FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

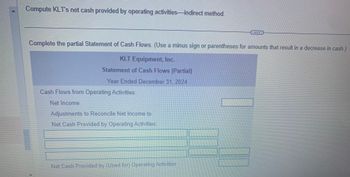

Transcribed Image Text:Compute KLT's net cash provided by operating activities-indirect method.

Complete the partial Statement of Cash Flows. (Use a minus sign or parentheses for amounts that result in a decrease in cash.)

KLT Equipment, Inc.

Statement of Cash Flows (Partial)

Year Ended December 31, 2024

Cash Flows from Operating Activities:

Net Income

Adjustments to Reconcile Net Income to

Net Cash Provided by Operating Activities:

Net Cash Provided by (Used for) Operating Activities

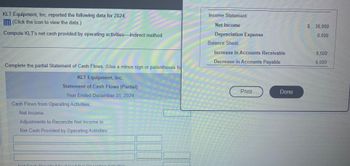

Transcribed Image Text:KLT Equipment, Inc. reported the following data for 2024:

(Click the icon to view the data.)

Compute KLT's net cash provided by operating activities-indirect method.

Complete the partial Statement of Cash Flows. (Use a minus sign or parentheses fo

KLT Equipment, Inc.

Statement of Cash Flows (Partial)

Year Ended December 31, 2024

Cash Flows from Operating Activities:

Net Income

Adjustments to Reconcile Net Income to

Net Cash Provided by Operating Activities:

IT'S

HL Alaed fan Me

MELIS

Income Statement:

Net Income

Depreciation Expense

Balance Sheet:

Increase in Accounts Receivable

Decrease in Accounts Payable

Print

Done

$ 38,000

8,000

8,500

6,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Shanequa Company uses the indirect method to prepare the statement of cash flows. Refer to the following income statement: Shanequa Company Income Statement Year Ended December 31, 2025 Sales Revenue Interest Revenue Gain on Sale of Plant Assets 6,000 Total Revenues and Gains Cost of Goods Sold Salary Expense Depreciation Expense Other Operating Expenses Interest Expense Income Tax Expense Total Expenses Net Income (Loss) $250,000 2,600 119,000 41,000 12,000 21,000 1,700 5,400 $258,600 200,100 $58,500 Additional information provided by the company includes the following: 1. Current assets, other than cash, increased by $21,000. 2. Current liabilities decreased by $1,300. Compute the net cash provided by (used for) operating activities.arrow_forwardArundel Company disclosed the following information for its recent calendar year. Selected Year-End Balance Sheet Datal Accounts receivable decrease Purchased a machine for cash Salaries payable increase Interest payable decrease Income Statement Data Revenues Expenses: Salaries expense Utilities expense Depreciation expense Interest expense Net loss $ 115,000 73,000 35,000 31, 200 8,100 $ (32,300) Prepare the operating activities section of the statement of cash flows using the indirect method. (Amounts to be deducted should be indicated with a minus sign.) Statement of Cash Flows (partial) Cash flows from operating activities-indirect method Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash $ 29,000 20,000 26,000 17,000 Changes in current operating assets and liabilitiesarrow_forwardUse the following information from Yardley Company’s financial statements to prepare a statement of cash flows (indirect method).arrow_forward

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardGDM Equipment, Inc. reported the following data for 2025: View the data. Compute GDM Equipment, Inc.'s net cash provided by operating activities-indirect method. (Use a minus sign or parentheses for amounts that result in a decrease in cash.) GDM Equipment, Inc. Statement of Cash Flows (Partial) Year Ended December 31, 2025 Cash Flows from Operating Activities: Net Income Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities: Net Cash Provided by (Used for) Operating Activities Data ... Income Statement: Net Income Depreciation Expense $ 46,000 9,500 Balance Sheet: Increase in Accounts Receivable 8,000 Decrease in Accounts Payable 3,000 Print Done - ☑arrow_forwardPortions of the financial statements for Alliance Technologies are provided bel ALLIANCE TECHNOLOGIES Income Statement For the year ended December 31, 2021 Net sales $375,000 Expenses: Cost of goods sold Operating expenses Depreciation expense Income tax expense Total expenses $220,000 67,000 16,700 25,500 329, 200 $ 45,800 Net income ALLIANCE TECHNOLOGIES Selected Balance Sheet Data December 31, 2021, compared to December 31, 2020 Decrease in accounts receivable Increase in inventory Decrease in prepaid rent Increase in salaries payable Decrease in accounts payable Increase in income tax payable $ 6,700 13,700 9,700 5,700 8,700 22,800arrow_forward

- Highlight the Net cash provided by Operating Activities for the Statement of Cash Flows Highlight the Net cash provided by Financing Activities for the Statement of Cash Flows Highlight the net change in cash for the period on the Statement of Cash Flowsarrow_forwardUse the following information from Dubuque Company's financial statements to prepare the operating activities section of the statement of cash flows (indirect method) for the year 2018: 2018 Income Statement Balance Sheets Sales Cost of Goods Sold Operating Expenses, other than depreciation expense Depreciation Expense Gain on Sale of Plant Assets $ 299,000 (135,000) (27,000) (17,000) 16,500 136,500 Net Income Dec. 31, 2018 $45,300 1,600 22,500 900 Accounts Receivable Inventory Accounts Payable Accrued Liabilities Accounts Receivable Inventory Accounts Payable Accrued Liabilities Dec. 31, 2017 $43,400 1,800 21,250 1,150 PLEASE NOTE: Use the account and term names exactly, as shown above and the accounts will be listed in the same order as shown in the textbook examples. All dollar amounts will be rounded to whole dollars using "$" and commas as needed (i.e. $12,345) and decreases will be shown with parentheses - $(12,345).arrow_forwardMacrosoft Company reports net income of $62,000. The accounting records reveal depreciation expense of $77,000 as well as increases in prepaid rent, accounts payable, and income tax payable of $57,000, $10,000, and $16,500, respectively. Prepare the operating activities section of Macrosoft's statement of cash flows using the indirect method. (Amounts to be deducted should be indicated with a minus sign.) Cash flows from operating activities MACROSOFT COMPANY Statement of Cash Flows (partial) Adjustments to reconcile net income to net cash flows from operating activities: Net cash flows from operating activitiesarrow_forward

- I need some assistance in Preparing the operating activities section of the statement of cash flows using the direct method. See attached images for the inputs. I have been getting "bounced" on the yellow sections for incorrect valuesarrow_forwardUsing the Exhibit below, assume that the balance of Accounts Receivable was $61,000 at the beginning of the current year. Furthermore, assume that the balance of Accounts Receivable is $62,000 at the end of the current year. When preparing the Statement of Cash Flow using the indirect method for the current year, which of the following statements would describe the proper presentation of accounts receivable on the Cash flow from operating activities section? EXHIBIT Increase (Decrease) Net Income (loss) $XXX Adjustments to reconcile net income to net cash flow from operating activities: Depreciation of fixed assets XXX Losses on disposal of assets XXX Gains on…arrow_forward125. accountigarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education