Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

solve the problem

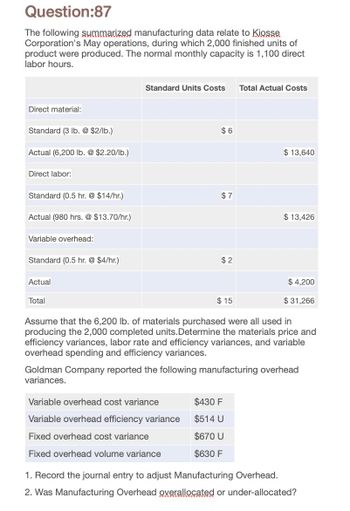

Transcribed Image Text:Question:87

The following summarized manufacturing data relate to Kiosse

Corporation's May operations, during which 2,000 finished units of

product were produced. The normal monthly capacity is 1,100 direct

labor hours.

Direct material:

Standard (3 lb. @ $2/lb.)

Actual (6,200 lb. @ $2.20/lb.)

Standard Units Costs Total Actual Costs

$6

$ 13,640

Direct labor:

Standard (0.5 hr. @ $14/hr.)

$ 7

Actual (980 hrs. @ $13.70/hr.)

$ 13,426

Variable overhead:

Standard (0.5 hr. @ $4/hr.)

$2

Actual

$ 4,200

Total

$ 15

$31,266

Assume that the 6,200 lb. of materials purchased were all used in

producing the 2,000 completed units. Determine the materials price and

efficiency variances, labor rate and efficiency variances, and variable

overhead spending and efficiency variances.

Goldman Company reported the following manufacturing overhead

variances.

Variable overhead cost variance

$430 F

Variable overhead efficiency variance

$514 U

Fixed overhead cost variance

$670 U

Fixed overhead volume variance

$630 F

1. Record the journal entry to adjust Manufacturing Overhead.

2. Was Manufacturing Overhead overallocated or under-allocated?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Standard unit cost and journal entries The normal capacity of Algonquin Adhesives Inc. is 40,000 direct labor hours and 20,000 units per month. A finished unit requires 6 lb of materials at an estimated cost of 2 per pound. The estimated cost of labor is 10.00 per hour. The plant estimates that overhead (all variable) for a month will be 40,000. During the month of March, the plant totaled 34,800 direct labor hours at an average rate of 9.50 an hour. The plant produced 18,000 units, using 105,000 lb of materials at a cost of 2.04 per pound. 1. Prepare a standard cost summary showing the standard unit cost. 2. Make journal entries to charge materials and labor to Work in Process.arrow_forwardStandard cost journal entries Bellingham Company produced 15,000 units that require 2.5 standard pounds per unit at a 3.75 standard price per pound. The company actually used 36,000 pounds in production. Journalize the entry to record the standard direct materials used in production.arrow_forwardAlgers Company produces dry fertilizer. At the beginning of the year, Algers had the following standard cost sheet: Algers computes its overhead rates using practical volume, which is 54,000 units. The actual results for the year are as follows: a. Units produced: 53,000 b. Direct materials purchased: 274,000 pounds at 2.50 per pound c. Direct materials used: 270,300 pounds d. Direct labor: 40,100 hours at 17.95 per hour e. Fixed overhead: 161,700 f. Variable overhead: 122,000 Required: 1. Compute price and usage variances for direct materials. 2. Compute the direct labor rate and labor efficiency variances. 3. Compute the fixed overhead spending and volume variances. Interpret the volume variance. 4. Compute the variable overhead spending and efficiency variances. 5. Prepare journal entries for the following: a. The purchase of direct materials b. The issuance of direct materials to production (Work in Process) c. The addition of direct labor to Work in Process d. The addition of overhead to Work in Process e. The incurrence of actual overhead costs f. Closing out of variances to Cost of Goods Soldarrow_forward

- A company estimates its manufacturing overhead will be $750,000 for the next year. What is the predetermined overhead rate given the following independent allocation bases? Budgeted direct labor hours: 60,000 Budgeted direct labor expense: $1,500,000 Estimated machine hours: 100,000arrow_forwardBusiness Specialty, Inc., manufactures two staplers: small and regular. The standard quantities of direct labor and direct materials per unit for the year are as follows: The standard price paid per pound of direct materials is 1.60. The standard rate for labor is 8.00. Overhead is applied on the basis of direct labor hours. A plantwide rate is used. Budgeted overhead for the year is as follows: The company expects to work 12,000 direct labor hours during the year; standard overhead rates are computed using this activity level. For every small stapler produced, the company produces two regular staplers. Actual operating data for the year are as follows: a. Units produced: small staplers, 35,000; regular staplers, 70,000. b. Direct materials purchased and used: 56,000 pounds at 1.5513,000 for the small stapler and 43,000 for the regular stapler. There were no beginning or ending direct materials inventories. c. Direct labor: 14,800 hours3,600 hours for the small stapler and 11,200 hours for the regular stapler. Total cost of direct labor: 114,700. d. Variable overhead: 607,500. e. Fixed overhead: 350,000. Required: 1. Prepare a standard cost sheet showing the unit cost for each product. 2. Compute the direct materials price and usage variances for each product. Prepare journal entries to record direct materials activity. 3. Compute the direct labor rate and efficiency variances for each product. Prepare journal entries to record direct labor activity. 4. Compute the variances for fixed and variable overhead. Prepare journal entries to record overhead activity. All variances are closed to Cost of Goods Sold. 5. Assume that you know only the total direct materials used for both products and the total direct labor hours used for both products. Can you compute the total direct materials and direct labor usage variances? Explain.arrow_forwardThe following product costs are available for Kellee Company on the production of eyeglass frames: direct materials, $32,125; direct labor, $23.50; manufacturing overhead, applied at 225% of direct labor cost; selling expenses, $22,225; and administrative expenses, $31,125. The direct labor hours worked for the month are 3,200 hours. A. What are the prime costs? B. What are the conversion costs? C. What is the total product cost? D. What is the total period cost? E. If 6.425 equivalent units are produced, what is the equivalent material cost per unit? F. What is the equivalent conversion cost per unit?arrow_forward

- Green Bay Cheese Company estimates its overhead to be $375,000. It expects to have 125,000 direct labor hours costing $1,500,000 in labor and utilizing 15,000 machine hours. Calculate the predetermined overhead rate using: A. Direct labor hours B. Direct labor dollars C. Machine hoursarrow_forwardEllerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 2.70 is direct materials and 5.30 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardposting my questions need answerarrow_forward

- Activity Rates and Product Costs using Activity-Based Costing Lonsdale Inc. manufactures entry and dining room lighting fixtures. Five activities are used in manufacturing the fixtures. These activities and their associated budgeted activity costs and activity bases are as follows: Budgeted Activity Activity Cost Activity Base Casting $215,160 Machine hours Assembly 189,550 Direct labor hours Inspecting 30,520 Number of inspections Setup 39,730 Number of setups Materials handling 36,960 Number of loads Corporate records were obtained to estimate the amount of activity to be used by the two products. The estimated activity-base usage quantities and units produced follow: Activity Base Entry Dining Total Machine hours 5,180 4,600 9,780 Direct labor hours 4,460 6,690 11,150 Number of inspections 1,660 520 2,180 Number of setups 230 60 290 Number of loads 700 180 880 Units produced 10,400 5,200 15,600 a. Determine the activity rate for each activity. If required, round the rate to the…arrow_forwardKimber Company has the following unit costs for the current year: Raw materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total unit cost $20.00 25.00 10.00 15.00 $70.00 Fixed manufacturing cost is based on an annual activity level of 8,000 units. Based on these data, the total manufacturing cost expected to be incurred to manufacture 9,000 units in the current year is: Oa. $560,000. Ob. $615,000. Oc. $630,000. Od. $575,000.arrow_forwardThe following information relates to production activities of Mercer Manufacturing for the year. Actual direct materials used Actual direct labor used. 16,400 pounds at $4.25 per pound 17,035 hours at $23 per hour 30,800 Actual units produced Standard quantity and price per unit for direct materials Standard quantity and rate per unit for direct labor 0.50 pound at $4.20 per pound 0.50 hour at $24 per hour AR = Actual Rate SR Standard Rate AQ = Actual Quantity SQ = Standard Quantity AP = Actual Price SP Standard Price (1) Compute the direct materials price and quantity variances. (2) Compute the direct labor rate and efficiency variances. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the direct materials price and quantity variances. (Indicate the effect of each variance by selecting favorable, unfavorable, or no variance.) Actual Cost Standard Cost $ 0 $ 0 Required 2 > $ 0 0 < Required 1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College