CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Financial Accounting

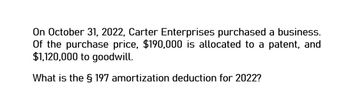

Transcribed Image Text:On October 31, 2022, Carter Enterprises purchased a business.

Of the purchase price, $190,000 is allocated to a patent, and

$1,120,000 to goodwill.

What is the § 197 amortization deduction for 2022?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- LO.7 On October 1, 2019, Priscilla purchased a business. Of the purchase price, 60,000 is allocated to a patent and 375,000 is allocated to goodwill. Calculate Priscillas 2019 197 amortization deduction.arrow_forwardOn October 1, 2023, Verónica purchased a business. Of the purchase price, $66,000 is allocated to a patent and $396,000 to goodwill. If required, round your intermediate values to nearest dollar and use in subsequent computations. Calculate Verónica's 2023 § 197 amortization deduction.arrow_forwardIf Ivanhoe paid $20,000 to a real estate broker on January 1, 2025, as a fee for finding the lessor, what is the initial measuremen of the right-of-use asset? (Round answers to O decimal places, e.g. 5,275.) Right-of-use asset $ 94178arrow_forward

- Aqua Corporation purchases nonresidential real property on May 8, 2020, for S1, 630, 000. Straight - line cost recovery is taken in the amount of $163, 000 before the property is sold on November 27, 2023, for S2, 445,000.a. Compute the amount of Aqua's recognized gain on the sale of the realty.b. Determine the amount of the recognized gain that is treated as § 1231 gain and the amount that is treated as § 1250 recapture (ordinary income due to § 291). § 1231 gain:§ 1250 recapture (ordinary income due to §arrow_forward6.In Jan of 2018, Entity D purchased a patent at a cost of P200,000. Legal and filing fees of P50,000 were paid to acquire the patent. The entity estimated a 10-year useful life for the patent and uses the straight line amortization method for all intangible assets. In 2021, the entity spent P40,000 in legal fees for an unsuccessful defense of the patent. The amount charged to income (expense and loss) in 2021 related to the patent should be:arrow_forwardOn January 1, 2020, Azure Corporation purchased Sparrow Corporation for $20 million. Of the $20 million purchase price, $2 million was allocated to goodwill. What is Azure’s amortization deduction related to the goodwill for 2020? Round your answer to the nearest whole dollar.arrow_forward

- On January 1, 2019, Sandhill Corp. purchased a trademark for $352950, which had an estimated useful life of 15 years. In January 2023, Sandhill paid $44990 for legal fees in a successful defence of the trademark. The amortization expense for this asset for calendar 2023, should be $17370. $20369. $27620,. $0arrow_forwardAssume that ABC, Inc, acquires a competitor's assets on June 10, 2020. The purchase price was $150,000. Of that amount, $125,000 is allocated to tangible assets and $25,000 is allocated to goodwill (a §197 intangible asset). What is ABC, Inc. amortization deduction for 2020? (Round final answer to the nearest whole number.) a) $25,000. b) $1,667. c) $972. d) $833. e) None of the above.arrow_forwardAqua Corporation purchases nonresidential real property on May 8, 2019, for $1,650,000. Straight-line cost recovery is taken in the amount of $165,000 before the property is sold on November 27, 2022, for $2,475,000. Question Content Area a. Compute the amount of Aqua's recognized gain on the sale of the realty $_______________ Determine the amount of the recognized gain that is treated as § 1231 gain and the amount that is treated as § 1250 recapture (ordinary income due to § 291). b. § 1231 gain: $_____________ § 1250 recapture (ordinary income due to § 291): $_______________________arrow_forward

- Company A purchased a patent from Company B on 6/30/2021 for $660,000. The useful life of the patent is estimated to be six years. On 12/31/2024 the fair market value of the patent was $250,000, while the undiscounted future net cash flows related to the patent were $300,000. Q1. Please record the journal entry, if necessary, to record impairment of the patent on 12/31/2024arrow_forwardOn July 1, 2022, Cullumber Company purchased the copyright to Bramble Corp. for $310000. It is estimated that the copyright will have a useful life of 5 years. The amount of amortization expense recognized for the year 2022 would bearrow_forwardChaz Corporation has taxable income in 2020 of $396,000 for purposes of computing the §179 expense and acquired the following assets during the year: What is the maximum total depreciation deduction that Chaz may deduct in 2020? (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) (Round your intermediate calculations and final answer to the nearest whole dollar amount.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT