FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Hello tutor provide correct answer the general accounting question

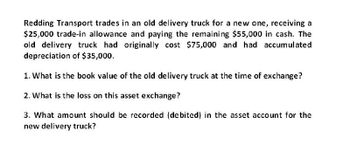

Transcribed Image Text:Redding Transport trades in an old delivery truck for a new one, receiving a

$25,000 trade-in allowance and paying the remaining $55,000 in cash. The

old delivery truck had originally cost $75,000 and had accumulated

depreciation of $35,000.

1. What is the book value of the old delivery truck at the time of exchange?

2. What is the loss on this asset exchange?

3. What amount should be recorded (debited) in the asset account for the

new delivery truck?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Solve this accounting questionarrow_forwardWillis Bus Service traded in a used bus for a new one. The original cost of the old bus was $52,000. Accumulated depreciation at the time of the trade-in amounted to $34,000. The new bus cost $67,000, but Willis was given a trade-in allowance of $10,000. a. What amount of cash did Willis have to pay to acquire the new bus? b. Compute the gain or loss on the disposal for financial reporting purposes. c. Explain how the gain or loss would be reported in the company's income statement. Solutions a. $57,000 ($67,000 less $10,000 trade-in allowance) b. Trade-in allowance Less: Book value ($52,000 - $34,000) Loss on trade-in $ 10,000 c. The $8,000 loss on trade-in is reported in Willis Bus Service's income statement following the amount of income from operations. (18,000) (8,000)arrow_forwardMonty Corp. exchanges old delivery equipment for new delivery equipment. The book value of the old delivery equipment is $37,200 (cost $67,200 less accumulated depreciation $30,000). Its fair value is $23,100, and cash of $6,000 is paid. Prepare the entry to record the exchange, assuming the transaction has commercial substance. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry isrequired,select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Creditarrow_forward

- Willis Bus Service traded in a used bus for a new one. The original cost of the old bus was $52,900. Accumulated depreciation at the time of the trade-in amounted to $35,300. The new bus cost $71,000 but Willis was given a trade-In allowance of $10,600. a. What amount of cash did Willis have to pay to acquire the new bus? b. Compute the gain or loss on the disposal for financial reporting purposes. Complete this question by entering your answers in the tabs below. Required A Required B What amount of cash did Willis have to pay to acquire the new bus? Payment of casharrow_forwardMarigold Corporation traded a used truck for a new truck. The used truck cost $25,000 and has accumulated depreciation of $21,250. The new truck is worth $43,750. Marigold also made a cash payment of $41,250. Prepare Marigold's entry to record the exchange. (The exchange has commercial substance.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)arrow_forwardBramble Corporation traded a used truck for a new truck. The used truck cost $25,400 and has accumulated depreciation of $21,590. The new truck is worth $44,450. Bramble also made a cash payment of $41,910. Prepare Bramble's entry to record the exchange. (The exchange has commercial substance.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Debit I Creditarrow_forward

- Cheng Company traded a used truck for a new truck. The used truck cost $30,000 and has accumulated depreciation of $27,000. The new truck is worth $37,000. Cheng also made a cash payment of $36,000. Prepare Cheng’s entry to record the exchange. (The exchange lacks commercial substance.)arrow_forwardGive solution for this general accounting questionarrow_forwardCaleb Co. owns a machine that had cost $42,400 with accumulated depreciation of $18,400. Caleb exchanges the machine for a newer model that has a market value of $52,000. 1. Record the exchange assuming Caleb paid $30,000 cash and the exchange has commercial substance. 2. Record the exchange assuming Caleb paid $22,000 cash and the exchange has commercial substance.arrow_forward

- Please provide answer in text (Without image)arrow_forwardMaxim Company exchanged a used machine with a book value of $26,000 (cost $54,000 less $28,000 accumulated depreciation) and cash of $8,000 for a delivery truck. The machine has a estimated fair market of $36,000. The transaction has commercial substance. Regarding the journal entry to record the exchange, what value will be assigned to the delivery truck? O 36,000 O 44,000 O 54,000 O 34,000 Question 17 The cost of training employees to operate newly acquired machinery are usually capitalized as part of the acquisition value of the asset. O Truearrow_forwardDhapaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education