Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Both Answer

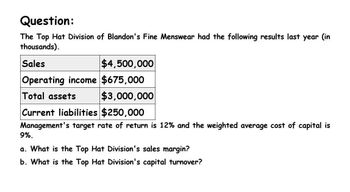

Transcribed Image Text:Question:

The Top Hat Division of Blandon's Fine Menswear had the following results last year (in

thousands).

Sales

$4,500,000

Operating income $675,000

Total assets

$3,000,000

Current liabilities $250,000

Management's target rate of return is 12% and the weighted average cost of capital is

9%.

a. What is the Top Hat Division's sales margin?

b. What is the Top Hat Division's capital turnover?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Aarrow_forwardGolden Goodness (GG) has an investment center that had the following data: Operating Income $28,000 Sales $350,000 Invested assets $175,000 PMB has set a minimum acceptable rate of return at 14%. Using the information, answer the following questions. You must include what type of number it is (%, $, etc.) Part A: What is the profit margin? Part B: What is the investment turnover? Part C: What is the return on investment? Part D: What is the residual income? Part E: Explain each of the calculations you just performed (a-d).arrow_forwardGolden Goodness (GG) has an investment center that had the following data: Operating Income $28,000 Sales $350,000 Invested assets $175,000 PMB has set a minimum acceptable rate of return at 14%. Using the information, answer the following questions. You must include what type of number it is (%, $, etc.) What is the profit margin? What is the investment turnover? What is the return on investment?arrow_forward

- During the past year Heart Company had a net income of $175,000. What is the ROI if the investment is $25,000? Select one: a. 2.500 b. 7.000 c. 0.142 d. 5.450 e. 5.140arrow_forwardDuring the past year Badger Company had a net income of $175,000. What is the ROI if the investment is $25,000? Select one: a. 5.450 b. 2.500 c. 0.142 d. 7.000 e. 5.140arrow_forwardWhat is the Rate of Return on Investment (ROI) for Stevenson Corporation, given the following info: Invested Assets = $275,000 Sales $330,000 Income from Operations = $49,500 Desired minimum rate of return = 7.5% O 10.0% 18.0% 8.0% 7.5%arrow_forward

- Assume the Hiking Shoes division of the All About Shoes Corporation had the following results last year (in thousands). Management's target rate of return is 5% and the weighted average cost of capital is 25%. Its effective tax rate is 30%. $13,000,000 1,300,000 1,500,000 Sales Operating income Total assets Current liabilities 810,000 What is the division's sales margin? O A. 10.00% O B. 54.00% O C. 866.67% O D. 86.67%arrow_forwardAssume the Hiking Shoes division of the Simply Shoes Company had the following results last year (in thousands). Management's target rate of return is 30% and the weighted average cost of capital is 15%. Its effective tax rate is 30%. Sales Operating income Total assets Current liabilities What is the division's Return on Investment (ROI)? A. 68.57% B. 171.43% C. 40% O D. 22.57% $6,000,000 2,400,000 3,500,000 790,000 COarrow_forwardGolden Goodness (GG) has an investment center that had the following data: Operating Income $28,000 Sales $350,000 Invested assets $175,000 PMB has set a minimum acceptable rate of return at 14%. Using the information, answer the following questions. You must include what type of number it is (%, $, etc.) Part A: What is the residual income? Part B: Show calcualtions on how you got answerarrow_forward

- Steel corporation presented the following results for the period just ended: Sales 6,000,000 Capital Investment 2,000,000 Net Income 1,000,000 To arrive at the return on investment, which of the following should be used? A. ROI = (6/2) X (1/6) B. ROI= (2/6) X (1/6) C. ROI= (6/2) X (6/1) D. ROI= (2/6) X (6/1)arrow_forwardAlexander Inc. makes basketballs. The results for the year were as follows: Basketballs Sales $450,000 Income $72,000 Asset base $300,000 Weighted average cost of capital 15% Required:Compute the following amounts for the company:SHOW ALL CALCULATIONS. ROUND EACH NUMBER TO TWO (2) DECIMAL PLACES. A. Return on investment (ROI). B. Residual income if the desired rate of return is 20%. C. EVA. D. Turnover. E. Margin.arrow_forwardAssume the Hiking Shoes division of the All About Shoes Corporation had the following results last year (in thousands). Management's target rate of return is 30% and the weighted average cost of capital is 5%. Its effective tax rate is 35%. Sales $14,000,000 Operating income Total assets 3,500,000 2,000,000 770,000 Current liabilities What is the division's sales margin? O A. 175.00% B. 25.00% OC. 38.50% O D. 700.00%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College