Quickbooks Online Accounting

3rd Edition

ISBN: 9780357391693

Author: Owen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Can you show me how to work this prob

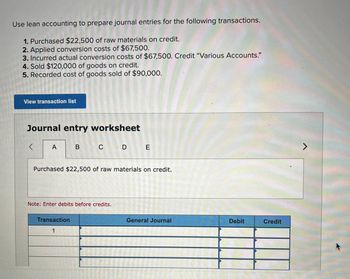

Transcribed Image Text:Use lean accounting to prepare journal entries for the following transactions.

1. Purchased $22,500 of raw materials on credit.

2. Applied conversion costs of $67,500.

3. Incurred actual conversion costs of $67,500. Credit "Various Accounts."

4. Sold $120,000 of goods on credit.

5. Recorded cost of goods sold of $90,000.

View transaction list

Journal entry worksheet

<

A

B

C D E

Purchased $22,500 of raw materials on credit.

Note: Enter debits before credits.

Transaction

1

General Journal

Debit

Credit

7

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Use the first-in, first-out (FIFO) cost allocation method, with perpetual inventory updating, to calculate (a) sales revenue, (b) cost of goods sold, and c) gross margin for A75 Company, considering the following transactions.arrow_forwardUse lean accounting to prepare journal entries for the following transactions. 1. Sold $33,250 of goods for cash. 2. Recorded cost of goods sold of $23,250, and finished goods inventory of $1,860.arrow_forward2) A company sold goods costing $126,000 to customers. What should be included in the journal entry necessary to record this sale of goods to customers? O Credit to work-in-process inventory for $126,000. O Credit to cost of goods sold for $126,000. O Debit to work-in-process inventory for $126,000. O Debit to cost of goods sold for $126,000.arrow_forward

- еBook Show Me How Applying the Cost of Goods Sold Model The following amounts were obtained from the accounting records'of Steed Company: Required: Compute the missing amounts. Year 1 Year 2 Year 3 Beginning inventory $10,600 $4 Net purchases 60,300 64,100 Ending inventory 11,200 13,750 Cost of goods sold 44,500 49,800 Check My Workarrow_forwardConsider the following account starting balances and transactions involving these accounts. Use T-accounts to record the starting balances and the offsetting entries for the transactions. The starting balance of Accounts Receivable is $3,200 The starting balance of Cash is $13,700 The starting balance of Inventory is $5,100 1. Buy $14 worth of manufacturing supplies for cash 2. Sell product for $35 in cash with historical cost of $35 3. Receive payment of $13 owed by a customer What is the final amount in Inventory? Note: No unit adjustments are necessary.arrow_forwardMAKE THE NECCESSARY JOURNAL ENTRIES FOR THE FOLLOWING TRANSACTIONS... 1)Merchandise acquired cost is 114.000 +10 % VAT. Freight In was 6.000 TL +10% VAT Paid by the vendor. Purchase is completed by endorsing a check. 2) Machinary is purchased for 326.000 TL + %10 VAT, Note is endorced for purchase . Transportation and Installations invoice is 94.000 TL + %10 VAT half paid by check balance is on account. 3) Merchandise sold for 64.000 USD (rate 7.05 TL/ USD) + 10% VAT received note for sale. VAT paid cash. Cost of good Sold is 235.000 TL 4) Bank Credit Memorandum states that , 95.000 TL issued check is collected from the Bank. 5) 24 month rent contract, Starting 1st April 2020 is signed for 384.000 TL. Prepayment is made by half check and half note issued, 6) 25.000 USD is paid (cash) by the customer for USD Merchandise sale. Rate is 7.15 TL/USD. 7) Customer transferred 85 .000 TL to the Bank, to close the open account 8) Customer ordered to purchase 270.000 TL + %10 VAT Merchandise .…arrow_forward

- Please do not give solution in image format thankuarrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardKindly help me Accounting questionarrow_forward

- Weighted average cost method with perpetual inventory The beginning inventory at Midnight Supplies and data on purchases and sales for a three-month period ending March 31 are as follows: Number of Units Per Unit Total $60.00 70.00 140.00 Date Transaction Jan. 1 Inventory Jan. 10 Purchase Jan. 28 Sale Jan. 30 Sale Feb. 5 Sale Feb. 10 Purchase Feb. 16 Sale Feb. 28 Sale Mar. 5 Purchase Mar. 14 Sale Mar. 25 Purchase Mar. 30 Sale 9,000 21,000 10,250 5,750 3,500 39,500 15,000 10,000 $540,000 1,470,000 1,435,000 140.00 805,000 140.00 490,000 75.00 2,962,500 150.00 2,250,000 150.00 1,500,000 25,000 82.00 2,050,000 30,000 150.00 4,500,000 10,000 88.40 884,000 19,000 150.00 2,850,000arrow_forwardPlease do not give solution in image format ? And Fast answering please and explain proper steps by Step.arrow_forwardExplain how to do the problem.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage