FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

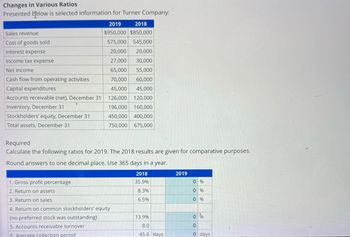

Transcribed Image Text:Changes in Various Ratios

Presented below is selected information for Turner Company:

Sales revenue

Cost of goods sold

Interest expense

Income tax expense

Net income

Cash flow from operating activities

Capital expenditures

Accounts receivable (net), December 31

Inventory, December 31

Stockholders' equity, December 31

Total assets, December 31

2019

2018

$950,000 $850,000

575,000 545,000

20,000

20,000

27,000

30,000

65,000

55,000

70,000

60,000

45,000

45,000

126,000 120,000

196,000 160,000

450,000 400,000

750,000

675,000

Required

Calculate the following ratios for 2019. The 2018 results are given for comparative purposes.

Round answers to one decimal place. Use 365 days in a year.

2018

35.9%

8.3%

6.5%

1. Gross profit percentage

2. Return on assets

3. Return on sales

4. Return on common stockholders' equity

(no preferred stock was outstanding)

5. Accounts receivable turnover

6. Average collection period

13.9%

8.0

45.6 days

2019

0 %

0 %

0 %

0 %

0

0 days

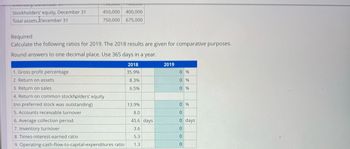

Transcribed Image Text:mventory, Decembero

Stockholders' equity, December 31

Total assets, December 31

10000

100,000

450,000 400,000

750,000 675,000

Required

Calculate the following ratios for 2019. The 2018 results are given for comparative purposes.

Round answers to one decimal place. Use 365 days in a year.

2018

35.9%

8.3%

6.5%

1. Gross profit percentage

2. Return on assets

3. Return on sales

4. Return on common stockholders' equity

(no preferred stock was outstanding)

5. Accounts receivable turnover

6. Average collection period

7. Inventory turnover

8. Times-interest-earned ratio.

9. Operating-cash-flow-to-capital-expenditures ratio

13.9%

8.0

45.6 days

3.6

5.3

1.3

2019

0%

0%

0%

oooooo

0 %

0

0 days

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 23arrow_forwardplease answerarrow_forwardOperating data for Sandhill Corporation are presented as follows. 2027 2026 Net sales $827,400 $647,900 Cost of goods sold 525,399 408,177 Selling expenses 124,110 77,748 Administrative expenses 74,466 51,832 Income tax expense 37,233 25,916 Net income 66,192 84,227 Prepare a schedule showing a vertical analysis for 2027 and 2026. (Round percentages to 1 decimal place, e.g. 12.1%.) SANDHILL CORPORATION Condensed Income Statements For the Years Ended December 31 Net sales $ Cost of goods sold Gross profit Selling expenses Administrative expenses Total operating expenses Income before income taxes Income tax expense Net income 2027 Amount Percent % $ % % % % ' " % % 10 $ % $ Amount 2026 Perarrow_forward

- Use the information above to calculate cash flows from operating activities using the indirect method. Note: Amounts to be deducted should be indicated by a minus sign. Cash flows from operating activities Net income Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash Changes in current operating assets and liabilities $ 42,000 S 42.000 42.000arrow_forwardTwo income statements for Cornea Company follow: Cornea CompanyIncome StatementsFor Years Ended December 31 2019 2018 Fees earned $843,000 $714,000 Operating expenses 682,830 614,040 Operating income $160,170 $99,960 a. Prepare a vertical analysis of Cornea Company's income statements. Enter percents as whole numbers. Cornea Company Income Statements For Years Ended December 31 2019 Amount 2019 Percent 2018 Amount 2018 Percent Fees earned $843,000 % $714,000 % Operating expenses 682,830 % 614,040 % Operating income $160,170 % $99,960 % I am having difficulty coming up with the percentages in each columnarrow_forwardCondensed financial data are presented below for the Tulsa Corporation: Accounts receivable Inventory C. d. Total current assets Total assets Current liabilities Long-term liabilities Sales Cost of goods sold Interest expense Net income Tax rate 2021 $277,500 310,000 675,000 800,000 700,000 250,000 200,000 77,500 75,000 1,640,000 985,000 10,000 130,000 25% 2020 $230,000 250,000 565,000 The profit margin used to calculate return on assets for 2021 is (rounded): a. b. 8.9% 16.3% 17.2% 18.3%arrow_forward

- What does the vertical analysis reveal on ABC Corporation in terms of Statement of Financial Positionarrow_forwardNet sales Cost of goods sold Selling and administrative expenses Interest expense Other income (expense) Income tax expense Net income Current assets Noncurrent assets Total assets Current liabilities Long-term debt Total stockholders' equity Total liabilities and stockholders' equity Total assets Total stockholders' equity Current liabilities Target Corporation Income Statement Data for Year $65,357 45,583 15,101 707 (94) 1,384 $ 2,488 $18,424 26,109 Balance Sheet Data (End of Year) $44,533 $11,327 17,859 15,347 Walmart Inc. $44,533 $408,214 304,657 79,607 10,512 2,065 (411) 7,139 $ 14,335 $48,331 122,375 $170,706 $55,561 44,089 71,056 $170,706 Beginning-of-Year Balances $44,106 13,712 $163,429 65,682 55,390arrow_forwardSales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes. Income tax expense Net income Assets Current assets Long-term investments Plant assets, net Total assets Sin Comparative Income Statements For Years Ended December 31 2021 $ 420,027 252,856 167,171 59,644 37,802 97,446 69,725 12,969 $ 56,756 Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings Total liabilities and equity Assets Current assets Long-term investments Plant assets, net. Total assets Liabilities and Equity Current liabaties Common stock Other paid-in capital Retained earnings Total liabilities and equity 2020 $ 321,775 202,718 KORBIN COMPANY Comparative Balance Sheets December 31 2021 119,057 44,405 28,316 72,721 46,336 9,499 $ 36,837 $ 55,286 0 102,674 $ 157,960 2020 3. Complete the below table to calculate the balance sheet data in trend percents with 2019 as answers to 2 decimal places.) 111.77 % 0.00 $ 37,003 700…arrow_forward

- Some recent financial statements for Smolira Golf Corporation follow. Assets Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets Sales Cost of goods sold Depreciation Taxable income Taxes (22%) Earnings before interest and taxes Interest paid Net income Dividends Retained earnings 2020 $35,585 $38,940 28,846 43,112 18,401 3,970 SMOLIRA GOLF CORPORATION 2021 Income Statement a. Price-earnings ratio b. Dividends per share c. Market-to-book ratio d. PEG ratio SMOLIRA GOLF CORPORATION 2020 and 2021 Balance Sheets 2021 Liabilities and Owners' Equity Current liabilities $57,956 $110,898 $ 465,585 $ 27,000 37,022 Accounts payable Notes payable Other $ 521,433 Total $ 523,541 $ 632,331 Total liabilities and owners' equity Long-term debt times Owners' equity Common stock and paid-in surplus Accumulated retained earnings times times Total $ 512,454 363,528 45,963 $102,963 20,883 $ 82,080 18,058 $ 64,022 Smolira Golf Corporation has 52,000…arrow_forwardAnalysis and Interpretation of ProfitabilityBalance sheets and income statements for Costco Wholesale Corporation follow. Costco Wholesale Corporation Consolidated Statements of Earnings For Fiscal Years Ended ($ millions) September 2, 2018 Total revenue $141,576 Operating expenses Merchandise costs 123,152 Selling, general and administrative 13,876 Preopening expenses 68 Operating Income 4,480 Other income (expense) Interest expense 159 Interest income and other, net (121) Income before income taxes 4,442 Provision for income taxes 1,263 Net income including noncontrolling interests 3,179 Net income attributable to noncontrolling interests (45) Net income attributable to Costco $3,134 Costco Wholesale Corporation Consolidated Balance Sheets ($ millions, except par value and share data) September 2, 2018 September 3, 2017 Current assets Cash and cash equivalents $6,055 $4,546 Short-term investments 1,204 1,233…arrow_forwardAlpesharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education