FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

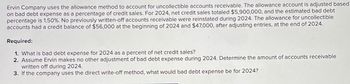

Transcribed Image Text:Ervin Company uses the allowance method to account for uncollectible accounts receivable. The allowance account is adjusted based

on bad debt expense as a percentage of credit sales. For 2024, net credit sales totaled $5,900,000, and the estimated bad debt

percentage is 1.50%. No previously written-off accounts receivable were reinstated during 2024. The allowance for uncollectible

accounts had a credit balance of $56,000 at the beginning of 2024 and $47,000, after adjusting entries, at the end of 2024.

Required:

1. What is bad debt expense for 2024 as a percent of net credit sales?

2. Assume Ervin makes no other adjustment of bad debt expense during 2024. Determine the amount of accounts receivable

written off during 2024.

3. If the company uses the direct write-off method, what would bad debt expense be for 2024?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At the beginning of the year, Mitchum Enterprises allows for estimated uncollectible accounts of $15,000. By the end of the year, actual bad debts total $17,000. Record the writeoff to uncollectible accounts. Following the write-off, what is the balance of Allowance for Uncollectible Accounts?arrow_forwardOn December 31, 2021, when its Allowance for Doubtful Accounts had a zero balance, Ling Co. estimated that 2% of its net accounts receivable of $450,000 will become uncollectible and records the necessary adjustment to Allowance for Doubtful Accounts. On May 11, 2022, Ling Co. determined that the Jeff Shoemaker account was uncollectible and wrote off $1,100. On June 12, 2022, Shoemaker paid the amount previously written off. Instructions Prepare the journal entries on December 31, 2021, May 11, 2022, and June 12, 2022. Journalize entries for the sale of accounts receivablearrow_forwardbints) On December 31, 2021, RTQ, Inc. reports an ending balance of $2,435,000 for Accounts Receivable and of $36,500 for the Allowance for Bad Debts. Credit sales for the year were $6,088,000 and the company estimates that 2% of credit sales will be uncollectible. Based on this information, how much will RTQ, Inc. need to credit its Allowance for Bad Debts as part of it adjusting entries? (AC 11) O $12,200 O $85,200 O $48,700 O $121,760arrow_forward

- Ivanhoe Company uses the allowance method in accounting for uncollectible accounts. Past experience indicates that 8% of receivables will eventually be uncollectible. Selected account balances at December 31, 2019, and December 31, 2020, appear below: Net Credit Sales Accounts Receivable Allowance for Doubtful Accounts (a) Nov. 15 Date Aug. 10 Record the following events in 2020. The given balance in the Accounts Receivable account at December 31, 2020 reflects the 2020 transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Sept. 12 12/31/19 $324,000 Aug. 10 Determined that the account of L. Young for $648 is uncollectible. Sept. 12 Determined that the account of J. E. Ford for $3,672 is uncollectible. Oct. 10 Received a check for $432 as payment on account from L. Young, whose account had previously been written off…arrow_forwardColorado Rocky Cookie Company offers credit terms to its customers. At the end of 2024, accounts receivable totaled $675,000. The allowance method is used to account for uncollectible accounts. The allowance for uncollectible accounts had a credit balance of $42,000 at the beginning of 2024 and $26,000 in receivables were written off during the year as uncollectible. Also, $2,200 in cash was received in December from a customer whose account previously had been written off. The company estimates bad debts by applying a percentage of 10% to accounts receivable at the end of the year. Required: 1. Prepare journal entries to record the write-off of receivables, the collection of $2,200 for previously written off receivables, and the year-end adjusting entry for bad debt expense. 2. How would accounts receivable be shown in the 2024 year-end balance sheet? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare journal entries to record the…arrow_forwardAt the end of 2023, Ayayai Corp. has accounts receivable of $2.90 million and an allowance for expected credit losses of $115,000. On January 16, 2024, Ayayai determined that its $22,400 receivable from Blossom Company will not be collected, and management has authorized its write-off. On January 31, 2024, Ayayai received notification that the company will receive $0.15 for every $1.00 of accounts receivable relating to Sunland Company The company had previously written off 100% of the amount due from Sunland ($60,500). (a) Your answer is partially correct. Prepare the journal entry for Ayayai to write-off the Blossom receivable and any journal entry needed to reflect the notice regarding Sunland. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Blossom Company accounts receivable write-off:…arrow_forward

- On January 1, 2018, Keiasia Company’s Accounts Receivable and the Allowance for Uncollectible Accounts showed balances of $24,000 and $1,200 respectively. During the year, the company reported $64,000 of credit sales, and cash collections of receivables amounted to $58,000. During the year, the company wrote of $1,400 of delinquent accounts. The company estimates that it will be unable to collect 5% of the year-end accounts receivable balance. The amount of bad debts expense recognized in the 2018 income statement will be: A. $1,230 B. $1,630 C. $230 D. $500 Answer is B, how do you get to 1,630arrow_forwardPincus Associates uses the allowance method to account for bad debts. 2024 was the first year of operations for Pincus, so it had a $0 opening balance in its allowance for uncollectible accounts. During 2024, Pincus provided a total of $267,000 of services on account. In 2024, the company wrote off uncollectible accounts of $10,700. By the end of 2024, cash collections on accounts receivable totaled $224,700. Pincus estimates that 15% of the accounts receivable balance at 12/31/2024 will prove uncollectible. Required: What journal entry did Pincus record to write off uncollectible accounts during 2024? What journal entry should Pincus record to recognize bad debt expense for 2024?arrow_forwardSmithson Corporation had a 1/1/20 balance in the Allowance for Doubtful Accounts of $30,653. During 2020, it wrote off $21,362 of accounts and collected $6,107 on accounts previously written off. The balance in Accounts Receivable was $600,779 at 1/1 and $722,708 at 12/31. At 12/31/20, Smithson estimates that 5% of accounts receivable will prove to be uncollectible. What is Bad Debt Expense for 2020? *round your final answer to the nearest $1 24,546arrow_forward

- JD Company decided on January 2, 2022, to effect the change in accounting policies in relation to bad debts as follows: Bad debt percentage from 2% to 10% of accounts receivables. JD Company's receivable balance at December 31, 2022 was P 960,000, and the allowance for bad debt account has a debit balance of P 7,000. What is the 2022 carrying value of the accounts receivable?arrow_forwardAs of January 1, 2024, Barley Company had a credit balance of $520,000 in its allowance for uncollectible accounts. Based on experience, 2% of Barley’s gross accounts receivable have been uncollectible. During 2024, Barley wrote off $650,000 of accounts receivable. Barley’s gross accounts receivable as December 31, 2024 is $18,000,000. How much bad debt expense should Barley record for 2024?arrow_forwardJohnson Company calculates its allowance for uncollectible accounts as 20% of its ending balance in gross accounts receivable. The allowance for uncollectible accounts had a credit balance of $21,000 at the beginning of 2021. No previously written-off accounts receivable were reinstated during 2021. At 12/31/2021, gross accounts receivable totaled $350,200, and prior to recording the adjusting entry to recognize bad debts expense for 2021, the allowance for uncollectible accounts had a debit balance of 38,400 Required: 1. What was the balance in gross accounts receivable as of 12/31/2020? 2. What journal entry should Johnson record to recognize bad debt expense for 2021? 3. Assume Johnson made no other adjustment of the allowance for uncollectible accounts during 2021. Determine the amount of accounts receivable written off during 2021. 4. If Johnson instead used the direct write-off method, what would bad debt expense be for 2021? Required 1 Required 2 Required 3 Required 4 What was…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education