Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

The Art League is a not-for-profit organization dedicated to promoting the arts within the community. There are two programs conducted by the Art League:(1) exhibition and sales of members’ art (referred to as Exhibition) and (2) Community Art Education. Activities of the Art League are conducted by a part-time administrator, a part-time secretary-bookkeeper, and several part-time volunteers. The volunteers greet visitors, monitor the security of the exhibit hall, and handle the sales of art to the public. Art on exhibit is considered the property of the member artists, not the Art League. The post-closing

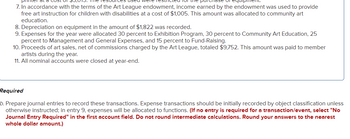

Transcribed Image Text:7. In accordance with the terms of the Art League endowment, income earned by the endowment was used to provide

free art instruction for children with disabilities at a cost of $1,005. This amount was allocated to community art

education.

8. Depreciation on equipment in the amount of $1,822 was recorded.

9. Expenses for the year were allocated 30 percent to Exhibition Program, 30 percent to Community Art Education, 25

percent to Management and General Expenses, and 15 percent to Fund-Raising.

10. Proceeds of art sales, net of commissions charged by the Art League, totaled $9,752. This amount was paid to member

artists during the year.

11. All nominal accounts were closed at year-end.

Required

b. Prepare journal entries to record these transactions. Expense transactions should be initially recorded by object classification unless

otherwise instructed; in entry 9, expenses will be allocated to functions. (If no entry is required for a transaction/event, select "No

Journal Entry Required" in the first account field. Do not round intermediate calculations. Round your answers to the nearest

whole dollar amount.)

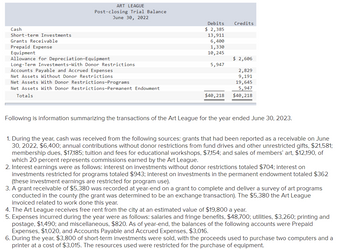

Transcribed Image Text:Cash

Short-term Investments

Grants Receivable

Prepaid Expense

Equipment

ART LEAGUE

Post-closing Trial Balance

June 30, 2022

Allowance for Depreciation-Equipment

Long-Term Investments-With Donor Restrictions

Accounts Payable and Accrued Expenses

Net Assets Without Donor Restrictions

Net Assets With Donor Restrictions-Programs

Net Assets With Donor Restrictions-Permanent Endowment

Totals

Debits

$ 2,385

Credits

13,911

6,400

1,330

10,245

$ 2,606

5,947

2,829

9,191

19,645

5,947

$40,218

$40,218

Following is information summarizing the transactions of the Art League for the year ended June 30, 2023.

1. During the year, cash was received from the following sources: grants that had been reported as a receivable on June

30, 2022, $6,400; annual contributions without donor restrictions from fund drives and other unrestricted gifts, $21,581;

membership dues, $17,185; tuition and fees for educational workshops, $7,154; and sales of members' art, $12,190, of

which 20 percent represents commissions earned by the Art League.

2. Interest earnings were as follows: interest on investments without donor restrictions totaled $704; interest on

investments restricted for programs totaled $943; interest on investments in the permanent endowment totaled $362

(these investment earnings are restricted for program use).

3. A grant receivable of $5,380 was recorded at year-end on a grant to complete and deliver a survey of art programs

conducted in the county (the grant was determined to be an exchange transaction). The $5,380 the Art League

invoiced related to work done this year.

4. The Art League receives free rent from the city at an estimated value of $19,800 a year.

5. Expenses incurred during the year were as follows: salaries and fringe benefits, $48,700; utilities, $3,260; printing and

postage, $1,490; and miscellaneous, $820. As of year-end, the balances of the following accounts were Prepaid

Expenses, $1,020, and Accounts Payable and Accrued Expenses, $3,016.

6. During the year, $3,800 of short-term investments were sold, with the proceeds used to purchase two computers and a

printer at a cost of $3,015. The resources used were restricted for the purchase of equipment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- tutor give answer ASAParrow_forwardOliver's Place is a nonprofit entity that cares for dogs until they are adopted. It uses fund accounting and uses a UCF, an RCF, and an EF. It charges its expenses to the care of animals program, special programs, and administrative expenses. Following are some of its transactions for its fiscal year. Prepare the journal entries needed to record these transactions, indicating the fund used for each entry and showing net asset classifications, where appropriate. 1. During the year, Oliver's Place received pledges of $80,000 without donor restrictions. It estimated that 95 percent of the pledges would be collected in cash. 2. It received the following gifts from various donors: a. Donor A made a gift of common stock that had a fair value of $16,000. Donor A stated that the gift could be used for any purpose. b. Donor B made a cash gift of $4,000, stipulating that it could be used only for a new program to take calm dogs to visit elderly people. c. Donor C made a gift of common stock that…arrow_forwardquestion 20 choose the correct answer from the choicesarrow_forward

- Ma ic Calendar My MCBS Library English (en) - Assets acquired in a lump-sum purchase are valued based on: a. Their assessed valuation. b. Their relative fair values. c. The present value of their future cash flows. d. Their cost plus the difference between their cost and fair values.arrow_forwardQUESTION 50 How to record a trade-in? Government Wide :Record at ticket price of the new asset Fund statement: only the cash aspects of the transaction be recognized as expenditures losses and gains should be recognized on fund statements. No losses and gains should be recognized on government wide financial statementarrow_forwardAnswer the Question below Under which basis should companies record donated assets in their books? a) Nominal value of $1 b) Donor's book value c) Fair market value at receipt d) Replacement cost value.arrow_forward

- hsd.1arrow_forwardHelp & Save is a private not-for-profit entity that operates in Kansas. Swim For Safety is a private not-for- profit entity that operates in Missouri. The leaders of these two organizations have decided to combine forces on January 1, 2020, in order to have a bigger impact from their work. They are currently discussing ways by which this combination can be created. The following are statements of financial position for both charities at that date. HELP & SAVE Statement of Financial Position January 1, 2020 Assets Cash $1,800,000 110,000 400,000 800,000 $3,110,000 Contributions receivable (net) Investments Buildings & equipment (net) Total assets Liabilities Accounts payable and accrued liabilities Notes payable Total liabilities $210,000 1,200,000 $1,410,000 Net Assets $1,300,000 400,000 $1,700,000 $3,110,000 Net assets without donor restrictions Net assets with donor restrictions Total net assets Total liabilities and net assets SWIM FOR SAFETY Statement of Financial Position January…arrow_forwardExercise E10-1 1-10, please. Thank you.arrow_forward

- A. Prepare CORIS RA Statement of Cash Flow for the year ended December 31, 2020 B. Prepare CORIS RA Statement of Financial Performance for the year ended December 31, 2020arrow_forwardThe long-term asset account group is used for which of the following funds? Enterprise Capital Projects Internal Service General Both b and darrow_forwardPLEASE USE ACCOUNTS FROM THIS LIST Accumulated Other Comprehensive IncomeAllowance for Investment ImpairmentBond Investment at Amortized CostCashDividends ReceivableDividend RevenueFV-NI InvestmentsFV-OCI InvestmentsGain on Disposal of Investments in AssociateGain on Disposal of Investments - Cost/Amortized CostGain on Disposal of Investments - FV-NIGain on Disposal of Investments - FV-OCIGain or Loss in Value of Investment PropertyGST ReceivableInterest ExpenseInterest IncomeInterest PayableInterest ReceivableInvestment in AssociateInvestment Income or LossLoss on Discontinued OperationsLoss on Disposal of Investments - Cost/Amortized CostLoss on Disposal of Investments - FV-NILoss on Disposal of Investments - FV-OCILoss on ImpairmentNo EntryNote Investment at Amortized CostOther InvestmentsRecovery of Loss from ImpairmentRetained EarningsUnrealized Gain or LossUnrealized Gain or Loss - OCIarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning