FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Zeke's Bikes uses a

Standards:

| 3 lbs of material per unit at a cost of $1.15 per pound. |

|---|

| 2 direct labor hours per unit costing $11.25 per hour. |

Actual:

| 2,500 lbs of material were purchased at a cost of $1.20 per pound. |

|---|

| Employees worked 1,800 hours and were paid $10.75 per hour. |

Zeke's Bikes produced a 1,000 bikes this period.

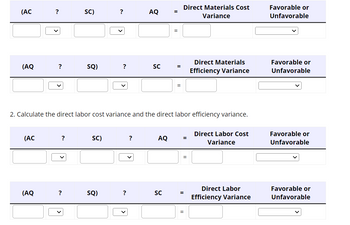

1. Calculate the direct materials cost variance and the direct materials efficiency variance.

Transcribed Image Text:(AC

(AQ

(AC

?

(AQ

?

?

SC)

?

SQ)

SC)

?

SQ)

?

?

AQ

2. Calculate the direct labor cost variance and the direct labor efficiency variance.

?

SC

AQ

=

SC

=

=

=

Direct Materials Cost

Variance

Direct Materials

Efficiency Variance

=

Direct Labor Cost

Variance

Direct Labor

= Efficiency Variance

Favorable or

Unfavorable

Favorable or

Unfavorable

Favorable or

Unfavorable

Favorable or

Unfavorable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nobel Ltd is a wool coat manufacturer. It produced 80 units in September. The following cost information is available:• Wool fabric: $150 per unit• Depreciation of production equipment: $3,000 per month• Research and development: $1,000 per month• Wages of staff involved in cutting, sewing and finishing: $30 per unit• Designers' salary: $23,000 per month• Advertising costs: $900 per month• Indirect material: $40 per unit• Salary of factory supervisor: $16,000 per month What is the total prime costs for Nobel Ltd in September? a. 14,400 b. 12,000 c. 24,600 d. 22,200arrow_forwardCozy, Inc., manufactures small and large blankets. It estimates $303,263 in overhead during the manufacturing of 80,487 small blankets and 85,543 large blankets. What is the predetermined overhead rate per machine hour if a small blanket takes 4 machine hour and a large blanket takes 1 machine hours? Round to the nearest penny, two decimal places.arrow_forwardBox Springs, Inc., makes two sizes of box springs: twin and double. The direct material for the twin is $30 per unit and $45 is used in direct labor, while the direct material for the double is $45 per unit, and the labor cost is $50 per unit. Box Springs estimates it will make 5,000 twins and 10,000 doubles in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: Activity CostPools Driver EstimatedOverhead Use perTwin Use perDouble Framing Square Feet of Pine $270,000 6,000 3,000 Padding Square Feet of Quilting 230,000 130,000 100,000 Filling Square Feet of Filling 240,000 450,000 350,000 Labeling Number of Boxes 250,000 850,000 400,000 Inspection Number of Inspections 165,000 11,000 4,000 After grouping cost pools and estimating overhead and activities, Box Springs determined these rates: Purchasing (per order) $56 Utilities (per square foot) 2 Machine Setups (per machine hour) 7 Supervision (per direct labor hour)…arrow_forward

- awson Toys, Limited, produces a toy called the Maze. The company has recently created a standard cost system to help control costs and has established the following standards for the Maze toy: Direct materials: 7 microns per toy at $0.35 per micron Direct labor: 1.1 hours per toy at $7.00 per hour During July, the company produced 5,400 Maze toys. The toy's production data for the month are as follows: Direct materials: 73,000 microns were purchased at a cost of $0.33 per micron. 25,750 of these microns were still in inventory at the end of the month. Direct labor: 6,340 direct labor-hours were worked at a cost of $48,818. Required: 1. Compute the following variances for July: (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round intermediate calculations. Round final answer to the nearest whole dollar amount.) a. The materials price and…arrow_forwardDawson Toys, Limited, produces a toy called the Maze with the following standards: Direct materials: 7 microns per toy at $0.30 per micron Direct labor: 1.2 hours per toy at $7.30 per hour During July, the company produced 5,100 Maze toys. The toy's production data for the month are as follows: Direct materials. 74,000 microns were purchased at a cost of $0.29 per micron. 29,375 of these microns were still in inventory at the end of the month. Direct labor. 6,720 direct labor-hours were worked at a cost of $53,088. Required: 1. Compute the following variances for July: Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round intermediate calculations. Round final answer to the nearest whole dollar amount. a. The materials price and quantity variances. b. The labor rate and efficiency variances. 1a. Material price variance 1a. Material quantity…arrow_forwardDawson Toys, Limited, produces a toy called the Maze with the following standards: Direct materials: 7 microns per toy at $0.35 per micron Direct labor: 1.5 hours per toy at $6.80 per hour During July, the company produced 5,100 Maze toys. The toy's production data for the month are as follows: Direct materials: 76,000 microns were purchased at a cost of $0.32 per micron. 31,375 of these microns were still in inventory at the end of the month. Direct labor. 8,050 direct labor-hours were worked at a cost of $58,765. Required: 1. Compute the following variances for July: Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round intermediate calculations. Round final answer to the nearest whole dollar amount. a. The materials price and quantity variances. b. The labor rate and efficiency variances.arrow_forward

- Summer company manufactures beach chairs. $ 4.00 of direct materials are needed for each chair. Labor is $ 15 an hour. The company manufactures 3 chairs per hour. Indirect costs are $ 9.00 per hour. Commissions to sellers are $ 2.00 per unit sold. The cost of a chair will be:arrow_forwardrrarrow_forwardCozy, Inc., manufactures small and large blankets. It estimates $389,225 in overhead during the manufacturing of 97,902 small blankets and 73,121 large blankets. What is the predetermined overhead rate per machine hour if a small blanket takes 7 machine hour and a large blanket takes 9 machine hours? Round to the nearest penny, two decimal places.arrow_forward

- Julia Company produces a single product. The company has set the following standards for materials and labor: Standard quantity or hours per unit Standard price or rate Direct materials ? pounds per unit $ ? per pound Direct labor 3.0 hours per unit $ 10 per hour During the past month, the company purchased 7,000 pounds of direct materials at a cost of $17,500. All of this material was used in the production of 1,300 units of product. Direct labor cost totaled $36,750 for the month. The following variances have been computed: Materials quantity variance $ 1,375 U Total materials variance $ 375 F Labor efficiency variance $ 4,000 F Required:1. For direct materials:a. Compute the standard price per pound of materials.b. Compute the standard quantity allowed for materials for the month's production.c. Compute the standard quantity of materials…arrow_forwardYour Brother's Company manufactures lights. Each light uses $15 in direct materials and $5 in direct labor per unit. Way has two activities: Machining, which is applied at the rate of $3 per machine hour, and Finishing, which is applied at the rate of $16 per batch. This month, Way made 250 lights, using 1,500 machine hours in 47 batches. What is the total manufacturing cost for one light? O $21 O $36 $41 O $26arrow_forwardAlpesharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education