FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

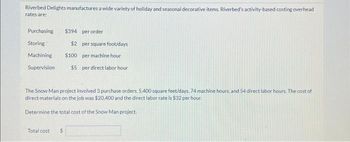

Transcribed Image Text:Riverbed Delights manufactures a wide variety of holiday and seasonal decorative items. Riverbed's activity-based costing overhead

rates are:

Purchasing

Storing

Machining

Supervision

Total cost

$394 per order

S

$2 per square foot/days

$100 per machine hour

The Snow Man project involved 3 purchase orders, 5,400 square feet/days, 74 machine hours, and 54 direct labor hours. The cost of

direct materials on the job was $20,400 and the direct labor rate is $32 per hour.

Determine the total cost of the Snow Man project.

$5 per direct labor hour

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Multiple Choice $6.49 $5.63 $3.92 $5.20arrow_forwardHamilton, a decorative wall clock manufacturer uses activity-based costing. Each clock consists of 20 separate parts totaling $95 in direct materials, and requires 2.5 hours of machine time to produce. Additional information is as follows: Activity Materials handling Number of parts Machining Machine hours Assembling Packaging What is the cost of machining per clock? Multiple Choice $144.00 Allocation Base $180.00 Number of parts Number of finished clocks Cost Allocation Rate $ 0.08 7.20 0.35 2.70arrow_forwardMemanarrow_forward

- Barry Pottery Supplies manufacturers supplies used during the pottery process. They have multiple processes, the first of which is Molding. The following information relates to the Molding beginning balance: 5,300 physical units $184,700 beginning cost During the period, 12,400 additional physical units are started. An additional costs of $77,900 in direct materials and $84,000 in manufacturing overhead are incurred. Additionally, 1,890 direct labor hours were incurred. Factory laborers are paid at a rate of $50 per hour. At the end of the period, 6,900 physical units remained in progress. These physical units were 60% complete. Using the information provided, calculate the work in progress ending balance. Round your answer to the nearest whole dollar.arrow_forwardGibson Company produces commercial gardening equipment. Since production is highly automated, the company allocates its overhead costs to product lines using activity-based costing. The costs and cost drivers associated with the four overhead activity cost pools follow: Cost Cost driver Unit Level $50,600 Req A and B 2,300 labor hours. Production of 890 sets of cutting shears, one of the company's 20 products, took 210 labor hours and 9 setups and consumed 10 percent of the product-sustaining activities. Complete this question by entering your answers in the tabs below. Req C a. Allocated cost b. Allocated cost Activities Batch Level $ 21,160 46 setups Required a. Had the company used labor hours as a companywide allocation base, how much overhead would it have allocated to the cutting shears? b. How much overhead is allocated to the cutting shears using activity-based costing? c. Compute the overhead cost per unit for cutting shears first using activity-based costing and then using…arrow_forwardSilven Company has identified the following overhead activities, costs, and activity drivers for the coming year: Activity Expected Cost Activity Driver Activity Capacity $138,000 Number of setups 10,200 Number of orders 92,400 Machine hours 18,480 Receiving hours phones with the following expected activity demands: Setting up equipment Ordering materials Machining Receiving Silven produces two models of cell Model X 5,000 80 200 6,600 385 Units completed Number of setups Number of orders Machine hours Receiving hours Required: Model Y 10,000 40 400 4,950 770 120 600 11,550 1,155arrow_forward

- Advanced Miniature Development manufactures computer graphics cards (GPUs). Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 4,160 GPUs were as follows: Cost Driver Direct materials Direct labor Factory overhead Instructions Determine the: Each GPU requires 0.5 hour of direct labor. f. Standard Costs 110,000 lbs. at $6.30 2,080 hours at $15.80 Rates per direct labor hr., based on 100% of normal capacity of 2,000 direct labor hrs.: Variable cost, $4.25 Fixed cost, $6.00 a. direct materials price variance b. direct materials quantity variance c. total direct materials cost variance d. direct labor rate variance direct labor time variance total direct labor cost variance g. the variable factory overhead controllable variance h. fixed factory overhead volume variance i. total factory overhead cost variance. Actual Costs 115,000 lbs. at $6.50 2,000 hours at $15.40 $8,200 variable cost $12,000 fixed costarrow_forwardLovell Variety Seeds mass produces wildflower seed packs. Relevant information used for the process costing system is provided below: Beginning physical units 2,300 Physical units started 22,600 Units in ending WIP 9,500, 40% complete Beginning costs $3,100 Added direct materials costs $12,000 Added direct labor costs $19,500 Added manufacturing overhead costs $8,600 What is the costs completed and transferred out? Please round your answer to the nearest whole dollar.arrow_forwardRundle Company produces commercial gardening equipment. Since production is highly automated, the company allocates its overhead costs to product lines using activity-based costing. The costs and cost drivers associated with the four overhead activity co pools follow: Cost Cost driver Req A and B Unit Level $ 25,200 Req C a. Allocated cost b. Allocated cost Production of 880 sets of cutting shears, one of the company's 20 products, took 130 labor hours and 10 setups and consumed 15 percent of the product-sustaining activities. Required 8. Had the company used labor hours as a companywide allocation base, how much overhead would it have allocated to the cutting shears? Complete this question by entering your answers in the tabs below. 1,200 labor hours b. How much overhead is allocated to the cutting shears using activity-based costing? c. Compute the overhead cost per unit for cutting shears first using activity-based costing and then using direct labor hours for allocation if 880…arrow_forward

- The Platter Valley factory of Bybee Industries manufactures field boots. The cost of each boot includes direct materials, direct labor, and manufacturing (factory) overhead. The firm traces all direct costs to products, and it assigns overhead cost to products based on direct labor hours. The company budgeted $15,000 variable factory overhead cost, $90,000 for fixed factory overhead cost and 2,500 direct labor hours (its practical capacity) to manufacture 5,000 pairs of boots in March. The factory used 2,700 direct labor hours in March to manufacture 4,800 pairs of boots and spent $15,600 on variable overhead during the month. The actual fixed overhead cost incurred for the month was $92,000. Required: 1. Compute the factory overhead flexible-budget variance, the factory overhead spending variance, and the efficiency variance for variable factory overhead for March and state whether each variance is favorable (F) or unfavorable (U). 2. Provide the appropriate journal entry to record…arrow_forwardSpacely, Corp. makes sprockets in two models: regular and professional, and wants to refine its costing system by allocating overhead using departmental rates. The estimated $843,100 of manufacturing overhead has been divided into two cost pools: Assembly Department and Packaging Department.The following data has been compiled: Spacely, Corp. Assembly Department Packaging Department Total Overhead costs $550,000 $293,100 $843,100 Machine Hours: Regular Model 153,000 35,100 188,100 Professional Model 352,400 12,600 365,000 Direct Labor Hours: Regular Model 40,300 80,600 120,900 Professional Model 322,700 413,400 736,100 (Round your answers to two decimal places when needed and use rounded answers for all future calculations).1. Compute the predetermined overhead allocation rates using machine hours as the allocation base for the Assembly Department and direct labor hours for the Packaging Department.arrow_forwardHartley Uniforms produces uniforms. The company allocates manufacturing overhead based on the machine hours each job uses. Hartley Uniforms reports the following cost data for the past year: Budget Actual 7,600 hours 6,100 hours Direct labor hours Machine hours 7,200 hours 6,300 hours Depreciation on salespeople's autos $23,000 $23,000 Indirect materials $48,500 $50,500 Depreciation on trucks used to deliver uniforms to customers solla $13,000 $70,000 $40,000 $11,000 Depreciation on plant and equipment Indirect manufacturing labor $72,500 $42,000 Customer service hotline $19,000 $21,000 Plant utilities $35,900 $38,400 Direct labor cost $72,500 $85,500 Requirements 1odel tba 1. Compute the predetermined manufacturing overhead rate. 2. Calculate the allocated manufacturing overhead for the past year. 3. Compute the underallocated or overallocated manufacturing overhead. How will this underallocated or overallocated manufacturing overhead be disposed of? 4. How can managers usA accoarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education