Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

None

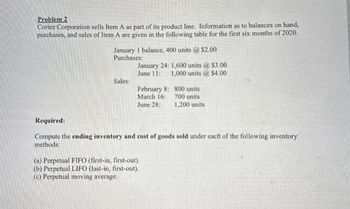

Transcribed Image Text:Problem 2

Cortez Corporation sells Item A as part of its product line. Information as to balances on hand,

purchases, and sales of Item A are given in the following table for the first six months of 2020.

January 1 balance, 400 units @ $2.00

Purchases:

January 24: 1,600 units @ $3.00

June 11:

1,000 units @ $4.00

Sales:

February 8:

800 units

March 16:

700 units

June 28:

1,200 units

Required:

Compute the ending inventory and cost of goods sold under each of the following inventory

methods:

(a) Perpetual FIFO (first-in, first-out).

(b) Perpetual LIFO (last-in, first-out).

(c) Perpetual moving average.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- Current Attempt in Progress Oriole Corporation sells item A as part of its product line. Information as to balances on hand, purchases, and sales of item A are given in the following table for the first six months of 2020. Date January 11 January 24 February 8 March 16 June 11 Purchased 1,380 660 Ending inventory $ Save for Later Quantities Cost of goods sold $ Sold 360 610 Balance 460 1,840 1,480 870 1,530 Unit Price of Purchase $4.60 Compute the ending inventory at June 30 under the perpetual LIFO inventory pricing method. $4.9 $5.3 Compute the cost of goods sold for the first six months under the periodic FIFO inventory pricing method. Attempts: 0 of 1 used Submit Answerarrow_forwardQUESTION & 6 The following are estimated the estimated sales of a company for eight month Navember 30.2020 Escimated Sales (Units) Manth 12,000 April 13,000 May 9,000 June 8,000 July 10,000 August September 12,000 October 14,000 November 12,000 As a matter of policy, the company maintains the closing balance of finished goods and raw materials as follows Inventory Items Finished goods Ending Balance -50% of estimated sales of next month Raw materials --Estimated consumption for next month Every unit of production requires 2 kgs of raw materials costing Br, 5 per kg Prepare: Production budget company for the half year ending September 30,2020 (units) and raw material budget in (units and cost) of the QUESTION #-7 Financial ratios are the symptoms like the blood pressure, the pulse or the temperature of an individual. Explain. also name and explain in brief the common types of ratios used by business companies.arrow_forwardsssssssssssssssarrow_forward

- Desiccate purchases direct materials each month. Its payment history shows that 70% is paid in the month of purchase with the remaining balance pad the month after purchase. Prepare a cash payment schedule for March if in January through March, it purchased $35,000, $37,000, and $39,000, respectively.arrow_forwardComprehensive The following information for 2019 is available for Marino Company: 1. The beginning inventory is 100,000. 2. Purchases returns of 4,000 were made. 3. Purchases of 300,000 were made on terms of 2/10, n/30. Eighty percent of the discounts were taken. 4. At December 31, purchases of 20,000 were in transit, FOB destination, on terms of 2/10, n/30. 5. The company made sales of 640,000. The gross selling price per unit is twice the net cost of each unit sold. 6. Sales allowances of 6,000 were made. 7. The company uses the LIFO periodic method and the gross method for purchase discounts. Required: 1. Compute the cost of the ending inventory before the physical inventory is taken. 2. Compute the amount of the cost of goods sold that came from the purchases of the period and the amount that came from the beginning inventory.arrow_forwardRefer to RE22-2. Assume Heller Company had sales revenue of 510,000 in 2019 and 650,000 in 2020. Prepare Hellers partial income statements (through gross profit) for 2019 and 2020. RE22-2 Heller Company began operations in 2019 and used the LIFO method to compute its 300,000 cost of goods sold for that year. At the beginning of 2020, Heller changed to the FIFO method. Heller determined that its cost of goods sold under FIFO would have been 250,000 in 2019. For 2020, Hellers cost of goods sold under FIFO was 360,000, while it would have been 410,000 under LIFO. Heller is subject to a 21% income tax rate. Compute the cumulative effect of the retrospective adjustment on prior years income (net of taxes) that Heller would report on its retained earnings statement for 2020.arrow_forward

- SALES RETURNS AND ALLOWANCES ADJUSTMENT At the end of year 1, JCs estimates that 2,000 of the current years sales will be returned in year 2. Prepare the adjusting entry at the end of year 1 to record the estimated sales returns and allowances and customer refunds payable for this 2,000. Use accounts as illustrated in the chapter.arrow_forwardAccounting questionarrow_forwardCraig Company buys and sells one product. Its beginning inventory, purchases, and sales during calendar-year 2018 follow. Problem Date Activity Units Acquired at Cost Total Units Sold at Retail Unit Inventory Jan. 1 Beg. Inventory 400 units @ $14 = Jan. 15 Sale Mar. 10 Purchase Apr. 1 Sale May 9 Purchase Sep. 22 Purchase Nov. 1 Sale Nov. 28 Purchase Totals 200 units @ $15 = 300 units @ $16 = 250 units @ $20= 100 units @ $21 = $5,600 - $3,000 - 200 units @ $30 200 units 400 units $5,000 200 units @ $30 $4,800 - 400 units $2,100 - 200 units 500 units 750 units 300 units @ $35 450 units 550 units 1,250 units $20,500 700 units 550 units Additional tracking data for specific identification: (1) January 15 sale-200 units @ $14, (2) April 1 sale-200 units @ $15, and (3) November 1 sale-200 units @ $14 and 100 units @ $20. 1. What is the Cost of Good Available for Sale? How many units available for sale? 2. Using the Periodic System, determine Cost of Goods Sold (COGS) and Ending Inventory…arrow_forward

- Problem 6-6B (Algo) Record transactions using a perpetual system, prepare a partial income statement, and adjust for the lower of cost and net realizable value (LO6-2, 6-3, 6-4, 6-5, 6-6) At the beginning of November, Yoshi Incorporated's inventory consists of 59 units with a cost per unit of $95. The following transactions occur during the month of November. November 2 Purchase 100 units of inventory on account from Toad Incorporated for $100 per unit, terms 2/10, n/30. November 3 Pay cash for freight charges related to the November 2 purchase, $300. November 9 Return 25 defective units from the November 2 purchase and receive credit. November 11 Pay Toad Incorporated in full. November 16 Sell 100 units of inyentory to customers/on account, $13,900. (Hint: The cost of units sold from the November 2 purchase includes $100 unit cost plus $4 per unit for freight less $2 per unit for the purchase discount, or $102 per unit.) November 20 Receive full payment from customers related to the…arrow_forwardQuestion: Jones Company was formed on December 1, 2021. The following information is available from Jones's inventory record for Product X. Units Unit Cost January 1, 2022 (beginning inventory) 1,600 £18.00 Purchases: January 5, 2022 2,600 £20.00 January 25, 2022 2,400 £21.00 February 16, 2022 1,000 £22.00 March 15, 2022 1,800 £23.00 A physical inventory on March 31, 2022, shows 2,500 units on…arrow_forwardSubject: acountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning  College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,