FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

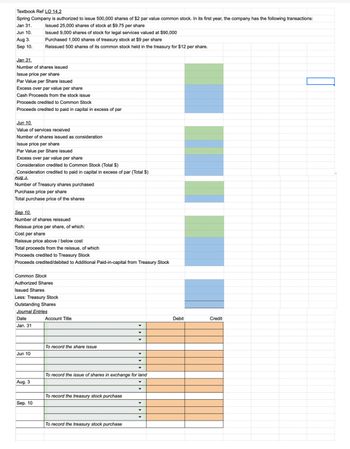

Transcribed Image Text:Textbook Ref LO 14.2

Spring Company is authorized to issue 500,000 shares of $2 par value common stock. In its first year, the company has the following transactions:

Jan 31.

Issued 25,000 shares of stock at $9.75 per share

Jun 10.

Aug 3.

Sep 10.

Jan 31.

Number of shares issued

Issue price per share

Par Value per Share issued

Excess over par value per share

Cash Proceeds from the stock issue

Proceeds credited to Common Stock

Proceeds credited to paid in capital in excess of par

Jun 10.

Value of services received

Number of shares issued as consideration

Issue price per share

Par Value per Share issued

Excess over par value per share

Consideration credited to Common Stock (Total $)

Consideration credited to paid in capital in excess of par (Total $)

Aug 3.

Number of Treasury shares purchased

Purchase price per share

Total purchase price of the shares

Issued 9,000 shares of stock for legal services valued at $90,000

Purchased 1,000 shares of treasury stock at $9 per share

Reissued 500 shares of its common stock held in the treasury for $12 per share.

Sep 10.

Number of shares reissued

Reissue price per share, of which:

Cost per share

Reissue price above / below cost

Total proceeds from the reissue, of which

Proceeds credited to Treasury Stock

Proceeds credited/debited to Additional Paid-in-capital from Treasury Stock

Common Stock

Authorized Shares

Issued Shares

Less: Treasury Stock

Outstanding Shares

Journal Entries

Date

Jan. 31

Jun 10

Aug. 3

Sep. 10

Account Title

To record the share issue

To record the treasury stock purchase

▼

To record the issue of shares in exchange for land

To record the treasury stock purchase

▼

Y

Debit

Credit

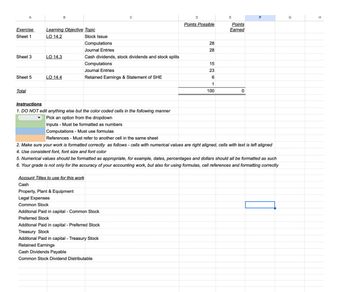

Transcribed Image Text:A

Exercise

Sheet 1

Sheet 3

Sheet 5

Total

Learning Objective Topic

LO 14.2

LO 14.3

LO 14.4

Stock Issue

Computations

Journal Entries

Cash dividends, stock dividends and stock splits

Computations

Journal Entries

Retained Earnings & Statement of SHE

Account Titles to use for this work

Cash

с

Property, Plant & Equipment

Legal Expenses

Common Stock

Additonal Paid in capital - Common Stock

Preferred Stock

Additonal Paid in capital - Preferred Stock

Treasury Stock

Additonal Paid in capital - Treasury Stock

Retained Earnings

Points Possible

Cash Dividends Payable

Common Stock Dividend Distributable

28

28

15

23

6

1

100

Instructions

1. DO NOT edit anything else but the color coded cells in the following manner

Pick an option from the dropdown

Inputs - Must be formatted as numbers

Computations - Must use formulas

References - Must refer to another cell in the same sheet

2. Make sure your work is formatted correctly as follows - cells with numerical values are right aligned, cells with text is left aligned

4. Use consistent font, font size and font color

E

5. Numerical values should be formatted as appropriate, for example, dates, percentages and dollars should all be formatted as such

6. Your grade is not only for the accuracy of your accounting work, but also for using formulas, cell references and formatting correctly

Points

Earned

0

F

G

H

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

In the queston you didn't answer the ones for August 3, could you do it and use formulas for the one in blue? Also, could you explain in more detail de formulas, more so for the common stock.

Solution

by Bartleby Expert

Follow-up Question

Could you include the formulas used for all the blue squares.

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

In the queston you didn't answer the ones for August 3, could you do it and use formulas for the one in blue? Also, could you explain in more detail de formulas, more so for the common stock.

Solution

by Bartleby Expert

Follow-up Question

Could you include the formulas used for all the blue squares.

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- March 1 May 10 June 1 Issues 60,000 additional shares of $1 par value common stock for $57 per share. Purchases 5,500 shares of treasury stock for $60 per share. Declares a cash dividend of $1.75 per share to all stockholders of record on June 15. (Hint: Dividends are not paid on treasury stock.) July 1 Pays the cash dividend declared on June 1. October 21 Resells 2,750 shares of treasury stock purchased on May 10 for $65 per share. Power Drive Corporation has the following beginning balances in its stockholders' equity accounts on January 1, 2024: Common Stock, $100,000; Additional Paid-in Capital, $5,000,000; and Retained Earnings, $2,500,000. Net income for the year ended December 31, 2024, is $650,000. Required: Prepare the stockholders' equity section of the balance sheet for Power Drive Corporation as of December 31, 2024. (Amounts to be deducted should be indicated by a minus sign.) POWER DRIVE CORPORATION Balance Sheet (Stockholders' Equity Section) December 31, 2024…arrow_forwardProblem 4 On December 29, 2018, Blue Company was registered at the Securities and Exchange Commission with 100,00 authorized shares of P100 par value. The following were Blue's transactions: December 29, 2018 May 14, 2019 August 9, 2019 December 31, 2019 Issued 40,000 shares at P105 per share. Purchased 600 of its ordinary shares at P110 per share. 400 treasury shares were resold at P95 per share. Profit for 2019 is P830,000. Dividends paid P200,000. 34. What is the total outstanding shares? 35. What is the balance of treasury shares? 36. How many shares are entitled to receive dividends? 37. What is the total shareholders' equity? Problem 5 Partners A & B have capital balances of P600,000 and P400,000 and share profits and losses in the ratio of 3:2, respectively, before the admission of C. With the consent of B, A sells one-half of his equity to C, with C paying A the amount of P350,000. 38. What is A's capital balance after the admission of C? 39. What is the total partnership…arrow_forward10arrow_forward

- Required information Exercise 10-3A Record the issuance of common stock (LO10-2) (The following information applies to the questions displayed below.) Clothing Frontiers began operations on January 1 and engages in the following transactions during the year related to stockholders' equity. January 1 Issues 600 shares of common stock for $35 per share. April 1 Issues 100 additional shares of common stock for $39 per share. Exercise 10-3A Part 2 2. Record the transactions, assuming Clothing Frontiers has either $1 par value or $1 stated value common stock. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) aw transaction llat 1 Record the issuance of 600 shares of common stock for $35 per share. 2 Record the issuance of 100 additional shares of common stock for $39 per share. Credit Note : = journal entry has been entered Record entry Clear entry View general Journalarrow_forwardRequired information Exercise 10-3 (Algo) Record the issuance of common stock (LO10-2) Skip to question [The following information applies to the questions displayed below.] Clothing Frontiers began operations on January 1 and engages in the following transactions during the year related to stockholders’ equity. January 1 Issues 600 shares of common stock for $32 per share. April 1 Issues 100 additional shares of common stock for $36 per share. Exercise 10-3 (Algo) Part 1 Required:1. Record the transactions, assuming Clothing Frontiers has no-par common stock. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardD. February 2 Issue 1.5 million shares of common stock for $15 per share. February 4 Issue 400,000 shares of preferred stock for $24 per share. June 15 Purchase 150,000 shares of its own common stock for $10 per share. August 15 Resell 112,500 shares of treasury stock for $25 per share. November 1 Declare a cash dividend on its common stock of $1.50 per share and a $400,000 (5% of par value) cash dividend on its preferred stock payable to all stockholders of record on November 15. (Hint: Dividends are not paid on treasury stock.) November 30 Pay the dividends declared on November 1. Required: 1. Record each of these transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list ces Journal entry worksheet 1 Record the issuance of 1.50 million shares of common stock for $15 per share. Note: Enter debits before credits. Date General Journal Debit Credit February 02, 2021arrow_forward

- 2 Issue 120,000 shares of common stock for $50 per share. January February 14 Issue 40,000 shares of preferred stock for $13 per share. May May December 1 Declare a cash dividend on its common stock of $0.25 per share and a $16,000 (4% of par value) cash 8 Purchase 12,000 shares of its own common stock for $40 per share. 31 Resell 6,000 shares of treasury stock for $45 per share. dividend on its preferred stock payable to all stockholders of record on December 15. The dividend is payable on December 30. (Hint: Dividends are not paid on treasury stock.) December 30 Pay the cash dividends declared on December 1. 2. Prepare the stockholders' equity section of the balance sheet as of December 31, 2021. Net income for the year was $470,000. (Amounts to be deducted should be indicated by a minus sign.) MAJOR LEAGUE APPAREL Balance Sheet (Stockholders' Equity Section) December 31, 2021 Stockholders' Equity: Total Paid-in Capital Total Stockholders' Equityarrow_forwardPROBLEM 32: CYPRUS COMPANY began operation on January 1. Authorized were 20,000 shares of P10 par value ordinary shares and 40,000 shares of 10%, P 100 par value preference shares. The following transactions involving shareholders' equity occurred during the first year of operations. January 1 February 23 March 10 April 10 July 14 August 3 December 1 Issued 500 ordinary shares to the corporation promoters in exchange for property valued at P170,000 and services valued at P70,000. The property had cost the promoters P90,000 3 years before and was carried on the promoters' books at P50,000. 31 Issued 10,000 preference shares with a par value of P100 per share. The shares were issued at a price of P150 per share, and the company paid P75,000 to an agent for selling the shares. Sold 3,000 ordinary shares for P390 per share. Issue costs were P25,000 Cordillera Career Development College COLLEGE OF BUSINESS EDUCATION AND ADMINISTRATION Buyagan, Poblacion, La Trinidad, Benguet 4,000 ordinary…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education