FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

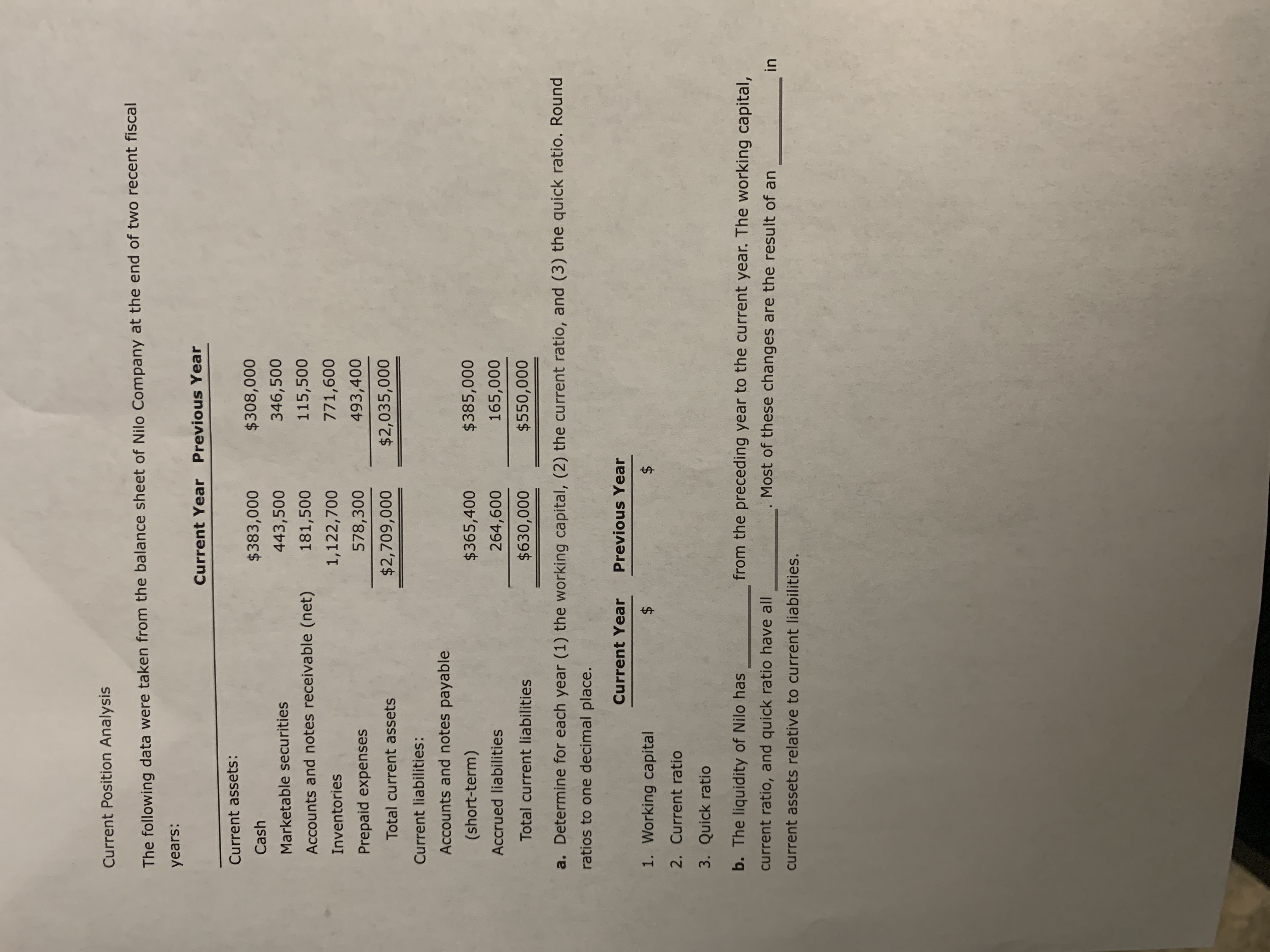

Transcribed Image Text:Current Position Analysis

The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal

years:

Current Year Previous Year

Current assets:

$383,000

$308,000

Cash

443,500

346,500

Marketable securities

Accounts and notes receivable (net)

181,500

115,500

1,122,700

771,600

Inventories

Prepaid expenses

578,300

493,400

$2,709,000

$2,035,000

Total current assets

Current liabilities:

Accounts and notes payable

(short-term)

$365,400

$385,000

Accrued liabilities

264,600

165,000

Total current liabilities

$630,000

$550,000

a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round

ratios to one decimal place.

Current Year

Previous Year

1. Working capital

2$

$4

2. Current ratio

3. Quick ratio

b. The liquidity of Nilo has

from the preceding year to the current year. The working capital,

current ratio, and quick ratio have all

Most of these changes are the result of an

in

current assets relative to current liabilities.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- Horizontal Analysis The comparative temporary investments and inventory balances of a company follow. Current Year Previous Year Accounts payable $59,409 $48,300 Long-term debt 44,795 52,700 Based on this information, what is the amount and percentage of increase or decrease that would be shown on a balance sheet with horizontal analysis? Amount of Change Increase/Decrease Percentage Accounts payable $ % Long-term debt $ %arrow_forwardFind for Armstrong Company and Blair Company : Liquidity Ratio (a) Current Ratio Market tests (b) Price/earnings ratio (c) Divident yield ratio (%)arrow_forwardWorking Capital and Short Term Liquidity RatiosBell Company has a current ratio of 2.85 on December 31. On that date the company's current assets are as follows: Cash $16,400 Short-term investments 49,000 Accounts receivable (net) 169,000 Inventory 200,000 Prepaid expenses 11,600 Current assets $446,000 Bell Company's current liabilities at the beginning of the year were $137,000 and during the year its operating activities provided a cash flow of $55,000.a. What are the firm's current liabilities on December 31?Round answer to the nearest whole number.Answerb. What is the firm's working capital on December 31?Round answer to the nearest whole number.Answerc. What is the quick ratio on December 31? Round answer to 2 decimal places.Answerd. What is the Bell's operating-cash-flow-to-current-liabilities ratio? Round answer to 2 decimal places.Answer PreviousSave AnswersNextarrow_forward

- Subject: acountingarrow_forwardVertical Analysis of Balance Sheet Balance sheet data for Kwan Company on December 31, the end of two recent fiscal years, follow: Current Year Previous Year Current assets $308,140 $179,040 Property, plant, and equipment 576,520 522,200 Intangible assets 109,340 44,760 Current liabilities 228,620 134,280 Long-term liabilities 397,600 313,320 Common stock 99,400 104,440 Retained earnings 268,380 193,960 Prepare a comparative balance sheet for both years, stating each asset as a percent of total assets and each liability and stockholders' equity item as a percent of the total liabilities and stockholders' equity. If required, round percentages to one decimal place. Kwan CompanyComparative Balance SheetFor the Years Ended December 31 CurrentyearAmount CurrentyearPercent PreviousyearAmount PreviousyearPercent Current assets $308,140 fill in the blank 1% $179,040 fill in the blank 2% Property, plant, and equipment 576,520 fill…arrow_forwardNonearrow_forward

- WD Corporation reports the following year-end balance sheet data. The company's debt-to-equity ratio equals: Cash $ 42,000 Current liabilities $ 77,000 Accounts receivable 57,000 Long-term liabilities 28,000 Inventory 62,000 Common stock 102,000 Equipment 147,000 Retained earnings 101,000 Total assets $ 308,000 Total liabilities and equity $ 308,000arrow_forwardPreparing a Single-Step Income Statement The following items are from the adjusted trial balance of Bailey Corp. on December 31, the end of its annual accounting period. Assume an average 25% income tax on all items. Weighted average shares of common stock outstanding for the year were 10,000. Sales revenue Depreciation for the period Rent revenue Gain on sale of investment Cost of goods sold Selling expenses General and administrative expenses Interest revenue Interest expense Loss on sale of investment $645,200 6,000 2,400 2,000 330,000 136,000 110,000 900 1,500 22,000 Prepare a single-step income statement for the 12 months ended December 31, including the earnings per share disclosures. Report income taxes in its own section. Note: Enter the answer for earnings per share in dollars and cents, rounded to the nearest penny. Note: Do not enter any negative signs with your answers.arrow_forwardThe current year financial statements for Blue Water Company and Prime Fish Company are presented below. Balance sheet Cash Accounts receivable (net) Inventory Property & equipment (net) Blue Water Prime Fish $ 42,400 45,000 $ 19,600 35,200 Other assets Total assets Current liabilities Long-term debt (interest rate: 10%) Capital stock ($10 par value) Additional paid-in capital Retained earnings Total liabilities and stockholders' equity $ 425,800 Income statement Sales revenue (1/3 on credit) Cost of goods sold Operating expenses Net income Other data Per share stock price at end of current year Average income tax rate $ 426,000 (234,000) (163,800) 92,000 161,000 85,400 $ 425,800 $ 92,000 74,800 157,800 30,400 70,800 48,400 417,800 319,000 $ 840,000 $ 70,000 62,800 526,000 107,400 73,800 $ 840,000 $ 788,000 (401,400) (312,400) $ 28,200 $ 74,200 $ 23.4 30% $ 29 30% Dividends declared and paid in current year $ 34,400 $ 155,000 Both companies are in the fish catching and manufacturing…arrow_forward

- Comprehensive Ratio Analysis Data for Lozano Chip Company and its industry averages follow. Lozano Chip Company: Balance Sheet as of December 31, 2019 (Thousands of Dollars) Cash $ 240,000 Accounts payable $ 600,000 Receivables 1,575,000 Notes payable 100,000 Inventories 1,135,000 Other current liabilities 560,000 Total current assets $2,950,000 Total current liabilities $1,260,000 Net fixed assets 1,315,000 Long-term debt 400,000 Common equity 2,605,000 Total assets $4,265,000 Total liabilities and equity $4,265,000 Lozano Chip Company: Income Statement for Year Ended December 31, 2019 (Thousands of Dollars) Sales $7,500,000 Cost of goods sold 6,375,000 Selling, general, and administrative expenses 943,000 Earnings before interest and taxes (EBIT) $ 182,000 Interest expense 40,000 Earnings before taxes (EBT) $ 142,000 Federal and state income taxes (25%) 35,500 Net income $ 106,500 a. Calculate the indicated ratios for Lozano. Do not round intermediate calculations. Round your answers…arrow_forwardReturn on total assets A company reports the following income statement and balance sheet information for the current year: Net income $410,000 Interest expense 90,000 Average total assets 5,000,000 Determine the return on total assets. (Round percentages to one decimal place.) %arrow_forwardVertical Analysis of Balance Sheet Balance sheet data for Alvarez Company on December 31, the end of two recent fiscal years, follows: Current Year Previous Year Current assets $299,520 $182,520 Property, plant, and equipment 542,880 484,380 Intangible assets 93,600 35,100 Current liabilities 215,280 112,320 Long-term liabilities 365,040 287,820 Common stock 93,600 98,280 Retained earnings 262,080 203,580 Prepare a comparative balance sheet for both years, stating each asset as a percent of total assets and each liability and stockholders' equity item as a percent of the total liabilities and stockholders' equity. If required, round percentages to one decimal place. Alvaraz Company Comparative Balance Sheet For the Years Ended December 31 Current Current Previous Previous уear year year year Amount Percent Amount Percent Current assets $299,520 % $182,520 % Property, plant, and equipment 542,880 % 484,380 Intangible assets 93,600 % 35,100 % Total assets $936,000 % $702,000 % Current…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education