FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

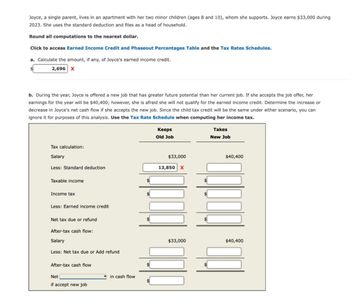

Transcribed Image Text:Joyce, a single parent, lives in an apartment with her two minor children (ages 8 and 10), whom she supports. Joyce earns $33,000 during

2023. She uses the standard deduction and files as a head of household.

Round all computations to the nearest dollar.

Click to access Earned Income Credit and Phaseout Percentages Table and the Tax Rates Schedules.

a. Calculate the amount, if any, of Joyce's earned income credit.

2,696 X

b. During the year, Joyce is offered a new job that has greater future potential than her current job. If she accepts the job offer, her

earnings for the year will be $40,400; however, she is afraid she will not qualify for the earned income credit. Determine the increase or

decrease in Joyce's net cash flow if she accepts the new job. Since the child tax credit will be the same under either scenario, you can

ignore it for purposes of this analysis. Use the Tax Rate Schedule when computing her income tax.

Tax calculation:

Salary

Less: Standard deduction

Taxable income

Income tax

Less: Earned income credit

Net tax due or refund

After-tax cash flow:

Salary

Less: Net tax due or Add refund

After-tax cash flow

Net

in cash flow

if accept new job

ta

Keeps

Old Job

$33,000

13,850 X

Takes

New Job

$40,400

$33,000

$40,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Luna, a self-employed accountant, currently earns $100,000 annually. Luna has been able to save 18% of her annual Schedule C net income. Assume that Luna paid $11,000 in Social Security taxes, and that she plans to pay off her mortgage at retirement, thereby relieving her of her only debt. Luna presently pays $1,500 per month toward the mortgage principal and interest. Based on the information provided herein, what do you expect Luna's wage replacement ratio to be at retirement? Question 2 options: a. 49% b. 53% c. 59% d. 63%arrow_forwardSocial Security. Dorinda earned $110,000. How much did she pay in Social Security taxes? The amount Dorinda paid in Social Security taxes is $ (Round to the nearest dollar.) GULDarrow_forwardSergei owns some property that has an assessed value of $242,675. Calculate the tax due if the tax rate is 51.50 mills. (Round your answer to the nearest cent if necessary)arrow_forward

- Khalid Khouri is married, has a gross weekly salary of $689 (all of which is taxable), and claims two withholding allowances. Use the tax tables to find the federal tax withholding to be deducted from his weekly salary. Click the icon to view the Married Persons-Weekly Payroll Period. The withholding tax is $ Portion of IRS Withholding Table for Married Persons Paid Weekly MARRIED Persons-WEEKLY Payroll Period (For Wages Paid Through December 31, 2016) 0 1 And the wages are-And the number of withholding allowances claimed is 5 4 2 3 At least But less than The amount of income tax to be withheld is $4 SO SO $680 $59 $47 $35 $28 $20 $12 5 d q 21 13 690 60 49 37 29 $670 680 Print Done 9 10 $0 $0 0 0 Xarrow_forwardSuppose you made $85,776 of income from wages and $830 of taxable interest. You also made contributions of $3700 to a tax deferred retirement account. You have 2 dependents and file as single. The standard deduction is 11900 and the exemption amount is 3100 per exemption. What is your Adjusted Gross Income? Answer to the nearest dollar.arrow_forwardSharon Jones is single. During 2022, she had gross income of $159,800, deductions for AGI of $5,500, itemized deductions of $14,000 and tax credits of $2,000. Sharon had $22,000 withheld by their employer for federal income tax. She has a tax (due/refund) rounded to the nearest whole dollar of $.arrow_forward

- Mrs. Nunn, who has a 24 percent marginal tax rate on ordinary income, earned $3,670 interest on a debt instrument this year. Required: Compute her federal income tax on this interest assuming that the debt instrument was: Note: For all requirements, round your final answers to the nearest whole dollar amount. Leave no cells blank - be certain to enter "0" wherever required. a. An unsecured note from her son, who borrowed money from his mother to finance the construction of his home. b. A certificate of deposit from a federal bank. c. A 30-year General Electric corporate bond. d. A U.S. Treasury note. e. A City of Memphis municipal bond. a. Federal income tax b. Federal income tax c. Federal income tax d. Federal income tax e. Federal income tax Amountarrow_forwardBill Blake pays a property tax of $2,500. In his community, the tax rate is 55 mills. What is Bill's assessed value? Round to the nearest dollar.arrow_forwardJohn, a single father, has AGI of $83,000 in 2021. During the year, he pays $4,000 in qualified tuition for his dependent son, who just started attending Small University. What is John’s American Opportunity tax credit for 2021? $0 $1,750 $2,250 $2,500 $4,000arrow_forward

- Kevin owns a small business with two employees. For one payroll period the total withholding tax for all employees was 1,536. The total employees Social security tax was $168 and the total employers social security tax was $251. The total employees Medicare tax was $110 How much John deposit as the employer's share of social security tax and Medicare tax? What is the total tax that must be deposited?arrow_forwardSuppose you made $63,245 of income from wages and $784 of taxable interest. You also made contributions of $6000 to a tax deferred retirement account. You have 3 dependents and file as single. The standard deduction is 3500 and the exemption amount is 5500 per exemption. What is your Taxable Income? Answer to the nearest dollar. 70 hp * M اشتarrow_forwardToby and Nancy are engaged and plan to get married. During 2023, Toby is a full-time student and earns $7,600 from a part-time job. With this income, student loans, savings, and nontaxable scholarships, he is self-supporting. For the year, Nancy is employed and has wages of $59,400. Click here to access the standard deduction table to use. Click here to access the Tax Rate Schedules. If an amount is zero, enter, "0". Do not round your intermediate computations. Round your final answer to the nearest whole dollar. a. Compute the following: Gross income and AGI Standard deduction (single) Taxable income Income tax Gross income and AGI Toby Filing Single b. Assume that Toby and Nancy get married in 2023 and file a joint return. What is their taxable income and income tax? Round your final answer to the nearest whole dollar. Standard deduction (married, filing jointly) Taxable income Income tax Nancy Filing Single Married Filing Jointly c. How much income tax can Toby and Nancy save if…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education