FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

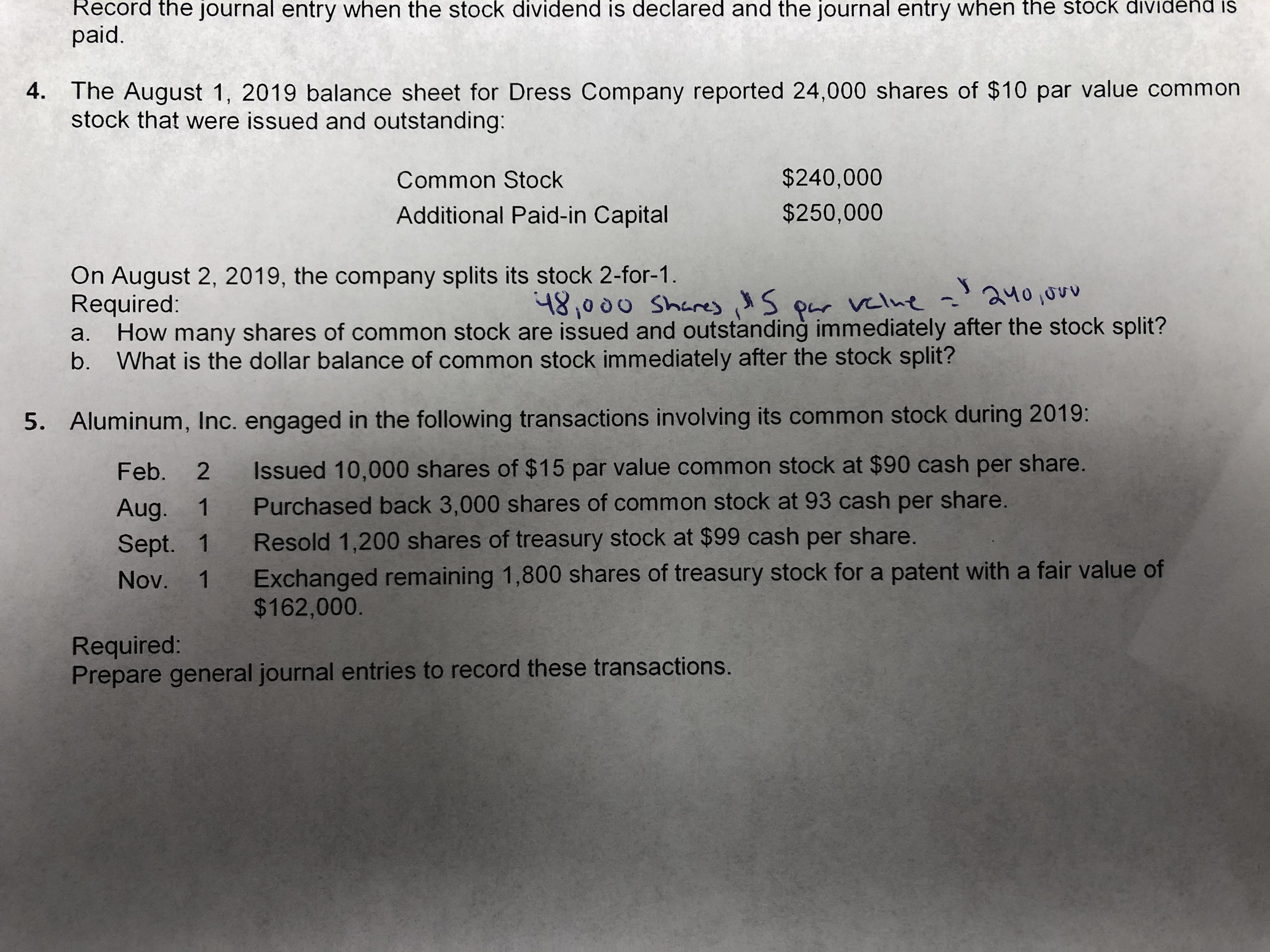

My answer is in blue pen. On question 4, is that all it is asking for? Seems kind of simple for a practice problem but I might of read it wrong. I put one answer for a and b on question 4

Transcribed Image Text:Record the journal entry when the stock dividend is declared and the journal entry when the st

paid.

d is

4. The August 1, 2019 balance sheet for Dress Company reported 24,000 shares of $10 par value common

stock that were issued and outstanding:

$240,000

Common Stock

$250,000

Additional Paid-in Capital

On August 2, 2019, the company splits its stock 2-for-1.

Required:

How many shares of common stock are issued and outstanding immediately after the stock split?

b. What is the dollar balance of common stock immediately after the stock split?

১५০ ৩৩

481000 SharesS

Par vlut

a.

5. Aluminum, Inc. engaged in the following transactions involving its common stock during 2019:

Issued 10,000 shares of $15 par value common stock at $90 cash per share.

2

Feb.

Purchased back 3,000 shares of common stock at 93 cash per share.

1

Aug.

Resold 1,200 shares of treasury stock at $99 cash per share.

1

Sept.

Exchanged remaining 1,800 shares of treasury stock for a patent with a fair value of

$162,000

1

Nov.

Required:

Prepare general journal entries to record these transactions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- hi im looking at the solution above and have a quuestion-im a littlepuzzled on exactly how i should be plugging in the numbersfor example, the chart liists Time (ln2/(ln(1+r)) but how exactly should i type this in my calculatorto get =l3/J3? maybe im overthinking itarrow_forwardUsing Excel, create a table that shows the relationship between the interestearned and the amount deposited, as shown. we will first create the dollar amount column and the interest row, as shown . Next we will type into cell B3 the formula = $A3*B$2. We can now use the Fill command to copy the formula in other cells, resulting in the table as shown. Note that the dollar sign before A3 means column A is to remain unchanged in the calculations when the formula is copied into other cells. Also note that the dollar sign before 2 means that row 2 is to remain unchanged in calculations when the Fill command is used.arrow_forwardPLEASE, WRITE THE SOLUTIONS ON PAPER, EXPLAINING THE ENTIRE PROCESS, THE ONLY AND CORRECT ANSWERS ARE FOR (i) V(t) = exp (-2e^0.02t + 2 ) for 0 15 (i) Derive, and simplify as far as possible, expressions in terms of t for V(t), where V(t) is the present value of a unit sum of cash flow made at time t. You should derive separate expressions for the three sub-intervals. (ii) Hence, making use of the result in part (i), calculate the value at time t = 3 of a payment of £2,500 made at time t = 15. (iii) Calculate, to the nearest 0.01%, the constant nominal annual rate of interest convertible half-yearly implied by the transaction in part (ii). (iv) Making use of the result in part (i), calculate the present value of a payment stream p(t) paid continuously from time t = 15 to t = 20 at a rate of payment at time t given by: p(t) = 300e 0.02tarrow_forward

- Please answer ASAP if you can please. Thank you! Please Please write expression or formula used Set up expression initially with functional notation (e.g.,(P/F,I,n))arrow_forwardAssignment: In the space at the right, type the best formula (or function) needed to perform the following computations. The first one has been done for youarrow_forwardThe first part of the assignment is to open Excel and in column A starting in row 1 and down to row 40 generate random values using the RAND() function. Copy and special paste those values onto sheet2. You will turn in the Excel file, but you will use the information below when directed. Say an individual is faced with the decision of whether to buy auto insurance or not (like before laws in many states changed). The states of nature are that no accident occurs (with probability .992) or an accident occurs (with probability .008). Here is the payoff table for the decision maker (where -500 is read minus 500, for example) State of Nature Decision No Accident Accident Purchase insurance -500 -500 Do not purchase Ins. 0 -10000 1. Say the individual is a RISK LOVER. Create a table with plausible values of utility for the risk lover where you pick as the indifference probability for the value -500 the first value that is appropriate from your simulation in Excel (starting in cell A1 on…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education