Using Excel for financial statement analysis

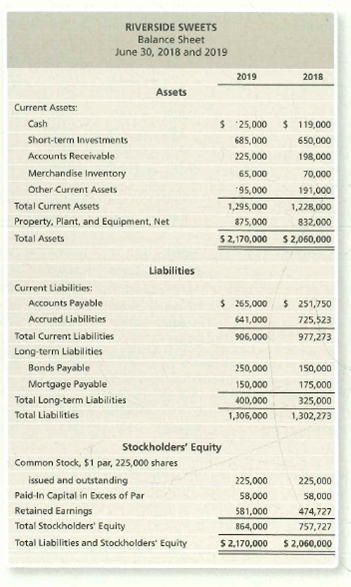

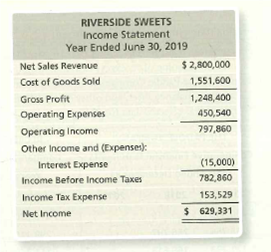

Download an Excel temp/ate for this problem online in MyAccountingLab or at http://www.pearsonhighered.com/Horngren Riverside Sweets, a retail candy store chain, reported the following figures:

Additional financial information:

a. 75% of net sales revenue are on account.

b. Market price of stock is $36 per share on June 30, 2019.

c. Annual dividend for 2019 was $1.50 per share.

d. All short-term investments are cash equivalents.

Requirements

- Perform a horizontal analysis on the

balance sheet for 2018 and 2019. - Perform a vertical analysis on the income statement.

- Compute the following ratios:

a.

b.

c. Acid-Test (Quick) Ratio

d. Cash Ratio

e.

f. Days’ Sales in Receivables

g. Inventory Turnover

h. Days’ Sales in Inventory

i. Gross Profit Percentage

j. Debt Ratio

k. Debt to Equity Ratio

l. Times-Interest-Earned Ratio

m. Profit Margin Ratio

n.

o. Asset Turnover Ratio

v. Rate of Return on Common

q. Earnings per Share (EPS)

r. Price/Earnings Ratio

s. Dividend Yield

t. Dividend Payout

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

- Begin by calculating the gross profit for each year, then prepare a horizontal analysis of revenues and gross profitlong dash—both in dollar amounts and in percentageslong dash—for 20192019 and 20182018. (Enter amounts in millions as provided to you in the problem statement. Round the percentages to one decimal place, X.X%. Use a minus sign or parentheses to indicate a decrease.) McDonald Corp. Income Statement - (Partial) Years Ended December 31, 2019 and 2018 (Amounts in millions) 2019 2018 2017 Revenues $9,575 $9,300 $8,975 Cost of Goods Sold 6,250 6,000 5,890 Gross Profitarrow_forwardPlease help me with show all calculation thankuarrow_forwardHere are the abbreviated financial statements for Planner's Peanuts: INCOME STATEMENT, 2019 Sales Cost $ 9,000 7,100 Net income $ 1,900 BALANCE SHEET, YEAR-END 2018 Assets $ 6,500 2019 $ 9,500 Total $ 6,500 $ 9,500 Debt Equity Total 2018 $ 853 2019 $1,000 5,647 $6,500 $9,500 8,500 a. If sales increase by 25% In 2020 and the company uses a strict percentage of sales planning model (meaning that all items on the Income and balance sheet also increase by 25%), what must be the balancing item? b. What will be the value of this balancing item? Answer is not complete. a. Balancing item Dividends b. Valuearrow_forward

- Abbott Laboratories’ Consolidated Statements of Earnings for the 3 fiscal year’s ending December 31, 2019. Required: Using the attached earnings statement, for each period presented, Compute the gross margin % Note: Gross margin % = [(Net sales – Cost of products sold)/Net sales] x 100 Compute the net profit margin on sales % Note: Net profit margin % = (Net earnings/Net sales) x 100 Considering the 3-year trend for a. and b. above, provide a brief comment about the company’s performance for: Gross margin % and Net profit margin %.arrow_forwardObtain Target Corporation's annual report for its 2018 fiscal year (year ended February 2, 2019) at http://investors.target.com a. What was Target's gross margin percentage for the fiscal year ended February 2, 2019 (2018) and 2017? Use "Sales" for these computations b. What was Target's Return on Sales percentage for 2018 and 2017? Use "Total Revenue" for these computations. c. Target's return on ales percentage for 2017 was higher than it was in 2018. Ignoring taxes, how much higher would Target's 2018 net income have been if it's return on sales percentage in 2018 had been the same as for 2017?arrow_forwardShow all of your work for numerical problems. 1. Based on the following information for ABC Corporation, answer each question (calculate for year 2023). Assume that price per share is $13.33 and number of shares is 175. Sales Cost of goods sold/Expenses Depreciation b. EBIT Interest Taxable Income Taxes Net Income Dividends Cash Inventory Account Receivable Current assets Net fixed assets Current liabilities Long-term debt Common stock Retained Earning 2022 1,000 1,400 1,600 4,000 9,000 3,500 4,000 3,000 2,500 2023 8,000 4,900 600 ? 450 ? ? ? 1,370 1,200 1,600 1,800 4,600 9,200 3,700 4,300 3,050 2,750 a. What are the ABC's tax liabilities (tax payments)? Use a 21 percent (flat) tax rate. Calculate cash flow from assets (CF Generating), cash flow to creditors, and cash flow to stockholders. Check CF identityarrow_forward

- can you help me fill out my balance sheets based on my journal.arrow_forwardAn extract from a boat retails 2020 financial statements follows: Income Statement Year ended Dec 31, 2020 Year ended Dec 31, 2019 Net Income 12,866 11,242 Balance Sheet As of Dec 31, 2020 As of Dec 31, 2019 Total Stockholders Equity 3,299 (3,116) What was the companys return on equity for 2020?arrow_forwardDebt Management Ratio's Trina's Trikes Inc reported a debt to equity ratio of 1.91 times at the end of 2018. If the forms total debt at year - end was $10.90 million, how much equity does Trina's Trikes Have?arrow_forward

- Two online magazine companies reported the following in their financial statements: Outdoor Fun BetterWorth 2020 $ 171,173 417,049 2.98 57.20 2021 2020 $ 105,000 537,186 1.80 52.40 2021 $ 85,500 397,151 1.10 30.05 $ 107,604 462,814 Net income Total stockholders' Earnings per share Stock price when annual results reported equity 2.19 48.54 Required: 1-a. Compute the 2021 ROE for each company. 1-b. Which company appears to generate greater returns on stockholders' equity in 2021? 2-a. Compute the 2021 P/E ratio for each company. 2-b. Which company do investors appear to value more? Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 2A Req 2B Compute the 2021 ROE for each company. (Round your answers to 1 decimal place.) ROE Outdoor Fun % BetterWorth %arrow_forwardUse the Ulta annual report to calculate profit margin, total debt ratio, and cash ratio for the year ending in 2021.arrow_forwardAssume General Motors announced a quarterly profit of $119 million for 4th quarter 2019. Below is a portion of its balance sheet. Conduct a horizontal analysis of the following line items. (Negative answers should be indicated by a minus sign. Round the "percent" answers to the nearest hundredth percent.) 2019 (dollars in millions) 2018 (dollars in millions) Difference % CHG Cash and cash equivalents $ 15,980 $ 15,499 Marketable securities 9,222 16,148 Inventories 13,642 14,324 Goodwill 1,278 Total liabilities and equity $ 103,249 $ 144,603arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education