FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:ek 6: Homework

CengageNOWv2 | Online teachin X

eBook

takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator=&inprogress=false

+

Print Item

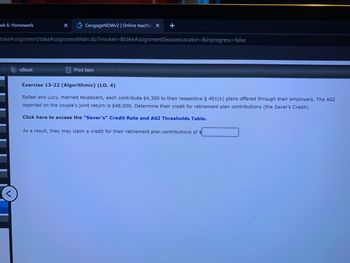

Exercise 13-22 (Algorithmic) (LO. 4)

Rafael and Lucy, married taxpayers, each contribute $4,300 to their respective § 401(k) plans offered through their employers. The AGI

reported on the couple's joint return is $48,000. Determine their credit for retirement plan contributions (the Saver's Credit).

Click here to access the "Saver's" Credit Rate and AGI Thresholds Table.

As a result, they may claim a credit for their retirement plan contributions of $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Social Security is paid in with after-tax dollars but may be subject to tax if annual income exceeds a base amount. A single taxpayer’s base is $25,000. Married taxpayers filing jointly have a base of $32,000. Married taxpayers filing separately have a base of zero. Suppose Eric is retiring this year at age 67. The following table shows his data. Part-time salary $30,500 Annual savings account interest $300 Annual dividends $2,750 Annual interest on Dallas municipal bonds $1,550 Based on the income calculated, Eric will have % of his Social Security benefits taxed.arrow_forwardSamuel and Annamaria are married, file a joint return, and have three qualifying children. In 2023, they earn wages of $57,900 and have no other income. Round your intermediate computations and final answer to the nearest dollar. Click here to access the Earned Income Credit and Phaseout Percentages Table. The earned income credit is $arrow_forwardJoyce, a single parent, lives in an apartment with her two minor children (ages 8 and 10), whom she supports. Joyce earns $33,000 during 2023. She uses the standard deduction and files as a head of household. Round all computations to the nearest dollar. Click to access Earned Income Credit and Phaseout Percentages Table and the Tax Rates Schedules. a. Calculate the amount, if any, of Joyce's earned income credit. 2,696 X b. During the year, Joyce is offered a new job that has greater future potential than her current job. If she accepts the job offer, her earnings for the year will be $40,400; however, she is afraid she will not qualify for the earned income credit. Determine the increase or decrease in Joyce's net cash flow if she accepts the new job. Since the child tax credit will be the same under either scenario, you can ignore it for purposes of this analysis. Use the Tax Rate Schedule when computing her income tax. Tax calculation: Salary Less: Standard deduction Taxable income…arrow_forward

- Grady received $9,040 of Social Security benefits this year. Grady also reported salary and interest Income this year. What amount of the benefits must Grady include in his gross income under the following five independent situations? Note: Leave no answer blank. Enter zero if applicable. Required: a. Grady files single and reports salary of $14,200 and interest income of $460. b. Grady files single and reports salary of $24,310 and interest income of $810. c. Grady files married joint and reports salary of $79,200 and interest income of $710. d. Grady files married joint and reports salary of $44,000 and interest income of $910. e. Grady files married separate and reports salary of $24,310 and interest income of $810. Complete this question by entering your answers in the tabs below. Required A Required C Required D Required E Grady files single and reports salary of $14,200 and interest income of $460. Amount to be included in gross income 19,180 Required B $ Hepaired A Required B >arrow_forwardCompute the gross income, adjusted gross income, and taxable income in the following situation. Use the exemptions and deductions in the table to the right. Explain how it was decided whether to itemize deductions or use the standard deduction. A man is single and earned wages of $63,600. He received $390 in interest from a savings account. He contributed $510 to a tax-deferred retirement plan. He had $1650 in itemized deductions from charitable contributions. Solve His gross income is $ Tax Rate Single 10% up to $9325 15% up to $37,950 25% up to $91,900 28% up to $191,650 33% up to $416,700 35% up to $418,400 39.6% above $418,400 Standard deduction $6350 Exemption (per person) $4050arrow_forwarda. Bruno and Bridget are married and file a joint return, with earned income of $48,000 and $12,000, respectively. Their combined AGI is $58,000. They have two children, ages 10 and 12, and employ a live-in nanny at an annual cost Refer to the information provided and compute the child and dependent care tax credit. Child and dependent Qualifying expenses eligible Applicable percentage care tax credit Requirement = Print % = For each of the independent situations, determine the amount of the child and dependent care tax credit. (Assume that both taxpayers are employed and the year is 2022.) Done X Independent Situations a. Bruno and Bridget are married and file a joint return, with earned income of $48,000 and $12,000, respectively. Their combined AGI is $58,000. They have two children, ages 10 and 12, and employ a live-in nanny at an annual cost of $8,000. b. Assume the same facts as in Part a, except that Bruno and Bridget employ Bridget's mother, who is not their dependent, as the…arrow_forward

- Ralph and Kathy Gump are married with one 20-year-old dependent child. Ralph expects to earn $98,000 (paid monthly) and estimates their itemized deductions to be $29,500 for the year. Kathy expects to earn wages of $54,000. The Gumps expect to have for AGI deductions of $3,600. Use Form W-4 and worksheet on 9-50 to 9-53 to determine what Ralph should report on lines of Form W-4. 3. 4(a). 4(b). 4(c).arrow_forwardDetermine the taxable amount of social security benefits for the following situations. a. Erwin and Eleanor are married and file a joint tax return. They have adjusted gross income of $39,200, no tax-exempt interest, and $13,720 of Social Security benefits. As a result, $ of the Social Security benefits are taxable. b. Assume Erwin and Eleanor have adjusted gross income of $19,800, no tax-exempt interest, and $21,780 of Social Security benefits. As a result, $ of the Social Security benefits are taxable. c. Assume Erwin and Eleanor have adjusted gross income of $116,500, no tax-exempt interest, and $17,475 of Social Security benefits. As a result, $ of the Social Security benefits are taxable.arrow_forwardMahmet earned wages of $148,800 during 2022. Mahmet qualifies to file as head of household and claims two dependents under the age of 17. How much will Mahmet's employer withhold in social security taxes for the year? Note: Round your answer to 2 decimal places. Multiple Choice $9,114.00. $8,537.40. $8,853.60 $9,039.60.arrow_forward

- Determine the taxable amount of Social Security benefits for the following situations. If required, round your answers to the nearest dollar. If an amount is zero, enter "0". a. Tyler and Candice are married and file a joint tax return. They have adjusted gross income of $40,000 before considering their Social Security benefits, no tax-exempt interest, and $14,000 of Social Security benefits. As a result, $ of the Social Security benefits are taxable. b. Assume Tyler and Candice have adjusted gross income of $17,600 before considering their Social Security benefits, no tax-exempt interest, and $19,360 of Social Security benefits. As a result, $ of the Social Security benefits are taxable. c. Assume Tyler and Candice have adjusted gross income of $106,000 before considering their Social Security benefits, no tax-exempt interest, and $15,900 of Social Security benefits. As a result, $ of the Social Security benefits are taxable.Determine the taxable amount of Social Security benefits for…arrow_forwardElton Weiss and Reyna Herrera-Weiss are married and report the following income items: Elton's salary Reyna's Schedule C net profit The income tax deduction for Reyna's SE tax was $3,532. Elton contributed the maximum to a Section 401(k) plan, and Reyna contributed the maximum to a SEP plan. Both spouses contributed $2,750 to their IRAS. $ 254,000 50,000 Required: Compute their AGI. Note: Round your intermediate calculations to the nearest whole dollar amount. AGI Answer is complete but not entirely correct. $ 304,000arrow_forwardMark's gross annual salary is $65,349 with biweekly paychecks. If he is married and has 4 dependent children, compute the biweekly withholding his employer will send to the IRS. Use the following information: • Biweekly allowance: $165.38 per person. 2023 Married Person Biweekly Withholding Table Taxable Wages $0-$1,123 $1,123 - $2,015 $2,015 - $4,750 $4,750 - $8,856 $8,856 - $15,888 $15,888 - $19,871 $19,871-$29.246 $29.246 or more Round your answer to the nearest dollar. Wages Withholding $0.00 $0.00 plus 10% of amount exceeding $1,123 $89.20 plus 12% of amount exceeding $2,015 $417.40 plus 22% of amount exceeding $4,750 $1,320.72 plus 24% of amount exceeding $8,856 $3,008.40 plus 32% of amount exceeding $15,888 $4,282.96 plus 35% of amount exceeding $19,871 $7,564.21 plus 37% of amount exceeding $29,246arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education