Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN: 9781285190907

Author: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Need help

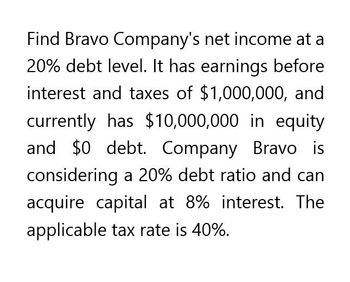

Transcribed Image Text:Find Bravo Company's net income at a

20% debt level. It has earnings before

interest and taxes of $1,000,000, and

currently has $10,000,000 in equity

and $0 debt. Company Bravo is

considering a 20% debt ratio and can

acquire capital at 8% interest. The

applicable tax rate is 40%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- SLM, Inc., with sales of $1,000, has the following balance sheet:SLM, Incorporated Balance Sheet as of 12/31/X0assetsLiabilities and equityAccounts receivable$200Trade accounts payable$ 200Inventory400Long-term debt600Plant800Equity600$1, 4 0 0$1, 4 0 0It earns 10 percent on sales (after taxes) and pays no dividends.a.Determine the balance sheet entries for sales of $1,500 using the percent of sales method of forecastingarrow_forwardIn Geri Co, the 5 year weighted average historical pre-tax economic earnings are $1,250,000. The tax rate is 28%. The hurdle and debt rate are 12.25%. The adjusted net assets from prior year-end is $2,050,000. The cap rate applicable to this kind of company is 25% pretax. Determine the value of this business using reasonable rate return on assets. a. $3,995,500 b. $2,050,000 c. $6,045,500 d. Cannot be determined from the information provided.arrow_forwardNonearrow_forward

- Calculate the WACC using the following information: Debt-Equity ratio is 50%. Cost of debt is 8.00% Cost of equity is 10.00% Company pays tax at 35%.arrow_forwardTake it all away has a cost of equity of 10.84 percent, a pretax cost of debt of 5.47 percent, and a tax rate of 39 percent. The company's captial structure consists of 76 percent debt on a book value basis, but debt is 38 percent of the company's value on a market value basis. What is the company's WACCarrow_forward16. In December 2020, Remal Co. had AED 200 million debt, AED 40 million in operating income, interest expense AED 4 million, AED 450 million in total assests and tax rate 35 percent. The ROA ratio is: ROA= Net Income + Interest exp Total assets.arrow_forward

- Broward Manufacturing recently reported the following information:Net income $615,000ROA 10%Interest expense $202,950Accounts payable and accruals $950,000Broward’s tax rate is 25%. Broward finances with only debt and common equity, so it has no preferredstock. 40% of its total invested capital is debt, and 60% of its total invested capital is common equity.Calculate its basic earning power (BEP), its return on equity (ROE), and its return on invested capital(ROIC).arrow_forwardBolero Corporation has one long term loan (interest bearing debt) of $700,000 at an interest rate of 8%. The company has accounts payable of $300,000 (non-interest bearing) and equity of $1,000,000. It estimates that its cost of equity is 16%. Its tax rate is 35%. A. What is the company’s weighted average cost of capital on interest bearing debt and equity? B. What is Bolero Corporation’s weighted average cost of capital on all liabilities and equity (or total invested capital)?arrow_forwardEstimate the gross income for Bling Enterprises, which reports a CFAT of $2.5 million, $900,000 in expenses, $900,000 in depreciation charges, and has an effective tax rate of 26.4%.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning