Entrepreneurial Finance

6th Edition

ISBN: 9781337635653

Author: Leach

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

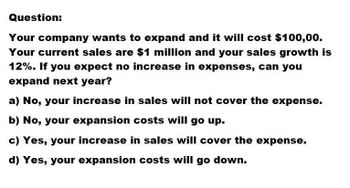

Transcribed Image Text:Question:

Your company wants to expand and it will cost $100,00.

Your current sales are $1 million and your sales growth is

12%. If you expect no increase in expenses, can you

expand next year?

a) No, your increase in sales will not cover the expense.

b) No, your expansion costs will go up.

c) Yes, your increase in sales will cover the expense.

d) Yes, your expansion costs will go down.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Finally, assume that the new product line isexpected to decrease sales of the firm’s otherlines by $50,000 per year. Should this be considered in the analysis? If so, how?arrow_forwardYou are preparing to produce some goods for sale. You will sell them in one year and you will incur costs of $89,000 immediately. If your cost of capital is 6.9%, what is the minimum dollar amount you need to sell the goods for in order for this to be a non-negative NPV? $______________ (Round to the nearest dollar.)arrow_forwardYou are preparing to produce some goods for sale. You will sell them in one year and you will incur costs of $71,000 immediately. If your cost of capital is 7%, what is the minimum dollar amount you need to sell the goods for in order for this to be a non-negative NPV? The minimum dollar amount is $_____ (Round to the nearest dollar)arrow_forward

- I need the answer as soon as possiblearrow_forwardYou are upgrading to better production equipment for your firm's only product. The new equipment will allow you to make more of your product in the same amount of time. Thus, you forecast that total sales will increase next year by 25% over the current amount of 96,000 units. If your sales price is $19 per unit, what are the incremental revenues next year from the upgrade? The incremental revenues are $ (Round to the nearest dollar.)arrow_forwardYou are considering an investment in a clothes distributer. The company needs $105,000 today and expects to repay you $120,000 in a year from now. What is the IRR of this investment opportunity? Given the riskiness of the investment opportunity, your cost of capital is 17%. What does the IRR rule say about whether you should invest? What is the IRR of this investment oppurtunity? The IRR of this investment opppurtunity is ____%arrow_forward

- Answer the following lettered questions on the basis of the information in this table: Amount of R&D, $ Millions Expected Rate of Return on R&D, % $ 10 16 20 14 30 12 40 10 50 8 60 6 Instructions: Enter your answer as a whole number. a. If the interest-rate cost of funds is 8 percent, what is this firm's optimal amount of R&D spending? million %24arrow_forwardYou are considering an investment in a clothes distributer. The company needs $106,000 today and expects to repay you $124,000 in a year from now. What is the IRR of this investment opportunity? Given the riskiness of the investment opportunity, your cost of capital is 15%. What does the IRR rule say about whether you should invest? What is the IRR of this investment opportunity? The IRR of this investment opportunity is %. (Round to two decimal places.)arrow_forwardou are preparing to produce some goods for sale. You will sell them in one year and you will incur costs of $ 76,000 immediately. If your cost of capital is 7%. What is the minimum dollar amount you need to sell the goods for in order for this to be a non-negative NPV? Question content area bottom Part 1 The minimum dollar amount is $XXX enter your response here .arrow_forward

- You are upgrading to better production equipment for your firm's only product. The new equipment will allow you to make more of your product in the same amount of time. Thus, you forecast that total sales will increase next year by 23%over the current amount of 103,000 units. If your sales price is $19 per unit, what are the incremental revenues next year from the upgrade? The incremental revenues are $__________.(Round to the nearest dollar.)arrow_forwardmusic studio predicts its future yearly net income (loss) to be as follows: Year 1: - $120Year 2: + $20Year 3: + $90Year 4: - $10Year 5: + $30Year 6: + $30Year 7: + $30Year 8: + $40 What is the NPV of the company, considering a discount rate of 10%?arrow_forwardAl_Tech plc is considering investing in a new company, New_tech plc. It has estimated that the new tech company will cost £440,000. Cash flows from increased sales will be £160,000 in the first year. These cash flows will increase by 5% every year. Al_Tech plc estimates that New_tech plc will lose all its technological advantages in five years from now and will lose all its value. Assume that the initial cost is paid now, and all the revenues are received at the end of each year. The company requires a 12% p.a. return for such an investment. a) Calculate the NPV of the investment project. b) Calculate the profitability index and the discounted payback period. c) Should Al_Tech plc consider investing in New_tech plc? What can you say about the internal rate of return to that project? Explain. d) Explain why it is theoretically correct to assume that accepting a project with a positive NPV should increase the value of a company by the NPV of the project.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you