FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

using the information can you create a

|

Asset Type |

Date of purchase |

Cost |

Useful life from the date of purchase |

|

Applicable depreciation rate |

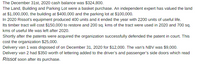

Transcribed Image Text:The December 31st, 2020 cash balance was $324,800.

The Land, Building and Parking Lot were a basket purchase. An independent expert has valued the land

at $1,000,000, the building at $400,000 and the parking lot at $100,000.

In 2020 Rissot's equipment produced 400 units and it ended the year with 2200 units of useful life.

Its timber tract will cost $150,000 to restore and 200 sq. kms of the tract were used in 2020 and 700 sq.

kms of useful life was left after 2020.

Shortly after the patents were acquired the organization successfully defended the patent in court. This

cost the organization $25,000.

Delivery van 1 was disposed of on December 31, 2020 for $12,000. The van's NBV was $9,000.

Delivery van 2 had $350 worth of lettering added to the driver's and passenger's side doors which read

Rissot soon after its purchase.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- answer quicklyarrow_forwardComputing Asset Related Ratios J.M. Smucker included the following information in its April 2019 10-K. $ millions Apr. 30, 2019 Apr. 30, 2018 $8,151.5 214.2 127.0 939.3 2,294.3 334.7 3,695.3 (1,684.5) $2,010.8 Sales Depreciation expense Land Buildings and fixtures Machinery and equipment Construction in progress Gross property, plant, and equipment Accumulated depreciation Total property, plant, and equipment $124.9 845.1 2,217.1 220.6 3,407.7 (1,588.3) $1,819.4 a. Compute PPE turnover for fiscal year ended April 30, 2019. Round answer to one decimal place. 0 x b. Compute the average useful life of depreciable assets at April 30, 2019. Round answer to one decimal place. 0 x years c. Compute the percentage used up of the PPE at April 30, 2019. Round answer to one decimal place (ex: 0.2345 = 23.5%) 0 * %arrow_forwardChoose the appropriate definition for each term. Term Amortization Useful life Licensing right Least and latest rule Component allocation Fixed asset turnover ratio Depreciable cost Copyright Depreciation schedule Revenue expenditures 2 Definitionarrow_forward

- What categories of property, plant, equipment, and intangible assets does Targetreport in its January 30, 2016, balance sheet?arrow_forwardwhat method of depreciation will produce the maximum depreciation expense in 2016arrow_forwardHow would accumulated depreciation be classified on the balance sheet? current asset fixed asset current liability O long term liabilityarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education