FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

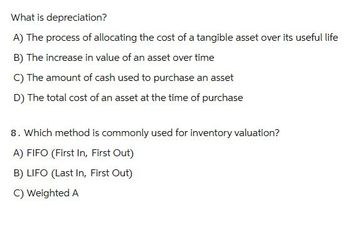

Transcribed Image Text:What is depreciation?

A) The process of allocating the cost of a tangible asset over its useful life

B) The increase in value of an asset over time

C) The amount of cash used to purchase an asset

D) The total cost of an asset at the time of purchase

8. Which method is commonly used for inventory valuation?

A) FIFO (First In, First Out)

B) LIFO (Last In, First Out)

C) Weighted A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- When is accumulated depreciation reduced to zero? Explain and provide examples for each element (Asset & Liability)arrow_forwardIdentify an example of a non-current asset. O a. Machinery O b. Bank overdraft O c. Inventory O d. Loanarrow_forwardDescribe the method of the asset's depreciation?arrow_forward

- Depreciation is a process of Select one Oa. asset valuation D. cost allocation C Cost accumulation. d. asset devaluation. e. The answer does not exstarrow_forwardWhich of the following is not true in regard to selling fixed assets? a.If the selling price is more than the book value, a gain is recorded. b.The cash receipt is recorded. c.The journal entry is similar to discarding fixed assets. d.Accumulated Depreciation will be credited.arrow_forwardIt is the initial cost of acquiring an asset, plus sales tax, transportation and normal costs of making asset serviceable. a. Adjusted standard cost O b. Cost basis O c. Standard cost O d. Adjusted cost basisarrow_forward

- Accounting: type question:,,,,,, While calculating purchase price, the following values of assets are considered A. Book value B. New values fixed C. Averagevalues D. Market valuesarrow_forwardwhat is the ultimate purpose of long-term assets? How should the cost of these assets be allocated over the asset's useful life? Why is depreciation not synonymous with valuation?arrow_forwardFIFO, Average cost, and LIFO are often used for inventory valuation purposes. Compare these methods and discuss the effects of each method in the determination of income and asset managementarrow_forward

- How would accumulated depreciation be classified on the balance sheet? current asset fixed asset current liability O long term liabilityarrow_forwardWhen is ending inventory written down below its acquisition cost on the balance sheet? Select one: A. When units are damaged, physically deteriorated, or obsolete B. When the inventory's replacement cost exceeds its acquisition cost C. When the inventory's replacement cost is below its acquisition cost D. Both A and Carrow_forwardWhat is the difference between the cost of a fixed asset and its accumulated depreciation called? Group of answer choices book value current value fixed value equity valuearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education