FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

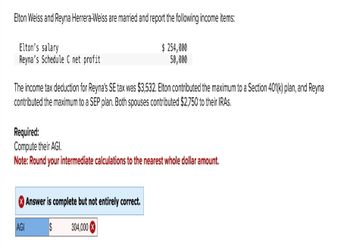

Transcribed Image Text:Elton Weiss and Reyna Herrera-Weiss are married and report the following income items:

Elton's salary

Reyna's Schedule C net profit

The income tax deduction for Reyna's SE tax was $3,532. Elton contributed the maximum to a Section 401(k) plan, and Reyna

contributed the maximum to a SEP plan. Both spouses contributed $2,750 to their IRAS.

$ 254,000

50,000

Required:

Compute their AGI.

Note: Round your intermediate calculations to the nearest whole dollar amount.

AGI

Answer is complete but not entirely correct.

$ 304,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please explain every step. Thank youarrow_forwardCalculating Social Security and Medicare Taxes Assume a Social Security tax rate of 6.2% is applied to maximum earnings of $128,400 and a Medicare tax rate of 1.45% is applied to all earnings. What is the social security tax paid if jose 's gross income is $145,780.00 for the year.arrow_forwardSubject: acountingarrow_forward

- Suppose you made $63,245 of income from wages and $784 of taxable interest. You also made contributions of $6000 to a tax deferred retirement account. You have 3 dependents and file as single. The standard deduction is 3500 and the exemption amount is 5500 per exemption. What is your Taxable Income? Answer to the nearest dollar. 70 hp * M اشتarrow_forward1:Bradley Banks' filing status is qualifying widower, and he has earned gross pay of $1,570. Each period he makes a 401(k) contribution of 6% of gross pay and makes a contribution of 2% of gross pay to a flexible spending account. His current year taxable earnings for Social Security tax and Medicare tax, to date, are $212,900.Social Security tax = $ Medicare tax = $ 2:Kyle Struck's filing status is single, and he has earned gross pay of $2,400. Each period he makes a 403(b) contribution of 9% of gross pay; and makes a contribution of 1.5% of gross pay to a cafeteria plan. His current year taxable earnings for Social Security tax and Medicare tax, to date, are $199,500.Social Security tax = $ Medicare tax = $ 3:Sebastian Wayne's filing status is married filing jointly, and he has earned gross pay of $3,820. Each period he makes a 401(k) contribution of 10% of gross pay and contributes $150 to a dependent care flexible spending account. His current year taxable earnings for Social…arrow_forwardThe Tax Formula for Individuals, A Brief Overview of Capital Gains and Losses (LO 1.3, 1.9) In 2020, Manon earns wages of $54,000. She also has dividend income of $2,800. Manon is single and has no dependents. During the year, Manon sold silver coins held as an investment for a $7,000 loss. Table for the standard deduction Filing Status Standard Deduction Single $12,400 Married, filing jointly 24,800 Married, filing separately 12,400 Head of household 18,650 Qualifying widow(er) 24,800 Calculate the following amounts for Manon: a. Adjusted gross income $fill in the blank b. Standard deduction $fill in the blank c. Taxable income $fill in the blankarrow_forward

- Problem 3: Determine Taxable Income Jules Winfield is a single taxpayer who maintained a home for his dependent daughter who was not a full-time student. The daughter lives with Jules for 8 months of 2022. During 2022 he had an AGI of $100,000 and reported the following expenditures: Expenditures State Income Taxes Contribution to a traditional individual retirement account (IRA) Charitable Contributions 6,000 4,000 8,000 ADDITIONAL INFORMATION For any item you determine is an allowable deduction, you can deduct the entire amount. Required: Determine Jules' taxable income for 2022.arrow_forwardSuppose you made $70,390 of income from wages and $178 of taxable interest. You also made contributions of $6400 to a tax deferred retirement account. You have 2 dependents and file as single. The standard deduction is 3900 and the exemption is 5900 per exemption. What is your Taxable Income? Answer to the nearest dollar.arrow_forwardMax and Jake file MFJ. Max received $15,424 and Jake received $27,452 in social security benefits. Jake also received taxable income of $22,148 from his pension and $2,378 in interest. Using the Social Security Benefits Worksheet - Line 6a and 6b, determine their combined taxable social security benefits. $0 $7,669 $21,438 $36,445arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education