FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

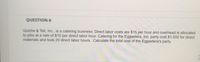

Transcribed Image Text:QUESTION 6

Quiche & Tell, Inc., is a catering business. Direct labor costs are $15 per hour and overhead is allocated

to jobs at a rate of $10 per direct labor hour. Catering for the Eggsetera, Inc. party cost $1,000 for direct

materials and took 20 direct labor hours. Calculate the total cost of the Eggsetera's party.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sydney Anime Apparel (SAA) manufacturers graphic t-shirts depicting popular anime characters. SAA uses a traditional plant-wide POHR to allocate their manufacturing costs to products. They estimated a total cost of $606,000. They identified direct labor hours as the cost driver. For the current year, they estimated a total of 80,800 direct labor hours, and actually incurred 76,200 in the production of their t-shirts. What is the applied manufacturing overhead costs? Give your answer to the nearest whole dollar.arrow_forwardWheeler's Bike Company manufactures custom racing bicycles. The company uses a job order cost system to determine the cost of each bike. Estimated costs and expenses for the coming year follow: Bike parts Factory machinery depreciation Factory supervisor salaries Factory direct labor Factory supplies Factory property tax Advertising cost Administrative salaries Administrative-related depreciation Total expected costs Required: 1. Calculate the predetermined overhead rate per direct labor hour if the average direct labor rate is $11.91 per hour. 2. Determine the amount of applied overhead if 18,600 actual hours are worked in the upcoming year. Required 1 Required 2 Complete this question by entering your answers in the tabs below. $ 341,800 61,500 140,000 211,998 Predetermined Overhead Rate 39,400 33,750 22,500 55,000 19, 200 $925,148 Calculate the predetermined overhead rate per direct labor hour if the average direct labor rate is $11.91 per hour. Note: Round your answer to 2 decimal…arrow_forwardMarvin’s Kitchen Supply delivers restaurant supplies throughout the city. The firm adds 10 percent to the cost of the supplies to cover the delivery cost. The delivery fee is meant to cover the cost of delivery. A consultant has analyzed the delivery service using activity-based costing methods and identified four activities. Data on these activities follow. Cost Driver Volume Activity Cost Driver Cost Driver Volume Processing order Number of orders $ 42,000 3,000 orders Loading truck Number of items 243,000 135,000 items Delivering merchandise Number of orders 51,000 3,000 orders Processing invoice Number of invoices 34,000 2,000 invoices Total overhead $ 370,000 Two of Marvin's customers are City Diner and Le Chien Chaud. Data for orders and deliveries to these two customers follow. City Diner Le Chien Chaud Order value $ 76,000 $ 86,000 Number of orders 56 180 Number of items 400 2,200…arrow_forward

- Caro Manufacturing has two production departments, Machining and Assembly, and two service departments, Maintenance and Cafeteria. Direct costs for each department and the proportion of service costs used by the various departments for the month of August follow: Department Machining Assembly Maintenance Cafeteria Direct Costs $115,000 65,000 54,000 43,000 Required A Required B Proportion of Services Used by Machining Maintenance Cafeteria 0.7 From Service department costs Maintenance Cafeteria Total Costs 0.2 Required: Use the step method to allocate the service costs, using the following: a. The order of allocation starts with Maintenance. b. The allocations are made in the reverse order (starting with Cafeteria). 0.5 0.1 Complete this question by entering your answers in the tabs below. Maintenance Cafeteria Assembly The order of allocation starts with Maintenance. (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations.) To 0.3 0.2 Machining…arrow_forwardRiverbed Delights manufactures a wide variety of holiday and seasonal decorative items. Riverbed's activity-based costing overhead rates are: Purchasing Storing Machining Supervision Total cost $394 per order S $2 per square foot/days $100 per machine hour The Snow Man project involved 3 purchase orders, 5,400 square feet/days, 74 machine hours, and 54 direct labor hours. The cost of direct materials on the job was $20,400 and the direct labor rate is $32 per hour. Determine the total cost of the Snow Man project. $5 per direct labor hourarrow_forwardLeandro Corp. manufactures wooden desks. Production consists of three processes: cutting, assembly, and finishing. The following costs are given for April: Cutting Assembly Finishing direct materials $7,000 $10,000 $3,000 direct labor 3,000 14,000 2,000 applied overhead 4,000 5,000 6,000 There were no work in process inventories and 1,000 podiums were produced.The journal entry to assign costs to the Assembly process would be a. Raw Materials 20,000 Payroll 19,000 Overhead Control 15,000 Work in Process - Assembly 54,000 b. Raw Materials 10,000 Payroll 14,000 Overhead Control 5,000 Work in Process - Assembly 29,000 c. Work in Process - Assembly 29,000 Raw Materials 10,000 Payroll 14,000 Overhead Control 5,000 d. Work in Process - Assembly 54,000 Raw Materials 20,000 Payroll 19,000 Overhead Control 15,000 e. None of these choices are correct.arrow_forward

- Gibson Company produces commercial gardening equipment. Since production is highly automated, the company allocates its overhead costs to product lines using activity-based costing. The costs and cost drivers associated with the four overhead activity cost pools follow: Cost Cost driver Unit Level $50,600 Req A and B 2,300 labor hours. Production of 890 sets of cutting shears, one of the company's 20 products, took 210 labor hours and 9 setups and consumed 10 percent of the product-sustaining activities. Complete this question by entering your answers in the tabs below. Req C a. Allocated cost b. Allocated cost Activities Batch Level $ 21,160 46 setups Required a. Had the company used labor hours as a companywide allocation base, how much overhead would it have allocated to the cutting shears? b. How much overhead is allocated to the cutting shears using activity-based costing? c. Compute the overhead cost per unit for cutting shears first using activity-based costing and then using…arrow_forwardUsing the sequential method, Pone Hill Company allocates Janitorial Department costs based on square footage serviced. It allocates Cafeteria Department costs based on the number of employees served. It has determined to allocate Janitorial costs before Cafeteria costs. It has the following information about its two service departments and two production departments, Cutting and Assembly: Number of Employees 20 10 60 20 Costs Janitorial Department $450,000 Cafeteria Department 200,000 Cutting Department 1,500,000 Assembly Department 3,000,000 Square Feet 100 10,000 2,000 8,000 The percentage (proportional) usage of the Janitorial Department by the Cutting Department is Oa. 20% Ob. 9.9% Oc. 80% Od. 10%arrow_forwardCozy, Inc., manufactures small and large blankets. It estimates $389,225 in overhead during the manufacturing of 97,902 small blankets and 73,121 large blankets. What is the predetermined overhead rate per machine hour if a small blanket takes 7 machine hour and a large blanket takes 9 machine hours? Round to the nearest penny, two decimal places.arrow_forward

- Your Brother's Company manufactures lights. Each light uses $15 in direct materials and $5 in direct labor per unit. Way has two activities: Machining, which is applied at the rate of $3 per machine hour, and Finishing, which is applied at the rate of $16 per batch. This month, Way made 250 lights, using 1,500 machine hours in 47 batches. What is the total manufacturing cost for one light? O $21 O $36 $41 O $26arrow_forwardAnemone Company produces picture frames. During the year, 200,000 picture frames were produced. Materials and labor standards for producing the picture frames are as follows: Direct materials (2 pieces of wood @ $3) $6.00 Direct labor (2 hours @ $12) $24.00 Anemone purchased and used 600,000 pieces of wood at $4.00 each, and its actual labor hours were 320,000 hours at a wage rate of $13. What is Anemone's labor rate variance? a. $450,000 F b. $320,000 U c. $445,000 U d. $660,500 Farrow_forwardSkyline Florists uses an activity-based costing system to compute the cost of making floral bouquets and delivering the bouquets to its commercial customers. Company personnel who earn $220,000 typically perform both tasks; other firm-wide overhead is expected to total $80,000. These costs are allocated as follows: Bouquet Production Delivery Other Wages and salaries 70 % 20 % 10 % Other overhead 50 % 30 % 20 % Skyline anticipates making 20,000 bouquets and 5,000 deliveries in the upcoming year.What is the cost of wages and salaries and other overhead that would be charged to each bouquet made?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education