18,541 $4,500 $1,011 $8,583 at the end of each year for 12 years today at the end of year 6 at the end of each year forever at the end of 15 years What is the uniform annual payment for the first 12 years equivalent to the above payment scheme, if the interest rate is 8%? Enter your answer as follow: 123456arrow_forwardThe following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of face value): Maturity (years) 1 4 Price (per $100 face value) 94.52 89.68 85.40 81.65 78.35 The yield to maturity for the three-year zero-coupon bond is closest to the yield to maturity for the four-year zero-coupon bond is closest to and --------arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education