SWFT Comprehensive Volume 2019

42nd Edition

ISBN: 9780357233306

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

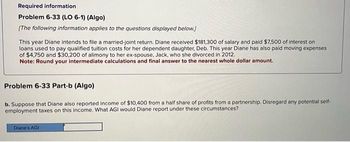

Transcribed Image Text:Required information

Problem 6-33 (LO 6-1) (Algo)

[The following information applies to the questions displayed below.)

This year Diane intends to file a married-joint return. Diane received $181,300 of salary and paid $7,500 of interest on

loans used to pay qualified tuition costs for her dependent daughter, Deb. This year Diane has also paid moving expenses

of $4,750 and $30,200 of alimony to her ex-spouse, Jack, who she divorced in 2012.

Note: Round your intermediate calculations and final answer to the nearest whole dollar amount.

Problem 6-33 Part-b (Algo)

b. Suppose that Diane also reported income of $10,400 from a half share of profits from a partnership. Disregard any potential self-

employment taxes on this income. What AGI would Diane report under these circumstances?

Diane's AGI

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Answer the following questions: Under a 2017 divorce agreement, Joan is required to pay her ex-husband, Bill, $ 700 a month until their daughter is 18 years of age. At that time, the required payments are reduced to $ 450 per month. 1. How much of each $ 700 payment may be deducted as alimony by Joan?$____________ 2. How much of each $ 700 payment must be included in Bill's taxable income?$____________ 3. How much would be deductible/included if the divorce agreement were dated 2019? $____________ Under the terms of a property settlement executed during 2019, Jane transferred property worth $ 450,000 to her ex-husband, Tom. The property has a tax basis to Jane of $ 425,000. 1. How much taxable gain must be recognized by Jane at the time of the transfer?$____________ 2. What is the amount of Tom's tax basis in the property he received from Jane?$____________arrow_forwardRequired information [The following information applies to the questions displayed below.] This year Diane intends to file a married-joint return. Diane received $189.500 of salary and paid $7,050 of interest on loans used to pay qualified tuition costs for her dependent daughter, Deb. This year Diane has also paid moving expenses of $7.400 and $29,300 of alimony to her ex-spouse, Jack, who she divorced in 2013. Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. a. What is Diane's adjusted gross income? Diane's AGI $ 158,966arrow_forwardRequired information [The following information applies to the questions displayed below.] This year Diane intends to file a married-joint return. Diane received $192,300 of salary and paid $7,800 of interest on loans used to pay qualified tuition costs for her dependent daughter, Deb. This year Diane has also paid moving expenses of $8,600 and $30,700 of alimony to her ex-spouse, Jack, who she divorced in 2013. Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. b. Suppose that Diane also reported income of $5,150 from a half share of profits from a partnership. Disregard any potential self- employment taxes on this income. What AGI would Diane report under these circumstances? Diane's AGIarrow_forward

- Required information [The following information applies to the questions displayed below] This year Diane intends to file a married-joint return. Diane received $191.700 of salary and paid $6,450 of interest on loans used to pay qualified tuition costs for her dependent daughter, Deb. This year Diane has also paid moving expenses of $5,750 and $30,400 of alimony to her ex-spouse, Jack, who she divorced in 2013. Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. a. What is Diane's adjusted gross income? Diane's AGIarrow_forwardFor the year 2024, please and thank you! n Required information Problem 6-66 (LO 6-1) (Algo) [The following information applies to the questions displayed below ( This year Diane intends to file a married-joint return. Diane received $192,100 of salary and paid $8,600 of interest on loans used to pay qualified tuition costs for her dependent daughter, Deb. This year Diane has also paid moving expenses of $4,550 and $30,600 of alimony to her ex-spouse, Jack, who she divorced in 2013. Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Answer is complete but not entirely correct. $ 159,000 Problem 6-66 Part-b (Algo) b. Suppose that Diane also reported income of $10,900 from a half share of profits from a partnership. Disregard any potential self- employment taxes on this income. What AGI would Diane report under these circumstances? Diane's AGIarrow_forwardharrow_forward

- ! Required information [The following information applies to the questions displayed below.] This year Diane intends to file a married-joint return. Diane received $188,300 of salary and paid $8,150 of interest on loans used to pay qualified tuition costs for her dependent daughter, Deb. This year Diane has also paid moving expenses of $9,000 and $28,700 of alimony to her ex-spouse, Jack, who she divorced in 2013. Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. a. What is Diane's adjusted gross income? Answer is complete but not entirely correct. $ 151,450 X Diane's AGIarrow_forwardRequired information [The following information applies to the questions displayed below.] This year Jack intends to file a married-joint return. Jack received $172,500 of salary and paid $5,000 of interest on loans used to pay qualified tuition costs for his dependent daughter, Deb. This year Jack has also paid moving expenses of $4,300 and $28,300 of alimony to his ex-wife, Diane, who divorced him in 2012. (Round your intermediate calculations and final answer to the nearest whole dollar amount.) b. Suppose that Jack also reported income of $8,800 from a half share of profits from a partnership. Disregard any potential self- employment taxes on this income. What AGI would Jack report under these circumstances? Jack's AGIarrow_forwardRequired information [The following information applies to the questions displayed below.] This year Jack intends to file a married-joint return. Jack received $172,500 of salary and paid $5,000 of interest on loans used to pay qualified tuition costs for his dependent daughter, Deb. This year Jack has also paid moving expenses of $4,300 and $28,300 of alimony to his ex-wife, Diane, who divorced him in 2012. (Round your intermediate calculations and final answer to the nearest whole dollar amount.) a. What is Jack's adjusted gross income? Jack's AGIarrow_forward

- ! Required information [The following information applies to the questions displayed below.] This year Diane intends to file a married-joint return. Diane received $188,700 of salary and paid $9,500 of interest on loans used to pay qualified tuition costs for her dependent daughter, Deb. This year Diane has also paid moving expenses of $8,700 and $28,900 of alimony to her ex- spouse, Jack, who she divorced in 2013. Note: Round your intermediate calculations and final answer to the nearest whole dollar amount.arrow_forwardDomesticarrow_forwardRequired information Problem 6-66 (LO 6-1) (Algo) [The following information applies to the questions displayed below.] This year Diane intends to file a married-joint return. Diane received $192,100 of salary and paid $8,600 of interest on loans used to pay qualified tuition costs for her dependent daughter, Deb. This year Diane has also paid moving expenses of $4,550 and $30,600 of alimony to her ex-spouse, Jack, who she divorced in 2013. Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Problem 6-66 Part-b (Algo) b. Suppose that Diane also reported income of $10,900 from a half share of profits from a partnership. Disregard any potential self- employment taxes on this income. What AGI would Diane report under these circumstances? X Answer is complete but not entirely correct. $ 159,000 X Diane's AGIarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT