FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

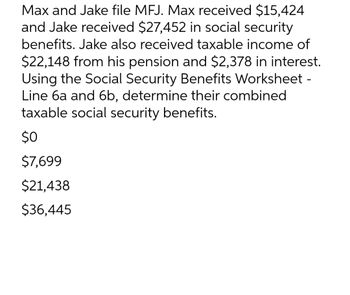

Transcribed Image Text:Max and Jake file MFJ. Max received $15,424

and Jake received $27,452 in social security

benefits. Jake also received taxable income of

$22,148 from his pension and $2,378 in interest.

Using the Social Security Benefits Worksheet -

Line 6a and 6b, determine their combined

taxable social security benefits.

$0

$7,699

$21,438

$36,445

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What type of defined contribution plan allows participants to contribute after-tax amounts to their retirement account? Select one: a. Roth 401(k) b. 403(b) c. 401(k) d. 457arrow_forwardExercise 12-25 (Algorithmic) (LO. 7) Compute the additional Medicare tax for the following taxpayers. If required, round your answers to the nearest dollar. a. Mario, who is single, earns wages of $490,200. His additional Medicare tax is $ b. George and Shirley are married and file a joint return. During the year, George earns wages of $298,100, and Shirley earns wages of $447,150. Their additional Medicare tax is $ c. Simon has net investment income of $56,880 and MAGI of $284,400 and files as a single taxpayer. Simon's additional Medicare tax is $arrow_forwardComplete the following table with the information provided. Employee, with your deductions allowed Gross income Social Security Tax (6.20%) Medical care contribution (1.45%) Income tax Other deductions Net income 8 Stream (0) $ 735 (12%) $ 25 9 Bravo (1) $ 675 (11%) $ 12 10 Colon (2) $ 895 (10%) -0- eleven Diaz (3) $ 580 (9%) $ 5 12 Figueroa (4) $ 610 (7%) -0- Determine: Social Security Contribution (FICA) Medical care contribution (Medicare - FICA) Income tax Net incomearrow_forward

- Exercise 4 - 26 (Algorithmic) (LO. 4) Determine the taxable amount of Social Security benefits for the following situations. If required, round your answers to the nearest dollar. If an amount is zero, enter "0". a. Tyler and Candice are married and file a joint tax return. They have adjusted gross income of $38, 200 before considering their Social Security benefits, no tax-exempt interest, and $ 13,370 of Social Security benefits. As a result, $fill in the blank 1 of the Social Security benefits are taxable. b. Assume Tyler and Candice have adjusted gross income of $16, 200 before considering their Social Security benefits, no tax-exempt interest, and $17,820 of Social Security benefits. As a result, $fill in the blank 2 of the Social Security benefits are taxable. c. Assume Tyler and Candice have adjusted gross income of $113, 500 before considering their Social Security benefits, no tax - exempt interest, and $17,025 of Social Security benefits. As a result, $fill in the blank 3 of…arrow_forwardSh48arrow_forwardUnions dues, vacation account, 401k, insurance, subtracted from gross pay Options are: personal exemptions, tax deductions, adjusted gross income, social security tax, taxable wages, fit, net pay, personal deductions, Medicare tax, dependent, graduated income tax, and withholding allowances. Which one is it?arrow_forward

- confused on how to do these calculations?arrow_forwardrweerrrrrrrarrow_forwardDuela Dent is single and had $182,400 in taxable income. Using the rates from Table 2.3, calculate her income taxes. What is the average tax rate? What is the marginal tax rate? Note: Do not round intermediate calculations and round your income tax answer to 2 decimal places, e.g., 32.16. Enter the average and marginal tax rate answers as a percent, rounded 2 decimal places, e.g., 32.16. Income taxes Average tax rate Marginal tax rate % %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education