FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

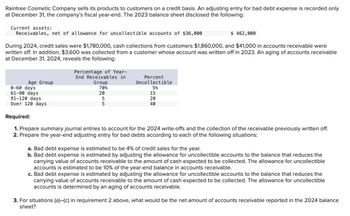

Transcribed Image Text:Raintree Cosmetic Company sells its products to customers on a credit basis. An adjusting entry for bad debt expense is recorded only

at December 31, the company's fiscal year-end. The 2023 balance sheet disclosed the following:

Current assets:

Receivables, net of allowance for uncollectible accounts of $36,000

$ 462,000

During 2024, credit sales were $1,780,000, cash collections from customers $1,860,000, and $41,000 in accounts receivable were

written off. In addition, $3,600 was collected from a customer whose account was written off in 2023. An aging of accounts receivable

at December 31, 2024, reveals the following:

Age Group

0-60 days

61-90 days

91-120 days

Percentage of Year-

End Receivables in

Group

Percent

Uncollectible

70%

20

5%

15

5

20

5

40

Over 120 days

Required:

1. Prepare summary journal entries to account for the 2024 write-offs and the collection of the receivable previously written off.

2. Prepare the year-end adjusting entry for bad debts according to each of the following situations:

a. Bad debt expense is estimated to be 4% of credit sales for the year.

b. Bad debt expense is estimated by adjusting the allowance for uncollectible accounts to the balance that reduces the

carrying value of accounts receivable to the amount of cash expected to be collected. The allowance for uncollectible

accounts is estimated to be 10% of the year-end balance in accounts receivable.

c. Bad debt expense is estimated by adjusting the allowance for uncollectible accounts to the balance that reduces the

carrying value of accounts receivable to the amount of cash expected to be collected. The allowance for uncollectible

accounts is determined by an aging of accounts receivable.

3. For situations (a)-(c) in requirement 2 above, what would be the net amount of accounts receivable reported in the 2024 balance

sheet?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At the end of the current year, using the aging of receivable method, management estimated that $24,750 of the accounts receivable balance would be uncollectible. Prior to any year-end adjustments, the Allowance for Doubtful Accounts had a credit balance of $465. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?arrow_forwardAerospace Electronics reports $570,000 in credit sales for 2018 and $634,500 in 2019. They have a $501,000 accounts receivable balance at the end of 2018, and $602,000 at the end of 2019. Aerospace uses the income statement method to record bad debt estimation at 4% during 2018. To manage earnings more favorably, Aerospace changes bad debt estimation to the balance sheet method at 6% during 2019. A. Determine the bad debt estimation for 2018. $ B. Determine the bad debt estimation for 2019. C. How does the new total bad debt expense affect net income and net accounts receivable? Bad debt expense is lower, net income is higher, and net re а. are higher. Bad debt expense is lower, net income is higher, and net re b. are lower. Bad debt expense is higher, net income is lower, and net re С. are higher. Bad debt expense is higher, net income is lower, and net re d. are lower.arrow_forwardDuring its first year of operations, Fall Wine Tour earned net credit sales of $311,000. Industry experience suggests that bad debts will amount to 3% of net credit sales. At December 31, 2024, accounts receivable total $44,000. The company uses the allowance method to account for uncollectibles. Read the requirements. Requirement 1. Journalize Fall Wine Tour's Bad Debts Expense using the percent-of-sales method. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit Dec. 31 Requirement 2. Show how to report accounts receivable on the balance sheet at December 31, 2024. Balance Sheet (Partial): Current Assets:arrow_forward

- Concord, Inc. had net sales in 2025 of $1,428,800. At December 31, 2025, before adjusting entries, the balances in selected accounts were Accounts Receivable $392,000 debit, and Allowance for Doubtful Accounts $4,240 credit. If Concord estimates that 9% of its receivables will prove to be uncollectible. Prepare the December 31, 2025, journal entry to record bad debt expense. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List debit entry before credit entry.)arrow_forwardRogan Company's total sales on account for the year amounted to $327,000. The company, which uses the allowance method, estimated bad debts at 1 percent of its credit sales. Required: Journalize the following selected entries: 2017 Dec. 31 Record adjusting entry. 2018 Mar. 2 Write off the account of A.M. Billson as uncollectible, $584. June. 6 Write off the account of W.H. Gilders as uncollectible, $492.arrow_forwardErvin Company uses the allowance method to account for uncollectible accounts receivable. Bad debt expense is established as a percentage of credit sales. For 2021, net credit sales totaled $4,500,000, and the estimated bad debt percentage is 1.5%. No previously written-off accounts receivable were reinstated during 2021. The allowance for uncollectible accounts had a credit balance of $42,000 at the beginning of 2021 and $40,000, after adjusting entries, at the end of 2021.Required:1. What is bad debt expense for 2021 as a percent of net credit sales?2. Assume Ervin makes no other adjustment of bad debt expense during 2021. Determine the amount of accounts receivable written off during 2021.3. If the company uses the direct write-off method, what would bad debt expense be for 2021?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education