Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN: 9781337619455

Author: Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Financial acc

Transcribed Image Text:Questions Related to Accountin

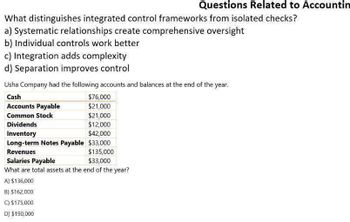

What distinguishes integrated control frameworks from isolated checks?

a) Systematic relationships create comprehensive oversight

b) Individual controls work better

c) Integration adds complexity

d) Separation improves control

Usha Company had the following accounts and balances at the end of the year.

Cash

Accounts Payable

Common Stock

Dividends

Inventory

$76,000

$21,000

$21,000

$12,000

$42,000

Long-term Notes Payable $33,000

Revenues

Salaries Payable

$135,000

$33,000

What are total assets at the end of the year?

A) $136,000

B) $162,000

C) $175,000

D) $190,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Systematic relationship quarrow_forwardAssume that an organization asserts that it has $35 million in net accounts receivable. Describe specifically what management is asserting with respect to net accounts receivable.arrow_forward•Compute for the profitability ratio, operating efficiency, and financial health of the given data below.arrow_forward

- The descriptive sections of the annual report that provides insight into what the company does and the types of risks it lates is felt Select one: OA management discussion and analysis. B. the industry overview. OC. the audit opinion. D. notes to the financial statements. To best interpret the accounts receivable turnover ratio, the days in accounts receivable should be compared to the company's Select one: A sales revenue. B. credit terms. OC. inventory turnover. D. accounts receivable balance. Two companies have an identical amount of current assets and current liabilities Donald Inc. has 40% of its current assets invested in whereas Mickey Corp. has 30% of its current assets invested in inventory Which of the following statements is true? Select one: OA. Donald will have the higher quick ratio. OB. Donald will have the higher current ratio. OC. The companies are equally liquid because their current ratios are the same OD. Donald is less liquid than Mickarrow_forwardThe following information was taken from a company's bank reconciliation at the end of the year. Bank balance Checks outstanding Note collected by the bank. Service fee Deposits outstanding NSF check Multiple Choice What is the correct cash balance that should be reported in the company's balance sheet at the end of the year? $10,620, $9,520. $5,673. $9,900 $8,700 $1,100 $ 27 $5,700. $4,500 $ 380arrow_forwardakeAssignment/takeAssignmentMain.do?Invoker=&takeAssignmentSessiohLocator=&inprogress=false 3 The cash collections expected in September from accounts receivable are estimated to be Oa. $134,960 Ob. $289,200 Oc. $168,700 Od. $241,000 Ti Nuthatch Corporation began its operations on September 1 of the current year. Budgeted sales for the first three months of business September, October, and November are $241,000, $309,000, and $401,000, respectively. The company expects to sell 30% of its merchandise for cash. Of sales on account, 80% are expected to be collected in the month of the sale and 20% in the month following the sale. Previous Upe Nextarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning