FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

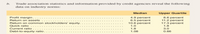

Transcribed Image Text:b.

Trade association statistics and information provided by credit agencies reveal the following

data on industry norms:

Median

Upper Quartile

Profit margin.

Return on assets

Return on commnon stockholders' equity.

Quick ratio

4.9 percent

6.5 percent

10.6 percent

8.6 percent

11.2 percent

17.3 percent

1.0

1.8

Current ratio

Debt-to-equity ratio

1.8

3.0

1.08

0.66

Transcribed Image Text:Ratios Compared with Industry Averages Because you own the common stock of Phantom

Corporation, a paper manufacturer, you decide to analyze the firm's performance for the most

recent year. The following data are taken from the firm's latest annual report:

P12-8A.

LO4

Dec. 31, 2020

Dec. 31, 2019

Quick assets.

$

$

700,000

372,000

4,788,000

552,000

312,000

Inventory and prepaid expenses

Other assets.

4,200,00O

$5,064,00O

Total Assets

$5,860,000

Current liabilities.

10% Bonds payable

8% Preferred stock, $1 00 par value

Common stock, $10 par value

Retained earnings

$4

724,000

1,440,00o

480,000

2,700,00O

516,000

$5,860,000

564,000

1,440,000

480,000

2,160,00O

420,000

Total Liabilities and Stockholders' Equity

$5,064,00o

For 2020, net sales amount to $11,280,000, net income is $575,000, and preferred stock dividends

paid are $42,000.

Required

Calculate the following ratios for 2020:

1.

a.

Profit margin

2.

Return on assets

3.

Return on common stockholders’ equity

Quick ratio

Current ratio

4.

5.

6.

Debt-to-equity ratio

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Current Position Analysis The following data were taken from the balance sheet of Albertini Company at the end of two recent fiscal years: Previous Year Current assets: Cash Marketable securities Accounts and notes receivable (net) Inventories Prepaid expenses. Total current assets. Current liabilities: Accounts and notes payable (short-term) Accrued liabilities Total current liabilities 1. Working capital 2. Current ratio: Current Year 3. Quick ratio b. The liquidity of Albertini has $356,400 412,700 168,900 1,547,700 797,300 $3,283,000 $388,600 281,400 $670,000 $278,400 313,200 104,400 1,167,500 746,500 $2,610,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year $406,000 174,000 $580,000 from the preceding year to the current year. The working capital, current ratio, and quick ratio have all in current assets relative to current liabilities. Most of these changes are the…arrow_forwardProfitability and Asset Management Ratios You are thinking of investing in Tikki's Torches, Inc. You have only the following information on the firm at year-end 2018: net income = $680,000, total debt = $13.8 million, debt ratio = 43%. What is Tikki's ROE for 2018? Multiple Choice 4.93% 11.47% 2.12%% 3.72%arrow_forwardCurrent Position Analysis The following data were taken from the balance sheet of Albertini Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash $506,200 $384,000 Marketable securities 586,100 432,000 Accounts and notes receivable (net) 239,700 144,000 Inventories 928,000 702,700 Prepaid expenses 478,000 449,300 Total current assets $2,738,000 $2,112,000 Current liabilities: Accounts and notes payable (short-term) $429,200 $448,000 Accrued liabilities 310,800 192,000 Total current liabilities $740,000 $640,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year 1. Working capital $fill in the blank 1 $fill in the blank 2 2. Current ratio fill in the blank 3 fill in the blank 4…arrow_forward

- Current Position Analysis The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash Marketable securities Accounts and notes receivable (net) Inventories Prepaid expenses Total current assets Current liabilities: Accounts and notes payable (short-term) Accrued liabilities Total current liabilities $387,600 448,800 183,600 1,032,200 531,800 $2,584,000 1. Working capital 2. Current ratio 3. Quick ratio b. The liquidity of Nilo has improved increased $394,400 285,600 $680,000 $306,800 345,200 115,000 719,800 460,200 $1,947,000 $413,000 177,000 $590,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year ✔ from the preceding year to the current year. The working capital, current ratio, and quick ratio have all ✔Most of these channes are the result of an increase ✔in nurrent accets…arrow_forwardProfitability and Asset Management Ratios You are thinking of investing in Nikki T's, Inc. You have only the following information on the firm at year-end 2015: net income is $250,000, total debt is $2.5 million, and debt ratio is 55 percent. What is Nikki T's ROE for 2015?arrow_forwardCurrent Position Analysis The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash $308,600 $240,000 Marketable securities 357,300 270,000 Accounts and notes receivable (net) 146,100 90,000 Inventories 689,000 427,000 Prepaid expenses 355,000 273,000 Total current assets $1,856,000 $1,300,000 Current liabilities: Accounts and notes payable (short-term) $336,400 $350,000 Accrued liabilities 243,600 150,000 Total current liabilities $580,000 $500,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year 1. Working capital $fill in the blank 1 $fill in the blank 2 2. Current ratio fill in the blank 3 fill in the blank 4 3.…arrow_forward

- Hardevarrow_forwardCurrent Position Analysis The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash $655,500 $520,000 Marketable securities 759,000 585,000 Accounts and notes receivable (net) 310,500 195,000 Inventories 643,500 475,800 Prepaid expenses 331,500 304,200 Total current assets $2,700,000 $2,080,000 Current liabilities: Accounts and notes payable (short-term) $435,000 $455,000 Accrued liabilities 315,000 195,000 Total current liabilities $750,000 $650,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year 1. Working capital $fill in the blank 1 $fill in the blank 2 2. Current ratio fill in the blank 3 fill in the blank 4 3.…arrow_forwardWhat is the year-over-year revenue change percent? Use the attached financial data to calculate the ratios for 2022. Round to the nearest decimal. Abercrombie & Fitch Co (ANF) Financial Data Revenues Cost of Sales Total Operating Expenses Interest Expense Income Tax Expense Diluted Weighted Shares Outstanding Cash + Equivalents Accounts Receivable Inventories Total Current Assets Total Assets Accounts Payable Total Current Liabilities Total Stockholders' Equity ANF Stock Price = $10.30 Select one O A. 5.3% B. 14.4% C. -1.4% O D. -3.5% 2022 $3,659.3 $1,545.9 $2,026.9 $28.5 $37.8 52.8 $257.3 $108.5 $742.0 $1,220.4 $2,694.0 $322.1 $935.5 $656.1 2021 $3,712.8 $1,400.8 $1,968.9 $34.1 $38.9 62.6 $823.1 $69.1 $525.9 $1,507.8 $2,939.5 $374.8 $1,015.2 $826.1arrow_forward

- Changes in Various Ratios Presented below is selected information for Turner Company: Sales revenue Cost of goods sold Interest expense Income tax expense Net income Cash flow from operating activities Capital expenditures Accounts receivable (net), December 31 Inventory, December 31 Stockholders' equity, December 31 Total assets, December 31 2019 2018 $950,000 $850,000 575,000 545,000 20,000 20,000 27,000 30,000 65,000 55,000 70,000 60,000 45,000 45,000 126,000 120,000 196,000 160,000 450,000 400,000 750,000 675,000 Required Calculate the following ratios for 2019. The 2018 results are given for comparative purposes. Round answers to one decimal place. Use 365 days in a year. 2018 35.9% 8.3% 6.5% 1. Gross profit percentage 2. Return on assets 3. Return on sales 4. Return on common stockholders' equity (no preferred stock was outstanding) 5. Accounts receivable turnover 6. Average collection period 13.9% 8.0 45.6 days 2019 0 % 0 % 0 % 0 % 0 0 daysarrow_forwardCurrent position analysis the following data were taken from the balance sheet of Nilo company at the end of the two recent Fisher years; Current assets: Cash Marketable securities Account and note receivable (net) Inventories Prepaid expenses Total Current assets Current liabilities Account and notes payable ( short-term) Accrued liabilities Total Current liabilities Current year $417,000 cash 483,100 Marketable securities 197,700 acct not receivable ( net) 845,500 inventory 435,500 prepaid 2,379,000 Total Current assets Previous year $339,200 cash 381,600 Marketable securities 127,200 access note receivable ( net) 614,300 inventory 392,700 prepaid expenses 1,855,000 Total Current assets Current year Current liabilities Short term $353,800 Accrued liabilities 256,200 Total Current liabilities $610,000 Previous year Short term $371,000 Accrued liabilities 159,000 Total Current liabilities $530,000 A. Determine for each year 1 capital, 2 the current ratio,…arrow_forwardForecasting with the Parsimonious Method and Estimating Share Value Using the DCF Model Following are income statements and balance sheets for Cisco Systems. Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places. Cisco Systems Consolidated Statements of Income Years Ended December ($ millions) July 27, 2019 July 28, 2018 Revenue Product $33,544 $31,570 Service 11,093 10,854 Total revenue 44,637 42,424 Cost of sales Product 12,782 12,407 Service 3,763 3,695 Total cost of sales 16,545 16,102 Gross margin 28,092 26,322 Operating expenses Research and development 5,656 5,446 Sales and marketing 8,231 7,948 General and administrative 1,571 1,844 Amortization of purchased intangible assets 129 190 Restructuring and other charges 277 308 Total operating expenses 15,864 15,736 Operating income 12,228 10,586 Interest income 1,125 1,297 Interest expense (739) (811) Other…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education