Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN: 9781337619455

Author: Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Acc.prob.

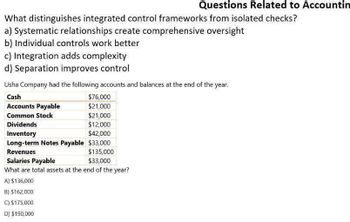

Transcribed Image Text:Questions Related to Accountin

What distinguishes integrated control frameworks from isolated checks?

a) Systematic relationships create comprehensive oversight

b) Individual controls work better

c) Integration adds complexity

d) Separation improves control

Usha Company had the following accounts and balances at the end of the year.

Cash

Accounts Payable

Common Stock

Dividends

Inventory

$76,000

$21,000

$21,000

$12,000

$42,000

Long-term Notes Payable $33,000

Revenues

Salaries Payable

$135,000

$33,000

What are total assets at the end of the year?

A) $136,000

B) $162,000

C) $175,000

D) $190,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- •Compute for the profitability ratio, operating efficiency, and financial health of the given data below.arrow_forwardRequlred Informetion [The following information applies to the questions displayed below.] The December bank statement and cash T-account for Stewart Company follow: BANK STATEMENT Checks Deposits Balance $ 48,000 40, 380 67,830 53,930 ৪9, 938 88,970 88,470 88,520 88,370 Date Other Dec. 1 $ 7,620 558 $28, 000 13,900 11 17 23 36, e00 26 960 30 NSF* $300 50 19, 200 19, e00 31 Interest earned 31 Service charge 150 NSF check from J. Left, a customer. Cash (A) Dec. 1 Balance 48, e00 Deposits Dec. 11 23 Checks written during December: 7,620 28, 800 36, ee0 19,e00 13,e00 550 30 13,900 960 31 150 19,200 4,500 Dec. 31 Balance 97,120 There were no deposits in transit or outstanding checks at November 30. Requlred: 1. Identify and list the deposits in transit at the end of December. (Select all that apply.) $28,000 $36,000 $19,000 $13,000 2. [dentify and list the outstanding checks at the end of December (Select all that apply.) $7,620 $550 $13,900 $880 $150 $19,200 $4,500 OOUIarrow_forwardThe descriptive sections of the annual report that provides insight into what the company does and the types of risks it lates is felt Select one: OA management discussion and analysis. B. the industry overview. OC. the audit opinion. D. notes to the financial statements. To best interpret the accounts receivable turnover ratio, the days in accounts receivable should be compared to the company's Select one: A sales revenue. B. credit terms. OC. inventory turnover. D. accounts receivable balance. Two companies have an identical amount of current assets and current liabilities Donald Inc. has 40% of its current assets invested in whereas Mickey Corp. has 30% of its current assets invested in inventory Which of the following statements is true? Select one: OA. Donald will have the higher quick ratio. OB. Donald will have the higher current ratio. OC. The companies are equally liquid because their current ratios are the same OD. Donald is less liquid than Mickarrow_forward

- The following information was taken from a company's bank reconciliation at the end of the year. Bank balance Checks outstanding Note collected by the bank. Service fee Deposits outstanding NSF check Multiple Choice What is the correct cash balance that should be reported in the company's balance sheet at the end of the year? $10,620, $9,520. $5,673. $9,900 $8,700 $1,100 $ 27 $5,700. $4,500 $ 380arrow_forwardProblem A: Net FloatABC Corporation has daily cash collections of P50,000 and daily cash disbursements of P60,000. A customer check is creditedon the bank statement an average of 5 days from the issue date. Company checks remain outstanding an average of 3 daysfrom the issue date.Required:1. Collection float2. Disbursement float3. Net Float (Place answer in parenthesis if unfavorable.)arrow_forwardakeAssignment/takeAssignmentMain.do?Invoker=&takeAssignmentSessiohLocator=&inprogress=false 3 The cash collections expected in September from accounts receivable are estimated to be Oa. $134,960 Ob. $289,200 Oc. $168,700 Od. $241,000 Ti Nuthatch Corporation began its operations on September 1 of the current year. Budgeted sales for the first three months of business September, October, and November are $241,000, $309,000, and $401,000, respectively. The company expects to sell 30% of its merchandise for cash. Of sales on account, 80% are expected to be collected in the month of the sale and 20% in the month following the sale. Previous Upe Nextarrow_forward

- Question Content Area Thompson Company gathered the following reconciling information in preparing its October bank reconciliation. Cash balance per bank, October 31 $14,172 Note receivable collected by bank 6,836 Outstanding checks 7,678 Deposits in transit 5,408 Bank service charge 147 NSF check 1,367 Determine the cash balance per company records (before adjustment) on October 31. a. $6,580 b. $27,258 c. $11,902 d. $17,224arrow_forwardQuestion Content Area Thompson Corporation gathered the following reconciling information in preparing its October bank reconciliation: Cash balance per bank, 10/31 $15,965 Note receivable collected by bank 4,859 Outstanding checks 9,437 Deposits in transit 4,203 Bank service charge 201 NSF check 1,307 Using the above information, determine the cash balance per books (before adjustments) for Thompson Corporation. a.$19,316 b.$7,380 c.$14,082 d.$10,731arrow_forwardNeed help this question general accountingarrow_forward

- The following information was taken from a company’s bank reconciliation at the end of the year: Bank balance $ 9,000 Checks outstanding $ 7,400 Note collected by the bank $ 1,800 Service fee $ 33 Deposits outstanding $ 4,700 NSF check $ 330 What is the correct cash balance that should be reported in the company's balance sheet at the end of the year? Multiple Choice $6,267. $6,300. $10,470. $8,670.arrow_forwardGive true answer this general accounting questionarrow_forwardRequired information [The following information applies to the questions displayed below.] The December bank statement and cash T-account for Stewart Company follow: BANK STATEMENT Date Checks Deposits Other Balance December 1 $ 36,000 December 6 $ 7,520 28,480 55,030 December 11 450 $ 27,000 December 17 8,900 46,130 December 23 34,000 80,130 December 26 450 79,680 December 30 12,200 18,000 NSF* $ 200 85,280 December 31 Interest earned 20 85,300 December 31 Service charge 50 85,250 NSF check from J. Left, a customer. Cash (A) Debit Credit December 1 Balance 36,000 Checks written during Deposits December: December 11 27,000 7,520 December 23 34,000 450 December 30 18,000 8,900 December 31 11,000 450 50 12,200 5,700 December 31 Balance 90,730 There were no deposits in transit or outstanding checks at November 30.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning